In a speech at Bitcoin 2025, MicroStrategy co-founder Michael Saylor proposed that the best way for people of all classes and ages to achieve financial freedom is through the accumulation of Bitcoin. Saylor immediately added that digital assets represent half of the world’s value.

Experts say this vision can only be realized in an ideal world. Representatives from Fedrok AG, Bitget Wallet and Brickken explained that Bitcoin needs greater scalability, reduced institutional pushbacks and more stability to absorb global wealth. Only if these factors match can Saylor’s fantasy become real.

Sayers on Bitcoin’s Road to Ultimate Wealth

Saylor recently took the stage at Bitcoin 2025 in Las Vegas and presented his “21 Ways to Wealth” speech. The Executive Chairman of Strategy and an aggressive Bitcoin Accumulator presented a comprehensive guide to building economic freedom with digital assets at the core.

A central pillar of Saylor’s vision was that adding Bitcoin to his portfolio could help him invest in a brighter future, regardless of his age or socioeconomic status.

He argued that the decentralized, programmable, non-corrupted nature of digital assets outweighs all other currencies over time and ultimately becomes the dominant global currency standard.

Although this term is not explicitly mentioned, Saylor strongly advocated a fundamental philosophy of hyper-bitcoinization.

This concept argues that as trust in the traditional financial system decreases, the inherent benefits of Bitcoin lead to the rapid and irreversible emergence as a major global currency.

Is hyperbitcoinization a prediction or fantasy?

Experts remain divided on the feasibility of Saylor’s speech. Enmanuel Cardozo, a market analyst at Brickken, is optimistic that Bitcoin will ultimately outperform its competitors. However, he admits that this vision is not immediate.

“The basics of Bitcoin are clear. Its rarity, decentralized nature and growing institutional adoption are a major hedge against Fiat’s devaluation. That’s why it is the fifth largest asset in the world and, as I said before, it’s Fiat currency that is headed towards zero towards BTC.

Other experts don’t expect much. They argue that hyperbitcoinization represents something more fantasy than predictions.

Unlike traditional assets such as businesses, real estate, and goods, Bitcoin’s lack of productivity, high volatility, and inability to generate income and utilities Make such a scenario unrealistic.

“In the end, Saylor’s vision is rooted in ideological beliefs rather than practical economics. While Bitcoin could continue to be a hedge against valuable alternative asset classes or inflation, the concept of alternative or controlling all other assets and currencies told Beincrypto.

Blazdell is based on his arguments based on several key factors that undermine the validity of Bitcoin’s reign.

Power Struggle: Bitcoin and Centralized Control

For Bitcoin to become globally dominant, players in the current banking system and government must be willing to give up their control. They don’t do that without a fight, and their grip to power remains solid.

“The biggest obstacle is not technology, it’s not power. It’s unlikely that governments will give up control over monetary policy. The transition to a Bitcoin-based system faces structural resistance at the highest level.”

Blazdell agreed, arguing that hyper-bitcoinization would be out of the question without this power monopoly. Recognizing this, the government has placed several hurdles that prevent widespread adoption of crypto.

“The vision of Bitcoin ‘valued in all half’ requires a fundamental change in the global financial system. It begins with the collapse or abandonment of Fiat currency. For Bitcoin to replace sovereignty, the government must support the issuance of debt issuances that are historically dependent to protect financial policies, taxation, and current trends for debt issuance that are prevented from issuing financial policies, taxation, and debt issuance. “Repression of major economic regulations,” he explained.

Global domination in this context requires extensive adoption. However, Bitcoin is currently not found in most investor portfolios.

Why does Bitcoin adoption keep up with crypto’s growth?

