Strategies (MSTR) Junior Preferred Stock Stride (STRD) saw its credit spread tighten further over the weekend, potentially highlighting strong demand for the company’s highest-yielding preferred stock.

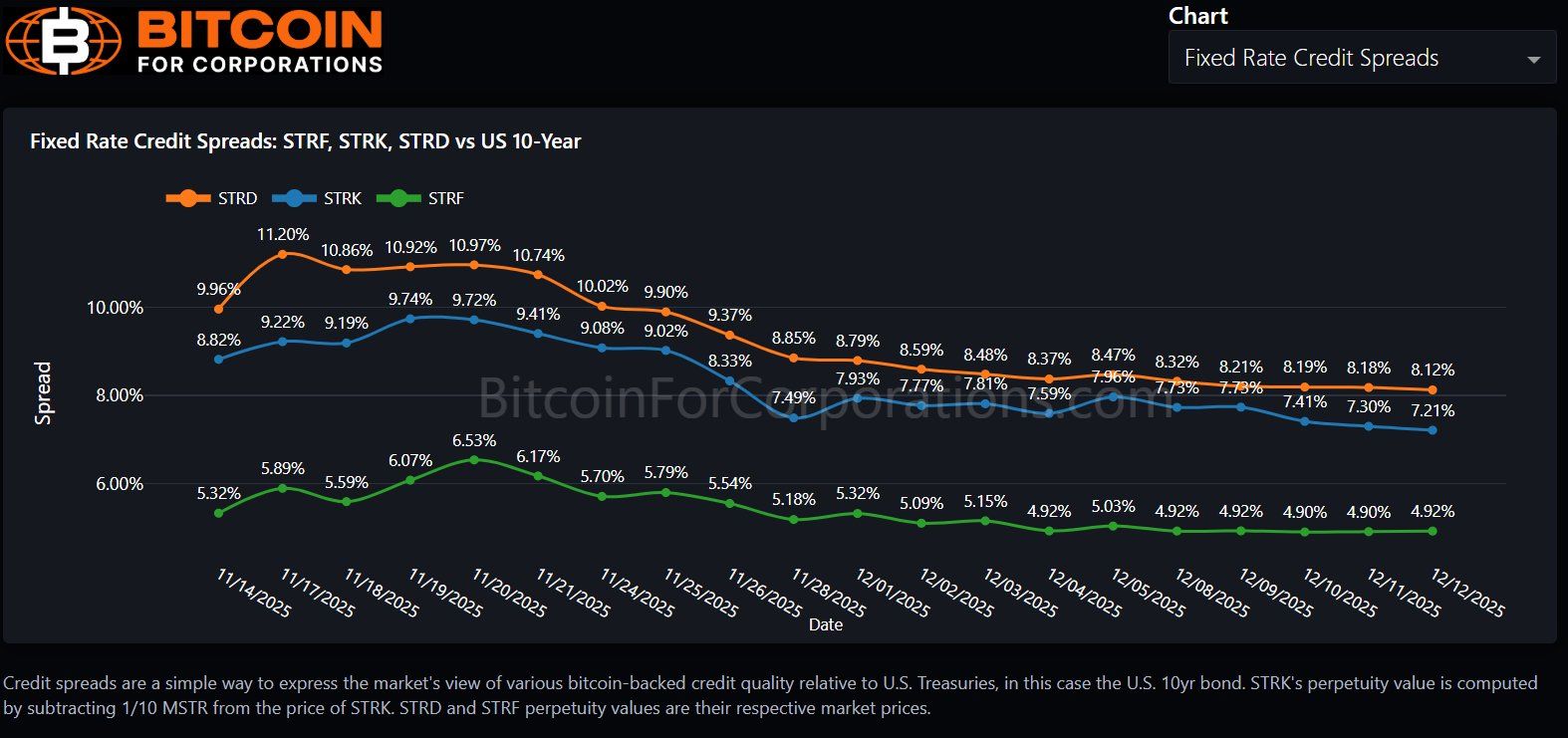

The spread between STRD and 10-year U.S. Treasury yields fell to a new low of 8.12% as of December 12, according to Bitcoin for Businesses data (on Monday, the spread widened again to nearly 9% as Bitcoin fell below $86,000).

Fixed Rate Credit Spread: STRF, STRK, STRD vs. US 10-Year Treasury Bond (Bitcoin for Corporates)

Credit spreads represent the additional return an investor requires to own riskier securities, such as bonds or preferred stocks, rather than lower-risk benchmarks such as the 10-year U.S. Treasury.

This latest data point for STRD continued what has been a steady decline since mid-November. A narrowing in the spread between STRD and government bonds can typically indicate increased investor demand and improved perceptions of credit quality.

Investors are reevaluating Strategies’ financial position and Bitcoin-centric business model and may be commanding a smaller premium over government debt as they view STRD as more stable than before.

Additionally, in early December, Strategy strengthened the creditworthiness of its preferred securities by establishing $1.44 billion in reserves to cover over 21 months of dividends, and continued to accumulate Bitcoin to increase the balance sheet collateral supporting its preferred stock.

Why STRD’s effective yield is attracting attention

STRDとストラテジー社のより上級の優先商品との間の利回り格差が市場の解説で再浮上している。 At current pricing, STRD offers a yield premium of approximately 320 basis points over STRF, another preferred series. However, this is despite the fact that both products have similar stated dividend rates.

