The US moves towards accumulation of bitcoin

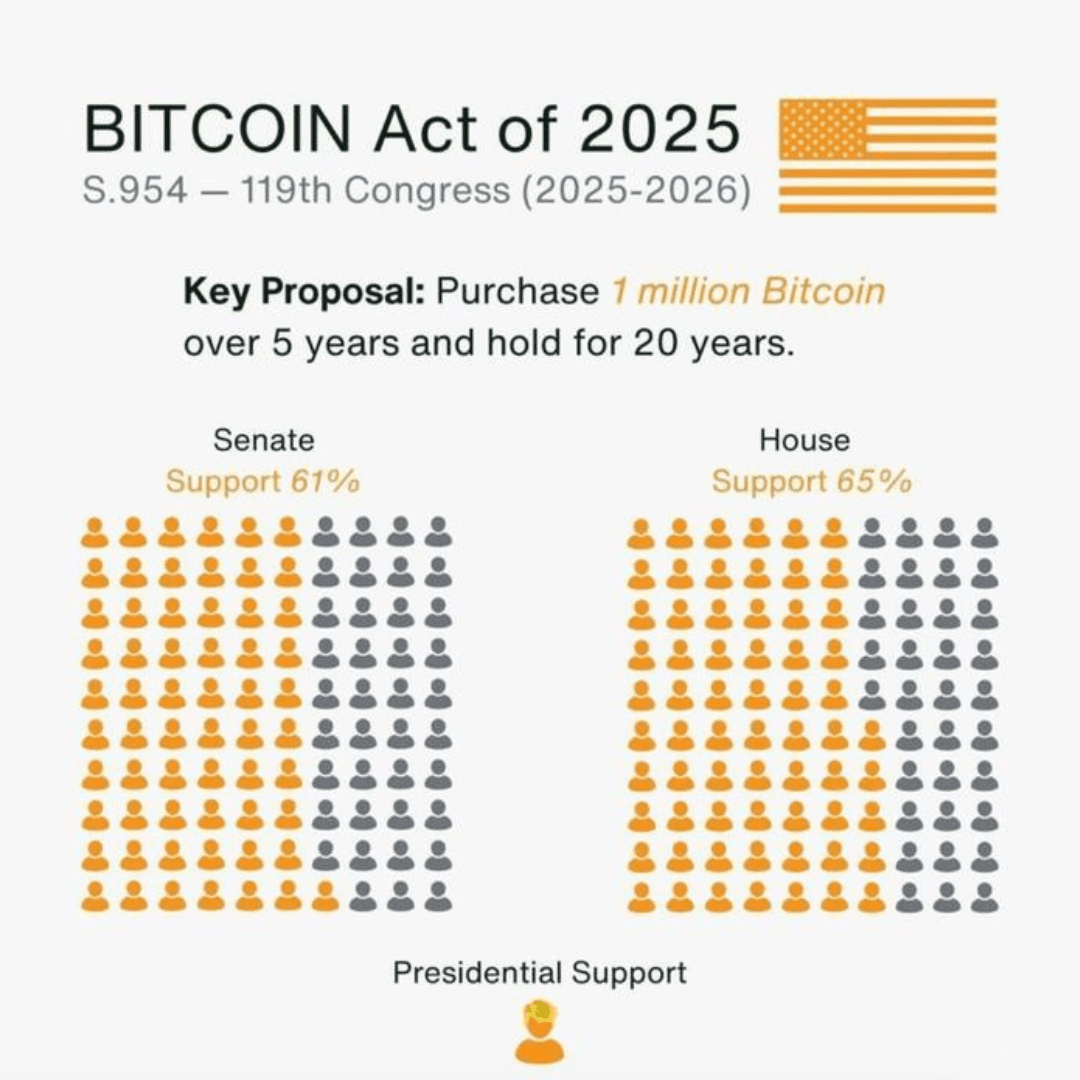

The US is about to undergo a groundbreaking change in its digital asset policy. Bitcoin Act 2025 (s.954)introduced at the 119th Conference (2025–2026), Strategic Bitcoin Reserve– The first national strategy to accumulate Bitcoin. With strong bipartisan support and momentum building, the law could reshape the role of Bitcoin in national economic and geopolitical strategies.

Political Landscape: majority support has been secured

According to recent data from Stand with the codethe bill gained considerable traction.

✅ 61% of US Senators (61 out of 100) Supports the law.

✅ 65% of the House (285 out of 435) I agree.

✅ The president has officially expressed his supportfurther strengthening the viability of the bill.

With this level of cross-party consensus, the 2025 Bitcoin Act is one of the most widely supported crypto initiatives in US history.

What the Bitcoin Act proposes

At the core of the bill is a Important suggestions:

The US government buys 1 million Bitcoin Holds for over 5 years and 20 years.

This initiative establishes a Strategic Bitcoin Reservereflects the logic behind the US strategic oil reserves, but applies to digital assets. The aim is to position Bitcoin as a long-term storage of value and the country’s economic hedge, especially in the face of global inflation and devaluation of Fiat currency.

