Spain’s public research institute is preparing to sell a long-forgotten stash of Bitcoin worth more than $10 million that was purchased for just $10,000 in 2012 as part of a blockchain research project.

The Institute for Technology and Renewable Energy (ITER), overseen by the Tenerife Island Council, acquired 97 Bitcoins (BTC) over a decade ago to research blockchain technology. The council is currently finalizing plans to sell its stake, Spanish-language newspaper El Día reports.

Tenerife Innovation Councilor Juan José Martínez said his council is working with the Bank of Spain and Spanish financial institutions licensed by the National Securities Market Commission (CNMV) to facilitate the sale.

Most European banks still refuse to handle Bitcoin transactions due to regulatory and volatility risks, complicating the process for research centers to sell their Bitcoin holdings.

Related: Analyst says it is unlikely to reach $125,000 target in 2025, Bitcoin shows depletion

Tenerife Island Council to reinvest profits into quantum research

Martinez said he expects the deal to close in the coming months, with proceeds reinvested in ITER’s own research programs, including in areas such as quantum technology. He added that the 2012 acquisition was never intended as an investment, but as part of an experimental project aimed at understanding blockchain infrastructure.

“This was one of the many research projects ITER has undertaken to explore and experiment with new technological systems,” Martinez said.

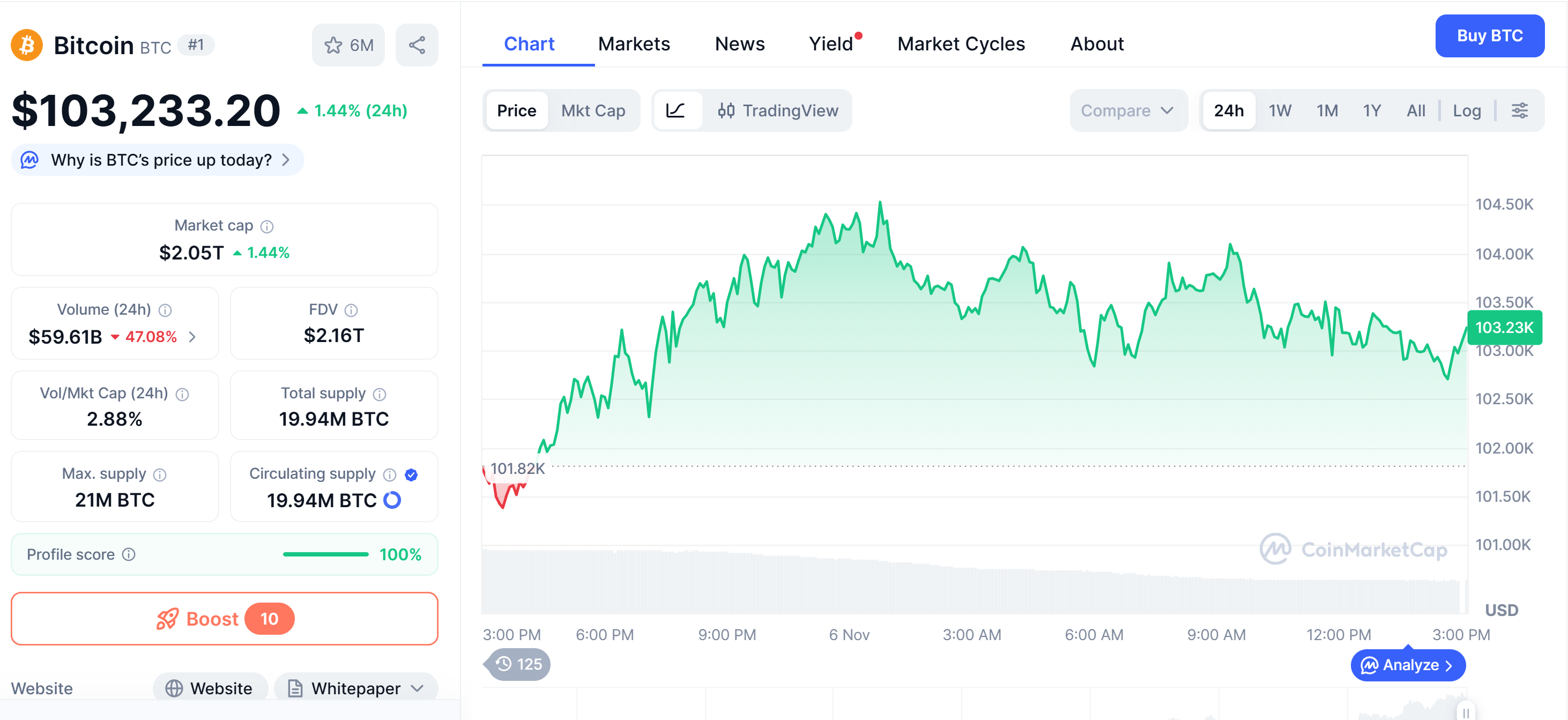

BTC is currently trading at around $103,200, and ITER’s Bitcoin holdings are worth more than $10 million. That stash was worth more than $12 million in early October, when Bitcoin reached an all-time high of about $126,198, according to CoinMarketCap data.

Bitcoin is trading above $103,000. Source: CoinMarketCap

Related: French government plans to consider motion to accept Bitcoin and cryptocurrencies

Major Spanish bank BBVA partners with Binance to store user funds

In August, major Spanish bank BBVA partnered with Binance to act as an independent custodian of customer funds. The agreement allows Binance users to store assets backed by U.S. Treasuries held on BBVA, which the exchange accepts as margin for trading.

The partnership comes after BBVA advised wealthy clients to invest between 3% and 7% of their portfolios in cryptocurrencies and Bitcoin.

magazine: Bitcoin OG Kyle Chasse is one shot away from being permanently banned from YouTube