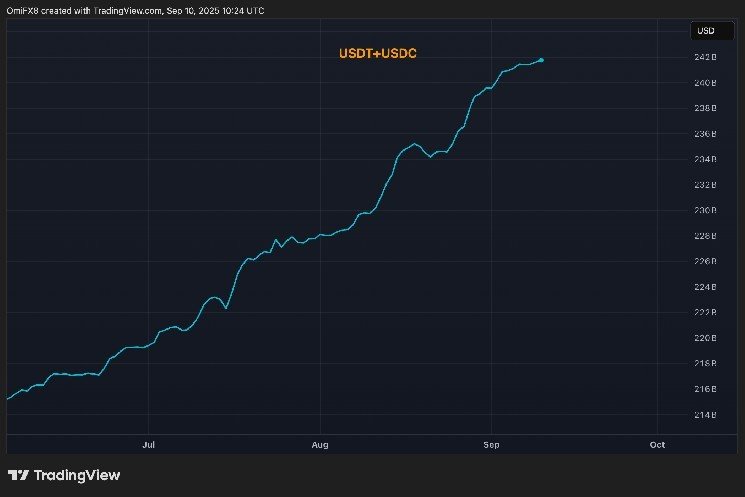

According to a research note from JPMorgan, the $270 billion Stablecoin sector has grown significantly, but accounts for less than 8% of Crypto’s total market capitalization.

Analysts, written by an analyst led by Nikolaos Panigirtzoglou, said that dynamics could turn the upcoming wave of Stablecoin into a zero-sum contest.

Tethers, which are primarily used overseas, are scheduled to debut US-compliant tokens, USAT. Unlike USDT, where reserves are compliant with US requirements at around 80%, the bank said USAT’s support will fully meet new regulatory standards.

Stablecoins are cryptocurrencies that have value in other assets, such as US dollars and gold. They play a major role in the cryptocurrency market, provide payment infrastructure and are also used to transfer money internationally. Tether’s USDT is the largest Stablecoin, followed by Circle (CRCL)USDC.

The passing of the US stability law in July has already driven new launches targeting USDC, the circle that controls the US market, the report says.

Analysts say the new players are serving as jockeys prior to regulatory implementation, but Stablecoin Market’s growth is tied to Crypto’s overall market capitalization.

Circles also occupy high lipid-like competitors, which account for almost 7.5% of USDC usage by exchange alone, as well as Fintech Giants Paypal (PYPL), Robin Hood (Food), and Revolut.

In response, Circle will develop ARC, a blockchain tailored to USDC transactions, improving speed, security and interoperability, keeping USDC at the heart of its crypto infrastructure.

Without a significant expansion, a new wave of Stablecoin competition could simply redistribute market share, rather than cultivating pie, the report added.

USDC supply spiked 25% ahead of Bernstein’s 2025 estimate to $72.5 billion, the broker said in a report earlier this month.

read more: Circle’s USDC market share “tears” says Wall Street broker Bernstein