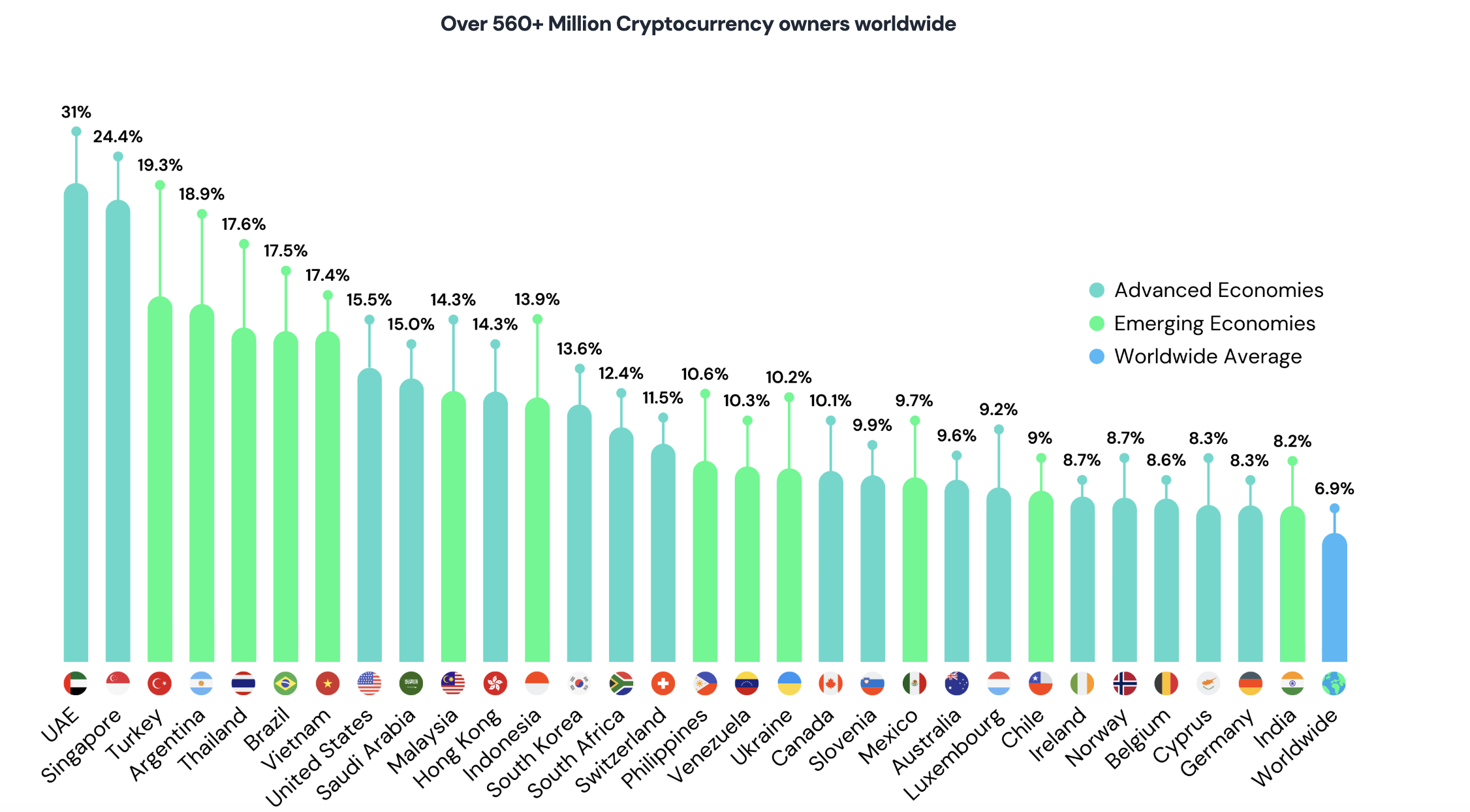

As of 2024, Triple-A data shows that around 6.9% of the world’s population (over 560 million people own cryptocurrency). Naturally, Bitcoin ownership is expected to be low, with various reports putting that figure at 1-3%.

Global crypto ownership reached 6.9% in 2024. Source: Triple-A.

Bitcoin’s inherent qualities, particularly price volatility, thwarts the path to widespread adoption, particularly as a stable medium of exchange.

“Its unpredictable fluctuations puts the pricing of goods and services at risk for maintaining wealth and unrealistic. Until it becomes more stable, Bitcoin remains a speculative asset rather than a reliable tool for everyday economic use,” Blazdell told Beincrypto.

In that sense, stubcoins are a more natural choice for common use cases. At the same time, the general misconceptions about ownership of Bitcoin tend to drive adoptions away from retail investors.

In particular, the fact that one Bitcoin alone is worth more than $100,000, investors assume that only wealthy individuals can afford such assets.

“The concept of Bitcoin being too expensive often ignores it being split into 0.0000001 BTC. But recognition is important. Many retail users still make value equal to the entire unit.

These misconceptions can lead traders to explore other cryptocurrencies, further distracting attention from Bitcoin.

Why “Affordable” Altcoins outperform Bitcoin for some retailers

Retailers are often more attractive as Altcoins and Meme Coins are priced lower per unit than Bitcoin. This is mainly due to misunderstanding and a lack of understanding of how easily bitcoin can be split into smaller units or Satosh.

“This price tag usually scares the average investor. Especially when Altcoins look like $1 or $100, it feels “affordable” even if it’s a risky investment. This perception makes us think at this point that Bitcoin is only for rich or institutional purposes. It’s attracting attention.

Regarding education, Bedzell emphasized that he knows how to grasp the value of Bitcoin and hold it.になったんです。 English: The first thing you can do is to find the best one to do.

“Managing private keys, understanding wallet options and security of funds requires a level of technical literacy that many users don’t have. This steep learning curve prevents mainstream adoption and makes Bitcoin easier to contain non-experts,” he said.

However, if Bitcoin does not have a reliable infrastructure to manage the volume of transactions, broad education can’t achieve anything.

Concerns about scalability and energy footprint

Scalability is often cited as Achilles heels in Crypto. Most blockchains (including Vitocoin) suffer from slow transaction speeds. If blockchain cannot handle the demand associated with global Bitcoin adoption, the entire effort will be wasted.

“Bitcoin’s limited scalability is a major technical hurdle. The network handles transactions per 7 seconds, which is very insufficient for a global financial system that requires thousands of transactions per second to function efficiently,” Bedzell told Beincrypto.

Bitcoin mining, on the other hand, requires intense energy consumption. The sudden demand for resources and the associated regulatory pushback further hinders widespread adoption.

“The Bitcoin Proof of Work Consensus Mechanism often consumes a huge amount of electricity compared to small countries’ energy usage, which raises serious environmental concerns and conflicts that highlight ESG (environmental, social and governance) standards worldwide.

Once everything is said and done, the remaining hurdles of Bitcoin to achieve hyper-bitcoinization outweigh their advantages.

Is Saylor’s vision for Bitcoin overnight?

Even if Saylor has a strong belief in the ultimate upward rise that Bitcoin is a good form of capital, its future domination will ultimately depend on its ability to overcome many of the obstacles it faces today.

His strong beliefs should not be ignored, but Saylor’s vision for Bitcoin does not happen overnight. For this reason, investors need to proceed with caution.

“It depends on the individual. Bitcoin can play a role in a diversified portfolio, but it is not a one-size-fits-all asset. Unknown volatility and regulations means it’s suitable for those who understand the risk,” Kang concluded.

Bitcoin certainly lies in the future of finance, but current restrictions suggest that it is a higher option guilty investment for anyone than a standard choice.