S&P Global Ratings says stablecoins, primarily those pegged to the U.S. dollar, could gain an even larger share in emerging market economies, with holdings in 45 countries potentially reaching $730 billion, up from about $70 billion currently.

The report, released this week, says the role of stablecoins in the financial system is “growing in tandem with the rapid expansion of issuance.”

Still, analysts say that even if stablecoin adoption reaches the expected high end, it is “not significant enough to have a material impact on the role of banks in intermediation or the effectiveness of monetary policy.”

Stablecoin introduction simulation. Source: S&P Global Ratings

The New York-based rating agency bases its forecasts on three main factors: pressure on local currencies, demand for cross-border remittances and widespread use of digital assets.

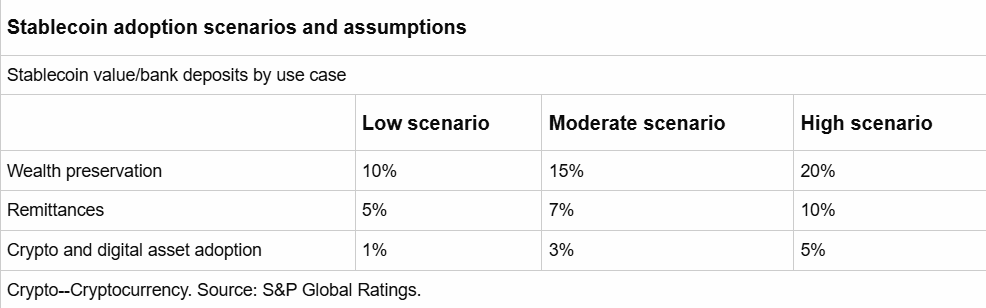

“Adoption will be driven, in order of importance, by wealth protection, remittances and international trade, and general enthusiasm for digital assets,” the report says.

Key markets for stablecoin adoption

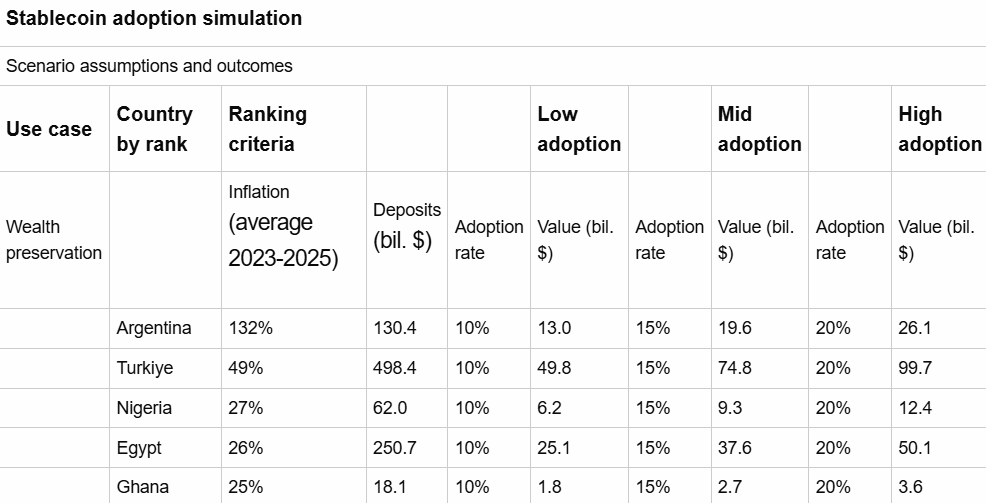

As S&P Global argues, countries with high inflation rates have the greatest potential for stablecoin adoption. In the most aggressive scenario, the company predicts that stablecoins could reach a significant share of the value of traditional bank deposits in some markets, where stablecoins are used to preserve wealth in countries where the purchasing power of logical currencies is eroding.

“We assume stablecoin adoption could reach 10-20% of bank deposits in the top 15 countries where wealth preservation (purchasing power) is the most important factor,” the report said.

The forecast is based on bank deposit data for the second half of 2024, with Argentina and Turkey leading the list in terms of average inflation over the past two years.

Stablecoin introduction simulation. Source: S&P Global Ratings

In early January, blockchain analytics firm Artemis estimated that Visa card spending linked to stablecoins will reach $3.5 billion annually in the second half of 2025, an increase of about 460% year-on-year.

A geographic breakdown of stablecoin usage shows India and Argentina to be “true global outliers,” with USDC accounting for 47.4% and 46.6% of usage, respectively. By comparison, data shows that USDT dominates stablecoin activity in most other markets, including Turkey, China, and Japan.