Canton’s CC token emerged as the top gainer on the crypto market on Christmas Eve, rising more than 25% in 24 hours despite thin holiday liquidity and generally bearish sentiment. This rise has seen CC outperform major assets and privacy coins.

This move isn’t driven by retail hype or seasonal speculation. Instead, it reflects a growing institutional narrative around the tokenization of real world assets (RWA) and regulatory clarity, two themes that have gained traction through the end of the year.

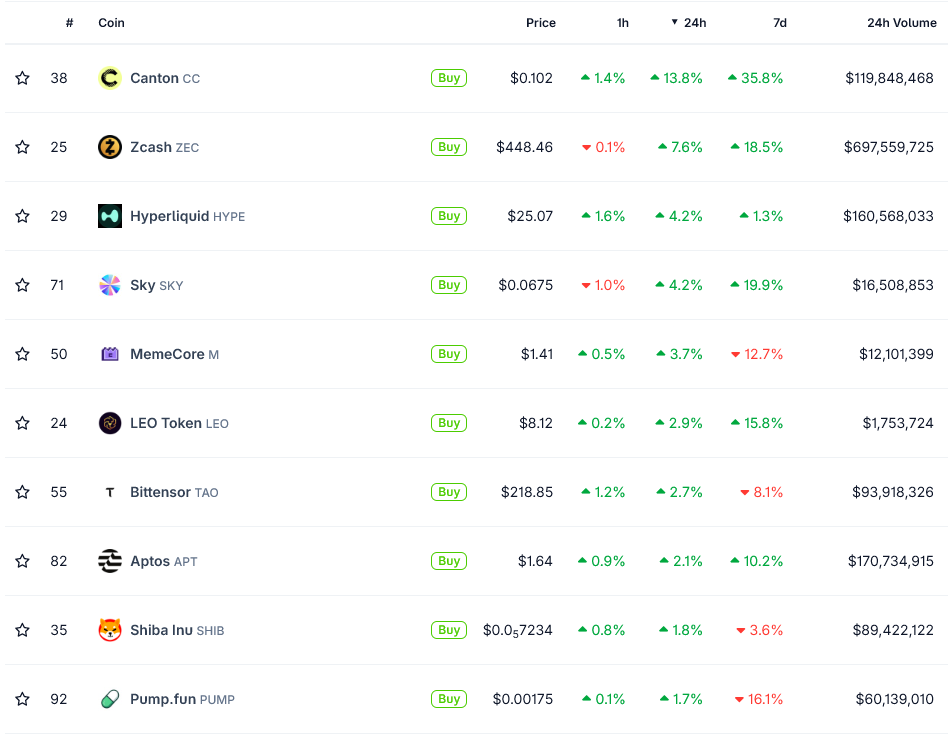

Top gainers in the crypto market on Christmas Eve 2025. Source: CoinGecko

Institutional Tokenization Drives Canton Token Rally

At the center of the gathering is canton networka privacy-enabled layer 1 blockchain designed specifically for regulated financial institutions.

Unlike public DeFi chains, Canton allows institutions to transact on-chain while keeping sensitive data private. This is a key requirement for banks, clearinghouses and asset management companies.

Canton’s utility token CC will be used for transaction fees, network security, and validator incentives. Its value is not closely tied to retail activities; Learn more about institutional use.

Therefore, price movements are very sensitive to developments at the infrastructure level.

Then the momentum picked up DTCC (Deposit Clearing Corporation) We confirmed the progress of tokenizing U.S. Treasury securities managed by DTC on the Canton Network.

The minting and use of U.S. Treasuries in Canton is scheduled for 2026, allowing tokenized USTs to be exchanged for stablecoins and other digital assets in near real-time, all with control over privacy and regulated market demands.

Major unlocking of global collateral mobility… pic.twitter.com/XnvdprRq7X

— Canton Network (@CantonNetwork) December 17, 2025

The initiative follows a regulatory green light from the US SEC, which issued a notice of non-action allowing DTCC to proceed with its live tokenization infrastructure.

This development marked one of the clearest regulatory approvals to date for on-chain US Treasuries.

As a result, the market has begun to reprice Canton as core infrastructure rather than a speculative blockchain project.

In early December, Canton also deepened its RWA stack through a partnership with RedStone, which has become a major oracle provider.

This integration enables real-time compliant price feeds for tokenized assets, bridging institutional markets and DeFi without compromising privacy.

These developments position Canton as a clearing layer for trillions of dollars of traditional financial assets.

Industry estimates suggest that more than $300 billion in transaction volume per day already flows through applications built on the network.

Canton CC token weekly price chart. Source: CoinGecko

Importantly, this rally occurred during an illiquid holiday session. This backdrop has amplified the movement, but it also highlights where the money is going to be concentrated heading into 2026: compliant tokenization infrastructure.

While the broader crypto market remains cautious, CC’s performance highlights a growing divergence.

I realized that $CC is useless. It also appears that the supply is constantly increasing, leading to inflation.

I often hear this in the comments. @CantonNetwork has implemented something called BME (Burn-Mint-Equilibrium).

1) Actual equilibrium:

• Annual goal:… https://t.co/kMAuMCAh7q— Heslin Kim (@HeslinKim) December 24, 2025

Investors are increasingly distinguishing between speculative tokens and protocols directly tied to regulated financial implementation.

On Christmas Eve, Guangzhou stood firmly in the latter position, and the market reacted accordingly.

The post State CC tokens jump on Christmas Eve as institutions push privacy narrative appeared first on BeInCrypto.