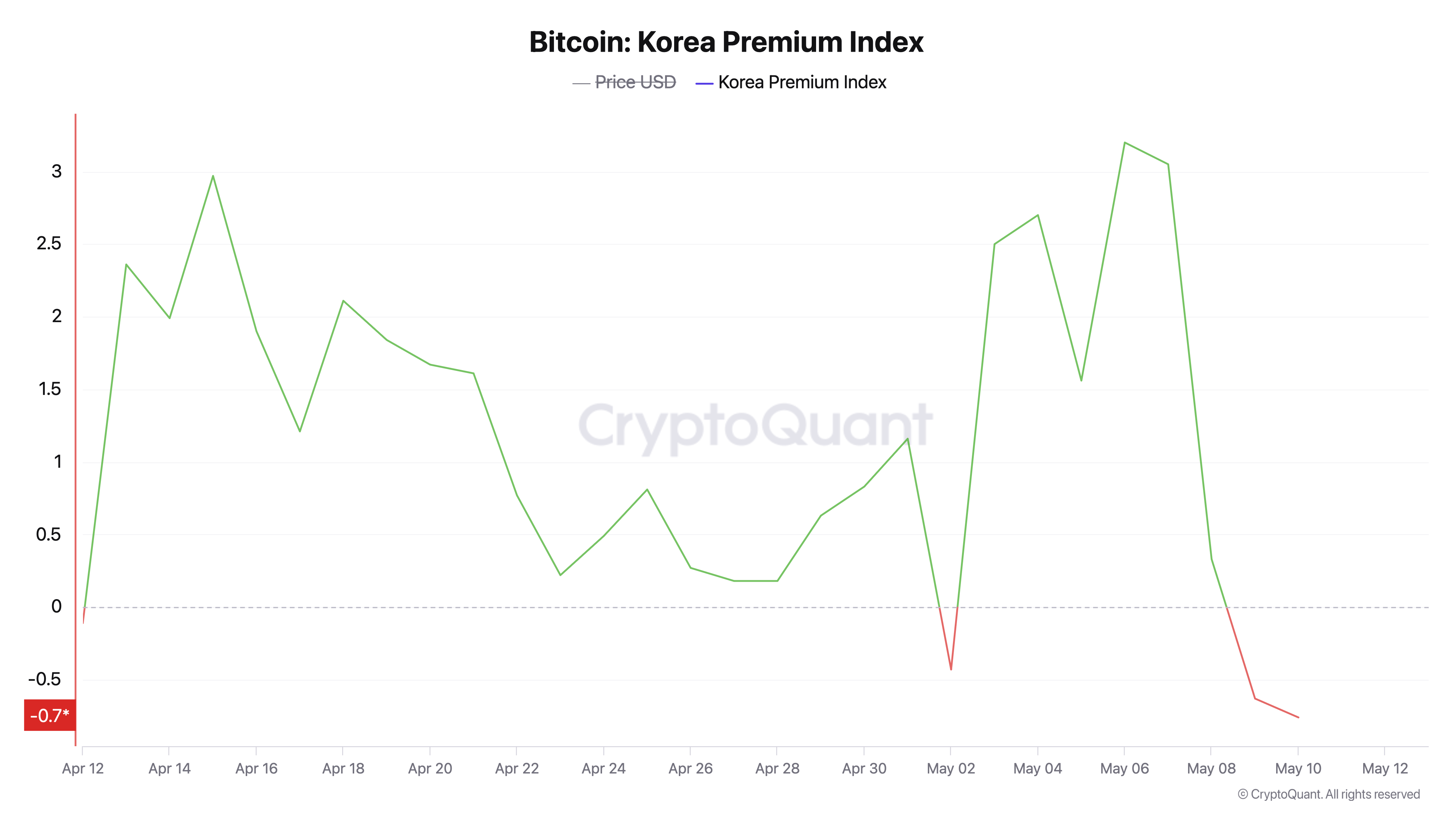

Over the past 24 hours, Bitcoin has been drifting between $103,133 and $104,841, but South Korea’s infamous premium has quietly flipped, immersing itself in the discounted area for several days this month.

Bitcoin’s comeback falls 0.76% below the global average of South Korea’s premium

Bitcoin has had an eventful week backed by a new appetite and regaining its first $100,000 milestone since February. But following these fresh prices peaks, the Korean exchange premium has turned back to discounts. As of Sunday, May 11, 2025, Bithumb and Upbit rates are almost identical to international exchanges.

Data from cryptoquant.com shows that the inversion began on May 2, falling 0.43% below the global average and deepened on May 9th and 10th, reaching a 0.76% shortfall on the latter date. Between May 2nd and 9th, the premium rose to 3% on May 6th. Such discounts in Korea are a rare event.