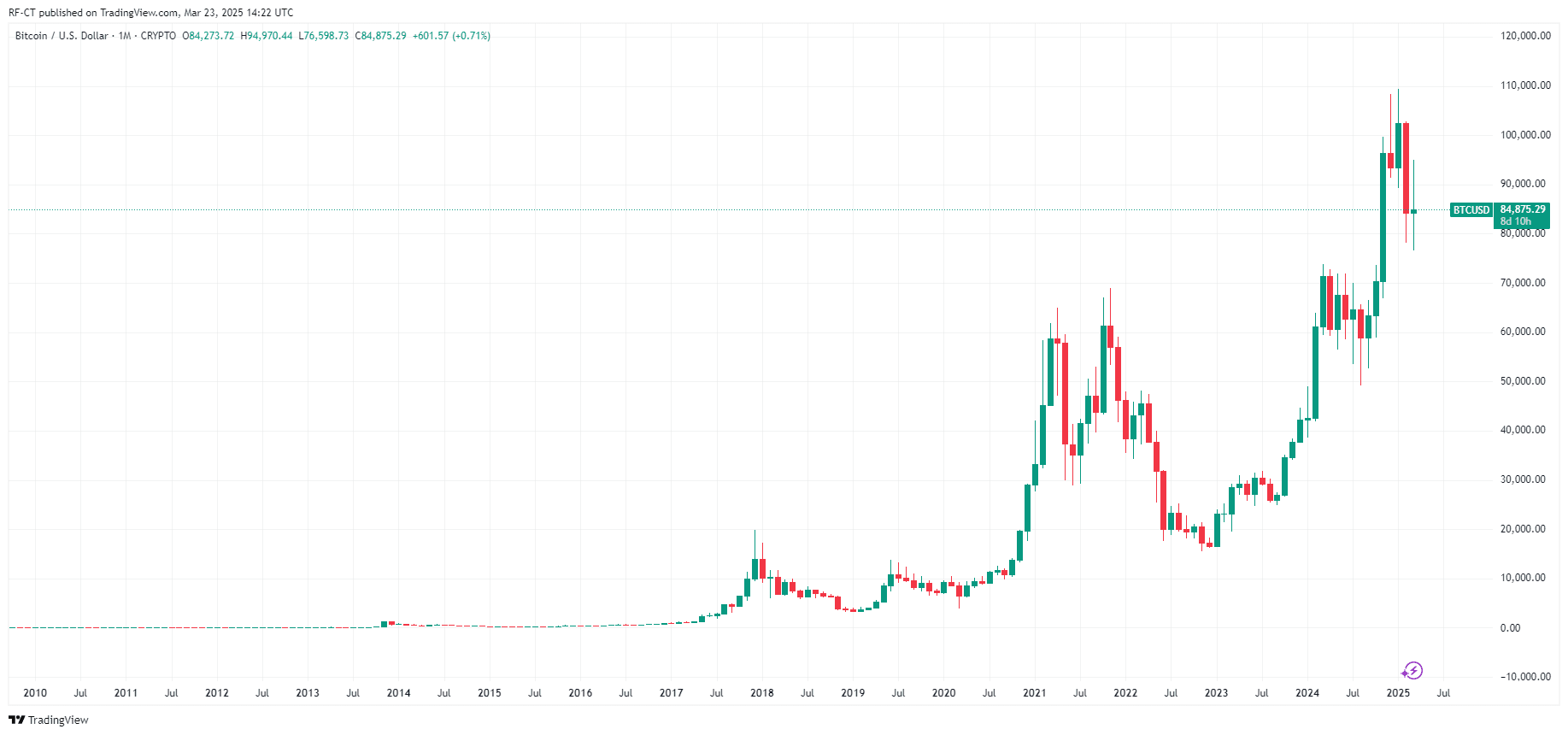

Why is this important: Historical accumulation events

If enacted, this bill could lead to that One of the biggest Bitcoin accumulation events in historypossibly causing domino effects among other countries. The idea of accumulation of nation-states is central to what is known as Bitcoin Game Theory– One major country is encouraged to start stockpiling BTC and the other countries follow so that they are not left behind.

this is:

- It dramatically increases the rarity of Bitcoin.

- Drives demand for institutional and global investors.

- Promote Bitcoin to a new all-time high.

- Redefine the role of Bitcoin from Digital Gold Digital National Reserve.

cordingView-BTCUSD_2025-03-23 (All)

Strategic Implications: Geopolitics Fills the Code

If the US leads the accusations, the move could put pressure on other global economies to respond quickly. The establishment of a strategic Bitcoin Reserve would make Bitcoin a geopolitical asset rather than just a speculative investment.

Countries that are slow to adapt can face strategic disadvantages in wealth conservation, monetary policy, and economic independence. Meanwhile, countries following the lawsuit may benefit from early stage accumulation and increased global impact.

Is this the beginning of a new financial era?

The Bitcoin Act of 2025 is more than a bill, it’s a declaration. The declaration that Bitcoin is no longer just a fringe asset, but a strategic preparation that can shape the future of finances and geopolitics. As bipartisan support is built and proposals approach the law, investors and institutions are watching closely.

Are you ready for what comes next? Bitcoin revolution?