According to a study by Ey-Parthenon, Stablecoin adoption has gained momentum among businesses and financial institutions driven by regulatory clarity and reduced global remittance costs.

A survey conducted in June with 350 executives after the Senate passed the Genius Act found that 13% of businesses already use Stablecoins, primarily for cross-border payments. Of those who did not use Stablecoins, 54% are expected to adopt them within the next six to 12 months.

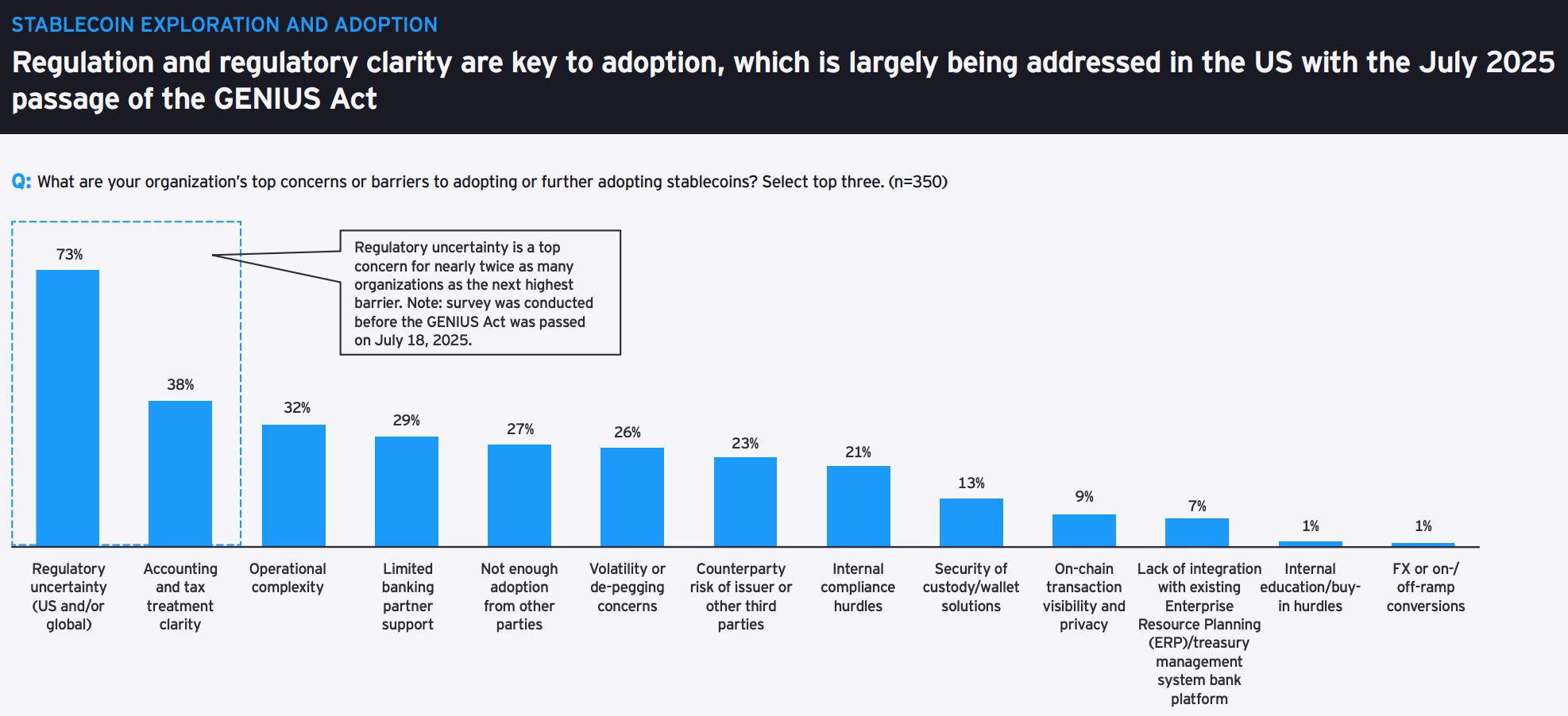

The clarity of regulations provided by the Genius Act was widely regarded as a turning point. The law, signed into law in July, provided the much-anticipated rules for the silly stubcoin controlled by the US dollar, including preliminary requirements and the issuer’s approval process.

Executives said in the investigation that the law reduces uncertainty regarding liquidity, tax treatment and custody services.

Cost reductions are also a key driver of adoption, with 41% of current users reporting that they are reducing costs by at least 10% by using stable international transactions.

Respondents also viewed stubcoin as a long-term fixture for global finance. By 2030, they estimate that stubcoins could promote 5% to 10% of their full payments, representing a value of between $2.1 trillion and $4.2 trillion.

Still, infrastructure hurdles remain. Only 8% of companies accepted payments with Stablecoins, and many planned to rely on banks and Fintech partners for integration.

Read more: US Stub Coin Battle could become a zero-sum game: JPMorgan