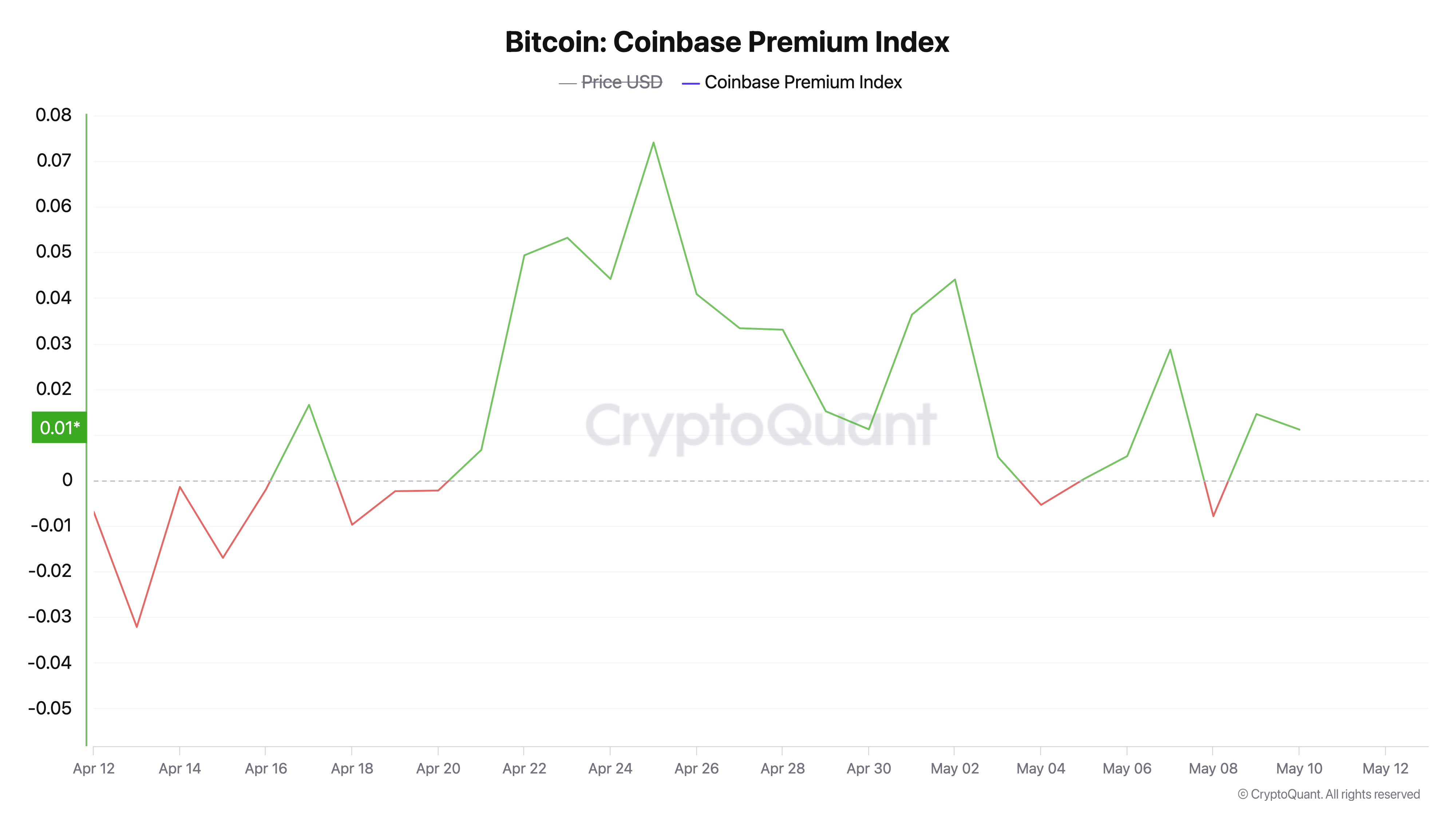

The previous inversion was dated April, marking a deeper discount, falling 1.19% on a weighted global average with prices falling by 1.19%. Before that episode, the final victory discount was recorded in December last year. Meanwhile, since April 20th, Cryptoquant’s Coinbase Premium Index remains primarily in the premium territory.

There were once again two short, modest reversals on May 4th and May 8th. Essentially, the Coinbase Premium Index of encryption calculates the percentage of the gap between Coinbase Pro and Binance, increasing premiums indicating active purchase pressure from US investors. Conversely, WON discounts could indicate subsided demand, surplus supply, or increased regional uncertainty in the Korean market.