The Financial Supervisory Service (FSS) has announced new rules to curb the frenzied buying of high-risk leveraged ETFs by Korean investors. The regulator announced on Sunday that from December 15, domestic investors will be required to attend a one-hour online training session before investing in overseas-listed inverse and leveraged ETFs.

The FSS noted that investors looking to purchase derivative products in foreign markets must also take a three-hour mock trading program in addition to the online course. Regulators are considering aligning regulations on foreign investments in these products with those for domestic listed products.

Korean investors are known for taking risks and are reportedly flocking to US-listed ETFs, which offer exposure to particularly high-flying tech stocks. Apparently, few countries can match the enthusiasm seen in South Korea, where investing in foreign stocks is seen as a way to accumulate wealth quickly.

Kim says new policy teaches compound interest effect

Bora Kim, head of Asia-Pacific strategy at Leverage Shares, said the new policy will help individual Korean investors realize the compounding effects and strategies of investing in leveraged foreign ETFs. He added that the program addresses something that Korean investors have been neglecting and could impact risk-neutral retail investors. Meanwhile, overall appetite is expected to remain unchanged.

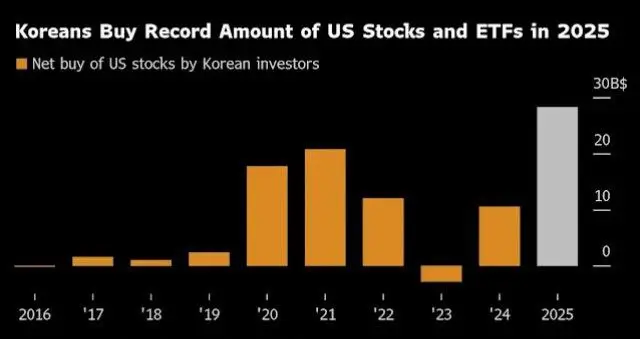

Data compiled by Bloomberg show Korean individual investors’ direct investments in US ETFs and stocks reached a new ATH this year. Currently at $28.3 billion by 2025, South Korean retail investors added $6.9 billion in October alone, marking the highest monthly amount since 2011.

Pure US stocks purchased by Korean individual investors from 2016 to present. Source: Bloomberg

Kim observed that leveraged ETFs also amplify the gains and losses that investors can make by buying U.S. stocks directly. He pointed out that when major indexes and securities fall sharply, inverse ETFs rise, and vice versa.

Overseas ETF activity gradually decreased in September

Data obtained from ETFGI, an independent research and consulting firm specializing in global ETF industry trends. indicates Foreign ETF activity among Korean retail investors decreased slightly in September.

In September, 21 of the top 50 foreign securities purchased by Korean investors were listed in the US, a slight decrease from 23 ETFs in August. ETF activity in September was also lower than in July (22 transactions) and June (26 transactions), indicating that the concentration of ETFs in top foreign investment stocks has slowed slightly.

Meanwhile, in terms of trading volume, Korean retail investors bought $9.8 billion in foreign ETFs in September. The peak so far this year was in April, when ETF purchases reached a record high of $12.08 billion. The biggest single buy was SPDR S&P 500 ETF Trust (SPY) for $2.31 billion.

Specifically, it bought $1.27 billion in ETFs from the Direxion Daily Semiconductor Bull 3X SHS ETF and another $1.01 billion from the Direxion Daily TSLA Bull 2X Shares. Korean retail investors also purchased over $920 million in ETFs from the Invesco QQQ Trust SRS1 ETF and another over $766 million in ETFs from the Vanguard S&P 500 ETF SPLR.

ETFGI also noted that 14 of the top 21 ETFs offer inverse or leveraged exposure, reflecting continued interest in calculated trading strategies. However, the ETF research firm pointed out that only 22.66% of ETFs listed on the Korea Stock Exchange offer inverse and leverage exposure, which accounts for nearly 6.99% of the assets of the Korean ETF industry.