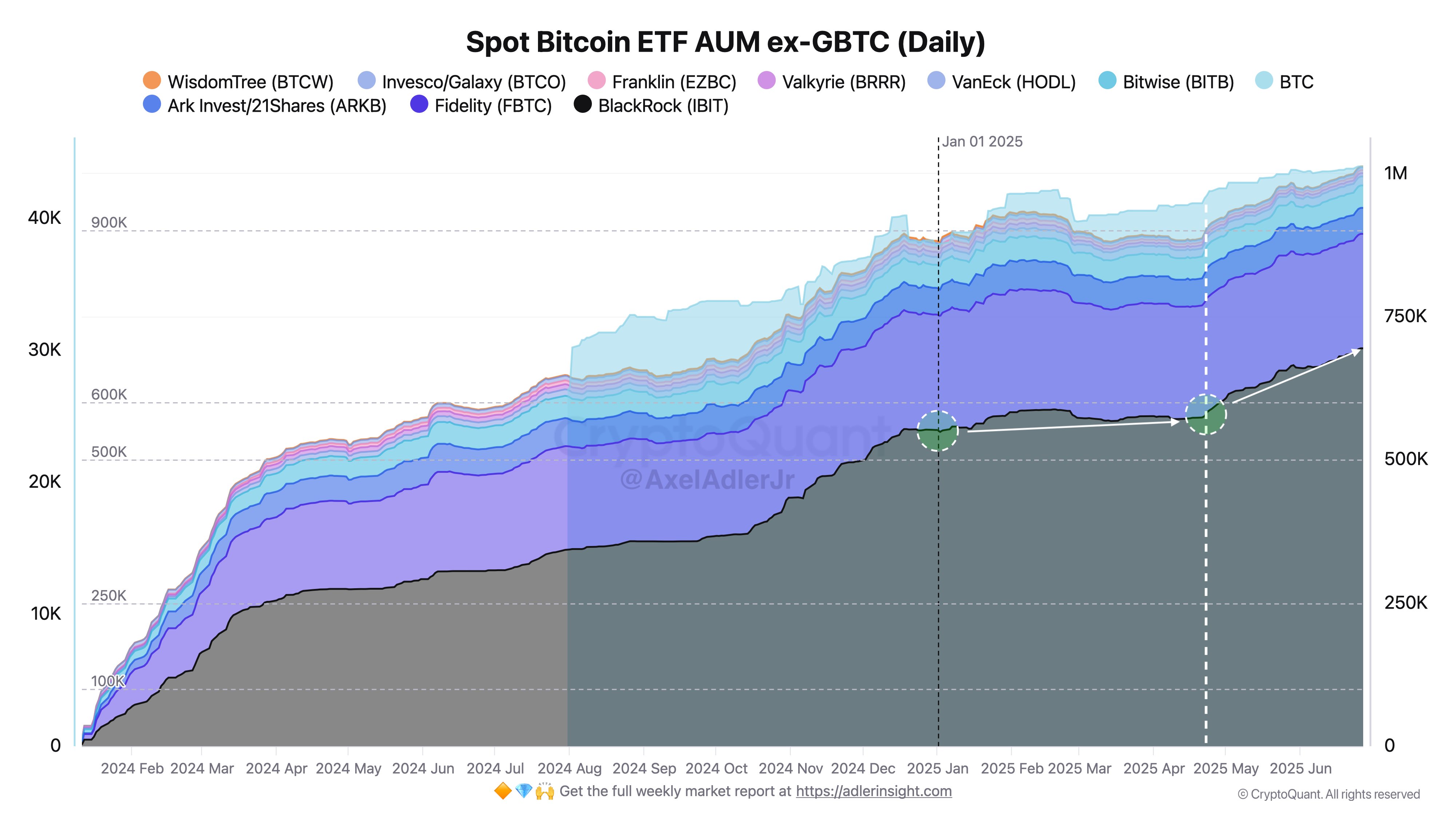

The US Bitcoin Spot ETF was now one of the main strongest drivers of the market cycle, and institutional investors were introduced into the BTC ecosystem. In 18 months, ATF secured 6.25%of Bitcoin’s market cap in the market.

Interestingly, AXEL Adler Jr., a prominent market analyst, points out the recent positive trend in the Bitcoin ETF space, suggesting more likely and strong for the next few months.

By September, Bitcoin Spot ETF will have 1.2 million BTC -Analysts

On June 28, market analyst Axel Adler Jr. emphasized a strong trend of the accumulation pattern of US Bitcoin Spot ETF over the past three months.

The famous analysts explain that the ETF’s AUM net assets, except for Grayscale GBTC, have increased significantly from 932,000 BTCs to 1,056,000 BTC in April 2025. This development shows net profit of 124,000 BTC for 87 days, and an average of 1,430 BTCs per day shows impressive inflow.

As a controversial market leader, BLACKROCK IBIT occupies most of this growth, which attracts 1,360 BTCs a day with deposits of most of this growth. In contrast, the remaining 11 ETFs combine a total of 6,000 BTC or 70 BTC a day to indicate a clear concentration of investors’ interest in Blackrock’s products.

According to ADler JR., if an institutional investor maintains a 1,430 BTC accumulation speed, the Bitcoin ETF is in the process of hitting 1,840,000 BTC AUM by September and indicating 9.25%of the circulation BTC token. Within the entire Blackrock Ibit is expected to have about 817,000 BTC.

In combination with GBTC’s current AUM, ADler JR. predicts that US Bitcoin SPOT ETFS will have a significant number of net assets of more than $ 195.4 billion.

Bitcoin price outline

At the time of writing, Bitcoin is trading at $ 107,339, which reflects a small price of 0.28%over the last 24 hours. Meanwhile, the daily trading volume of assets decreased by 33.88% and worth $ 30 billion.

In a larger time frame, Pryptocurrency also maintains positive performance with 5.61%and 1.06%of the weekly and monthly charts, respectively, showing potential optimistic momentum after a few weeks of bounds.

Since the establishment of a new record of $ 111,970 in late May, Bitcoin has been difficult to explore a new price range, and instead, it has settled on a down channel between $ 100,000 and $ 110,000.

Libertex’s main image, TradingView chart

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.