Just as Bitcoin (BTC) goes through a stressful trading day, Michael Saylor has stepped into the spotlight. In today’s new post, the CEO of Strategy shared a photo generated by his AI on a chess board and captioned, “Bitcoin is chess.”

Importantly, the timing of the post coincides with rising financial market uncertainty as everything awaits fresh commentary from Federal Reserve Chair Jerome Powell.

Chess is, after all, about structure and strategy, not panic and prediction. Saylor has mastered this long game, citing fairness. Strategy, the company he chairs is 528,185 BTC, about $443.1 billion, as it holds one of the largest Bitcoin Treasury ministries on the planet.

The average purchase price is $67,458, and the current market is located in a healthy profit zone of around 24.35%.

Bitcoin is chess. pic.twitter.com/pnookuofzj

– Michael Saylor (@saylor) April 16, 2025

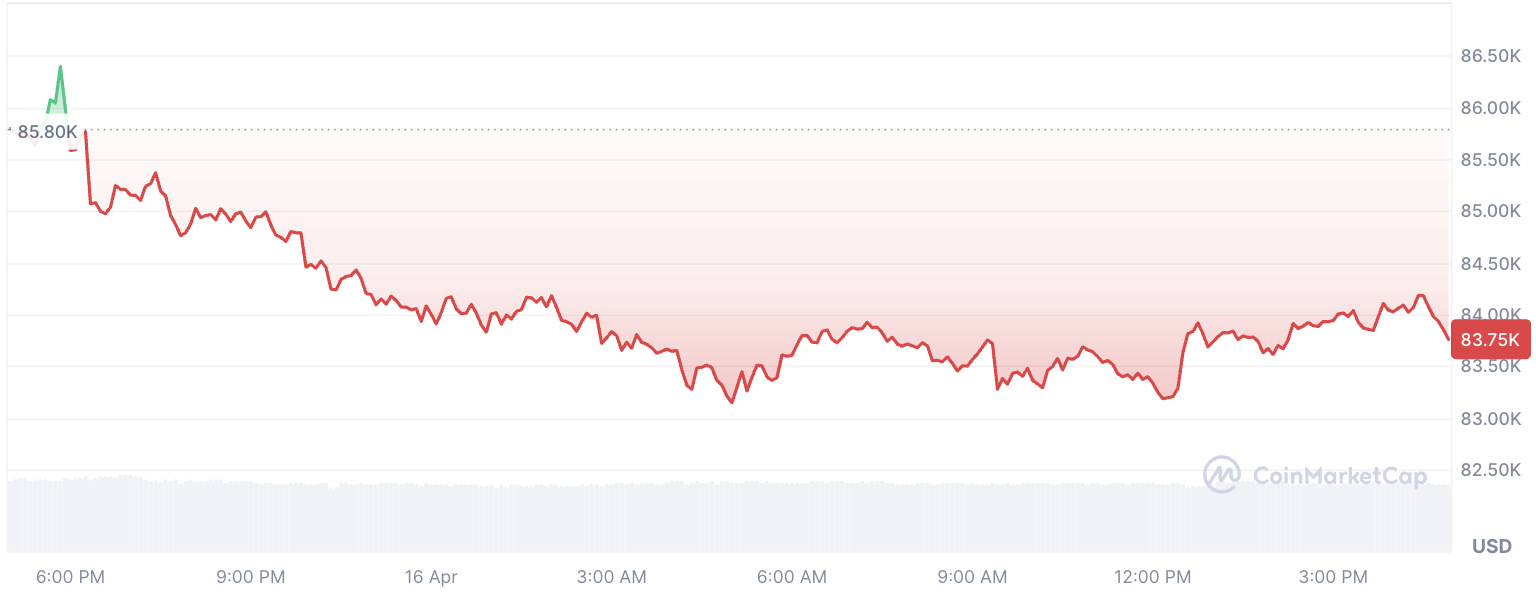

But today it is unsettling that controls the conversation, not profit. The Bitcoin price chart for April 16 shows all the classic signs of nervous trading behavior. From the reset of the trading session, Bitcoin bounced irregularly between $83,100 and $84,300, eventually landing around $83,909.

This pattern reveals nervous emotions: no sharp reversals, short-lived gatherings, and no clear directional beliefs. It’s not a crash, it’s not a breakout, it’s just a nervous one.

It is no coincidence that this atmosphere coincides with Powell’s expected commentary, who is expected to touch on interest rates, liquidity conditions and macro signals that can wavy risk assets. In that frame, Bitcoin is about less about Fed timing and longer than noise, as seen through the Saylor lens.