The stablecoin economy hit a record peak of $311.837 billion about 27 days ago this year, but has fallen to $300.722 billion by February 1st. But over the past two weeks, the sector has put $7.251 billion back on the tab, with most of that expansion unfolding over the past seven days.

Rising to $307 billion

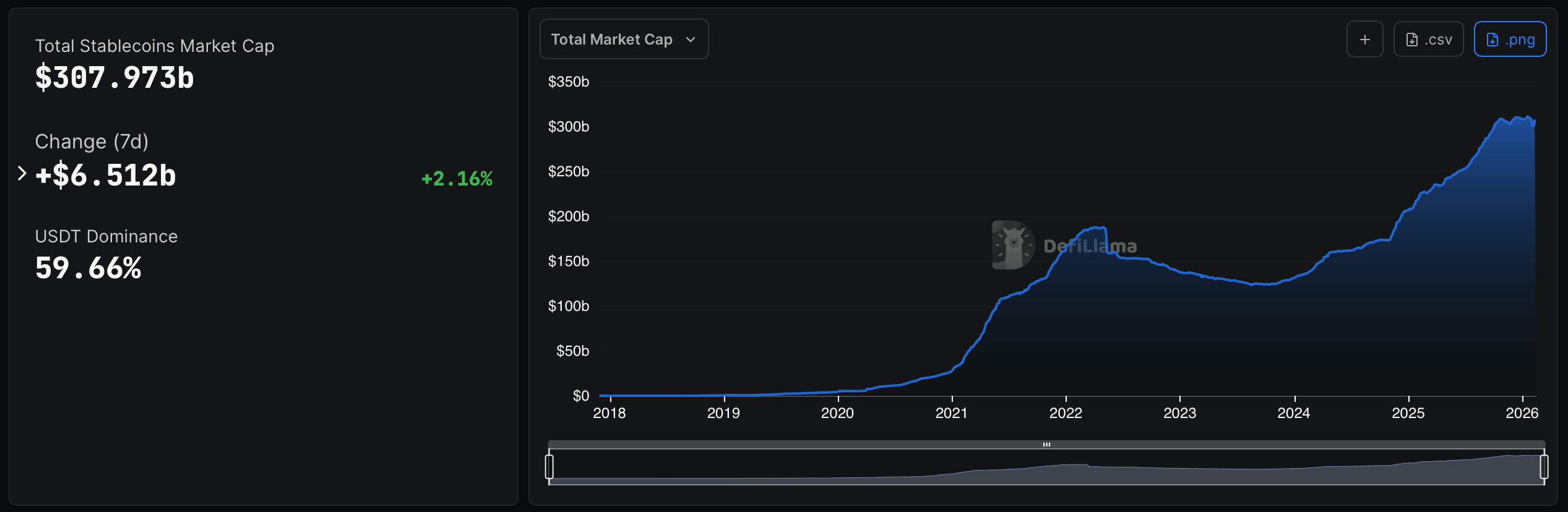

Stablecoin statistics from defillama.com show that from February 7 to February 14, 2026, the fiat-pegged token sector increased by 2.16% week-on-week, adding $6.512 billion to the total. This accounts for 89.81% of the $7.251 billion expansion recorded over the past two weeks, meaning that almost all of the recent gains have occurred within this narrow range.

Stablecoin market cap statistics via defillama.com for February 14, 2026.

As of Saturday, February 14th, the stablecoin economy reached $307.973 billion, including Tether ( $USDT) accounts for 59.66% of the total. Over the past week $USDT‘s market capitalization increased by 0.14%, adding $251.98 million to its balance sheet. Currently, the market valuation of the dominant stablecoin is $183.727 billion. Circle’s $USDC This was followed by a 1.39% increase to $73,559 million, reflecting an increase of $1,012 million in the same period.

Sky Dollar (USDS) showed a strong week-on-week expansion, rising 3.72% and showing a clear increase in capital inflows. The market capitalization of USDS is $6.622 billion. The biggest decline among the top 10 groups was Ethena. $USDeindicating short-term contraction. $USDe The stock fell 2.25%, with a market capitalization of $6.312 billion. World Liberty Financial’s US dollar rose 1.63% to $5.302 billion through Saturday.

$DAI This was the steepest decline among the weekly top 10, reflecting a significant reduction in circulating supply. $DAIThe stock plunged 4.53%, leaving its market capitalization at $4.387 billion. paypal $PYUSD had the best weekly performance among major issuers, rising 5.07% over the seven-day period and reaching a market capitalization of $4.022 billion. the location of the lift $PYUSD It is one of the rising stocks that will attract attention this week.

BlackRock’s BUIDL had the sharpest rise within the top 10 cohort, rising 23.07% week over week to reach a valuation of $2.363 billion. The move follows weeks of capital outflows from the BUIDL market and is a decisive reversal. Its significant rise far outpaces the broader stablecoin sector and signals renewed demand for tokenized dollar products linked to traditional financial rails.

falcon finance $USDfIn contrast, it fell by 0.67% during the same period. The recoil was found to be relatively suppressed compared to other weekly contractions; $USDf With a market capitalization of $1.637 billion, it maintains its position within the top 10 ranking.

Rounding out the list, Ripple’s RLUSD has risen 1.85% over the past week, increasing its market cap to $1.522 billion. This increase reflects a measured expansion at the lower end of the top tier, reinforcing a broader pattern of incremental growth among fiat-backed new entrants, even as the sector’s largest tokens continue to account for the majority of supply.

The latest numbers show that the stablecoin market is neither stagnant nor overheated, but is realigning in real time as capital changes hands between established companies and emerging issuers. Tethering ( $USDT) and $USDC While supply continues to support the sector, smaller new entrants are steadily carving out market share through targeted growth spurts and niche positions. The fiat-backed token arena appears to be systematically gaining momentum as total valuations once again approach all-time highs.

Frequently asked questions ❓

- What is the stablecoin market size as of February 14, 2026? The stablecoin economy reaches $307.973 billion.

- How much has the stablecoin sector grown this week? The market added $6.512 billion from February 7th to February 14th, a weekly increase of 2.16%.

- Which stablecoin holds the largest market share? Tether ( $USDT) is dominant with 59.66% of the total market.

- Which stablecoin made the most money each week? BlackRock’s BUIDL rose 23.07% while PayPal’s BUIDL rose 23.07%. $PYUSD It has increased by 5.07% in the past 7 days.