As CoinDesk reported on October 20, Michael Saylor at the time dismissed concerns about the possibility of the younger stock’s dividend not being paid, saying that not paying STRD’s dividend was not a viable option.

The strategy executive chairman argued that the yield differential between the two products reflects credit spreads driven by capital stack positioning rather than fundamentals. Strategy introduced STRD six months ago as part of a broader effort to build a structured yield curve that ranges from relatively conservative income products to high-risk exposures associated with a Bitcoin-centric balance sheet.

Record STRD issuance stands out in historical context

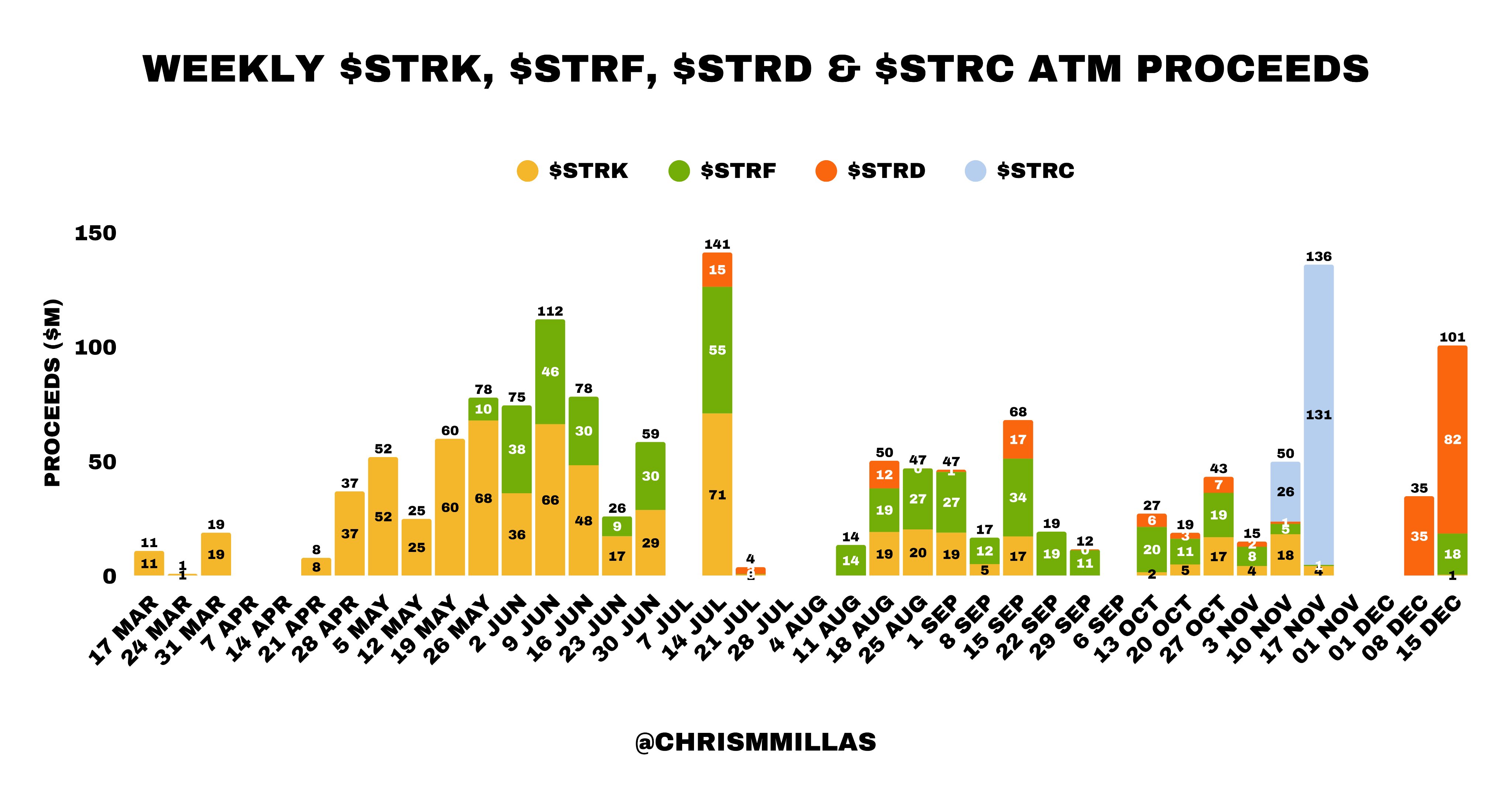

Strategy revealed on Monday morning that it sold approximately 1 million shares of STRD through its at-the-market program during the week ending December 14, raising $82.2 million. Junior preferreds accounted for most of the preferred stock issuance during the period, with STRF contributing $16.3 million, with minimal issuance from STRK and no sales of STRC.

According to weekly ATM issuance data compiled by cryptocurrency analyst Chris Milas based on Strategy’s public information since March 17, this STRD issuance is the largest single-week gain ever among the company’s preferred stock. The chart below shows that while issuance has rotated between STRF, STRK, STRD, and STRC over time, STRD has dominated in recent weeks, indicating a clear shift toward the company’s highest-yielding junior preferred stock.

Strategy Preferred Stock Weekly ATM Net Returns (Chris Millas)