Strategies (MSTR) has written a formal letter in response to MSCI’s proposal to exclude companies whose digital asset holdings represent 50% or more of their total assets from the MSCI Global Investable Market Index.

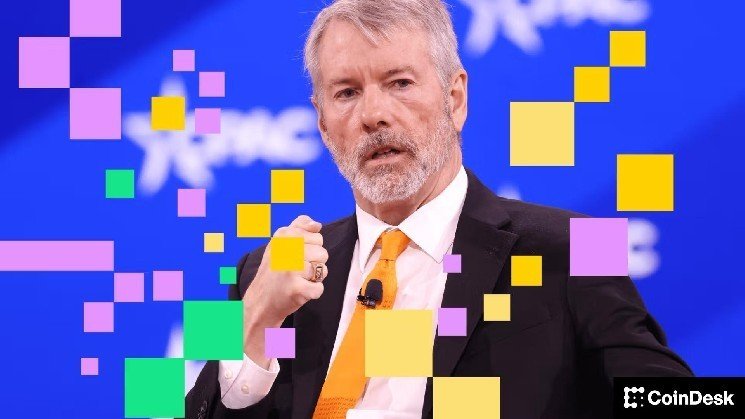

Strategy, led by executive chairman Michael Saylor, argued that digital asset treasury companies (DATs), including itself, are in the business of using digital assets as productive capital, rather than a passive means of tracking price movements. Strategy builds Bitcoin-backed credit products, manages aggressive corporate treasury programs, and maintains a global enterprise analytics software business. Investors are buying the company’s strategy and management, not a static wrapper around Bitcoin, the company said.

Strategy stocks, which were already under severe pressure due to falling Bitcoin prices and the shrinking mNAV (the premium investors use to value companies for holding Bitcoin), fell further when MSCI’s proposal was revealed two weeks ago. If MSTR were to be removed from the MSCI index, billions of dollars could be lost in passive capital flows.

Returning to Strategy’s argument, the company also cited five reasons why it is not an investment fund.

1. Organize your strategy as a traditional business company.

2. We do not have the structure or obligations of a fund or ETP.

3. MSTR is not an investment company under applicable law.

4. We do not establish funds that provide tax benefits to investors.

5. We have a long history as an operating software business.

Strategy says the proposed 50% threshold is arbitrary and unworkable. Many companies have concentrated reserves in oil, real estate, timber, utilities, etc., yet remain eligible for inclusion in the MSCI index. Therefore, MSCI only singles out companies that support digital assets.

Strategy further argued that the proposal injects policy insights into index construction as federal policy shifts to support digital asset innovation. Excluding DAT could force large-scale passive outflows, hurting U.S. competitiveness and slowing the expansion of new financial technologies.

If MSCI continues to be inclined to treat DAT differently, Strategy has asked the company to extend the consultation and provide more detailed rationale for the proposed changes.