SWIFT is preparing for major structural changes in the global payments system. This migration deprecates older messaging frameworks and >See how London’s neobank becomes wealthtech on fmls25

On November 22, 2025, SWIFT will complete the transition to the ISO 20022 CBPR+ standard. The network connects more than 11,000 banks and financial institutions in more than 200 countries. This cutover will retire the long-standing MT format for core payment instructions and replace it with an integrated framework built for richer, more consistent data.

SWIFT also tested connectivity with blockchain networks to explore cross-border remittances, CBDC payments, and asset tokenization.

This transition has been underway since March 2023, when SWIFT entered a coexistence period allowing both MT and MX formats. This period ends on November 22, 2025. After that date, payment instructions between financial institutions must be sent in ISO 20022 only.

(#Highlighted link#)

Institutions that continue to use MT for core cross-border payments risk delays, denials, and forced conversions by emergency response services, increasing costs and reducing transparency.

connected blockchain

SWIFT has tested connections between the ISO 20022 framework and several blockchain networks. Ripple is used for interbank payments and CBDC payments. Stellar supports cross-border remittances and stablecoins.

Algorand is testing asset tokenization and digital bonds. Hedera has been applied to corporate and government registries. Quant acts as a gateway between banks and blockchain.

Industry observers expect further integration of CBDCs and tokenized assets to occur by January 2026, potentially supporting new models of digital currency transactions and interoperability between networks.

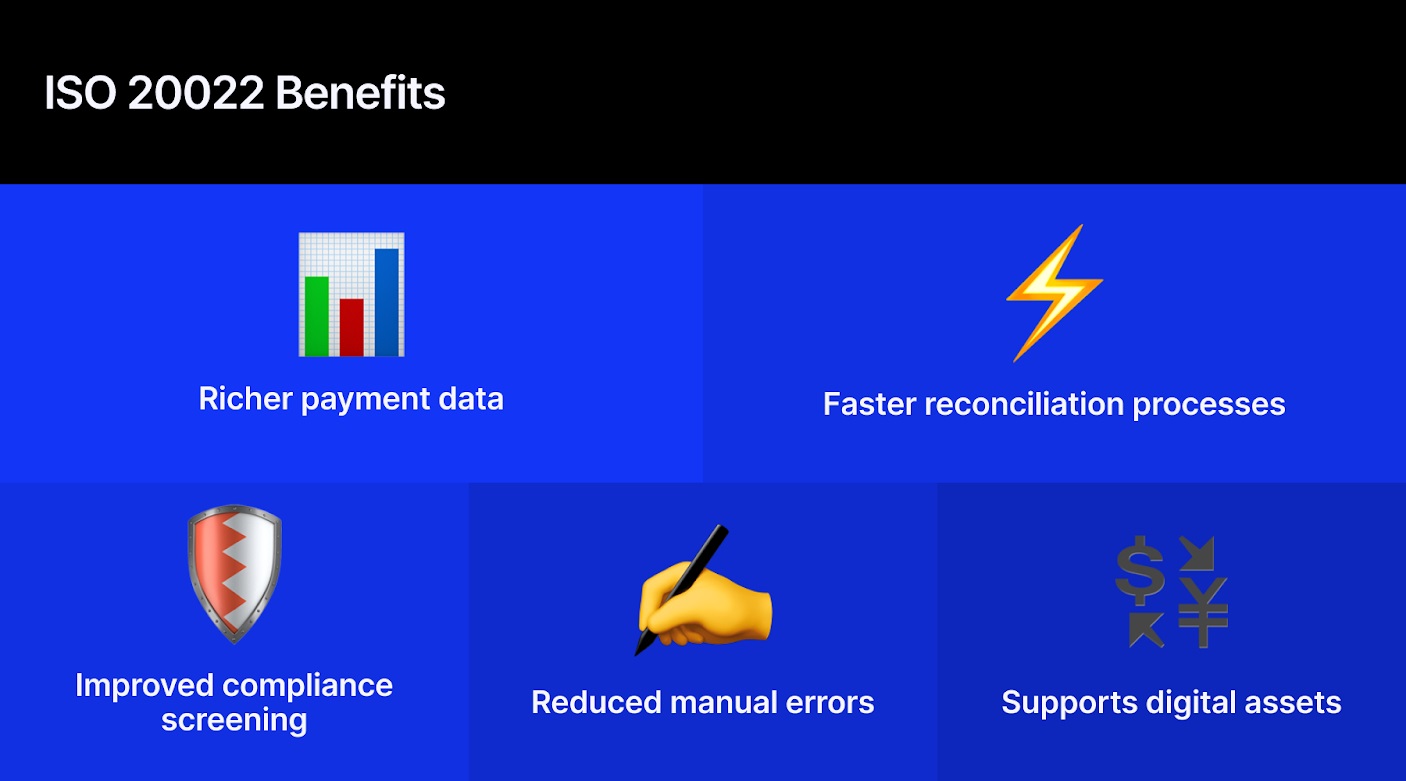

Operational benefits

Murthy Maddali, Managing Director, Techwave

“ISO 20022 facilitates improved compliance with regulations such as AML and GDPR through rich data,” emphasizes Murthy Maddali, Managing Director at Techwave.

He added that “automation reduces costs and errors and increases processing speed,” and that “API-driven integrations provide scalability, enhanced customer transparency, and robust encryption-based data security.”

The standard is also designed to reduce fraud and human error, improve traceability, and support cross-border transactions, while allowing all participants to communicate using a consistent messaging framework for cross-border payments based on CBPR+.

Final migration timeline

SWIFT has divided the final phase into three stages. On November 17, 2025, ISO 20022 will enter full operational readiness. From November 17th to 24th, banks and market infrastructure in Europe, Asia and the US will undergo a synchronized transition procedure. The complete switchover on November 22nd marks the point at which MT payment instructions will no longer be supported for live traffic.

Citibank is leading SWIFT’s ISO 20022 transition. All banks will follow suit and this will become the new standard for global payments.

ISO 20022 fixes messaging, not payments. That’s the gap. #XRP is a bridge that enables real-time value transfer. https://t.co/4RHx9A7CtV pic.twitter.com/H0HuerdH7Y

— Black Swan Capitalist (@VersanAljarrah) September 10, 2025

Scope of change

This cutover primarily applies to payment instruction messages, which are central to correspondent banking. Some other MT categories, such as reporting and research, will remain on a gradual roadmap beyond 2025. However, the main effect is significant: core cross-border payments will move to a single modern standard for the first time.

Purpose of introducing ISO20022

ISO 20022 provides richer, more structured data to improve automation, reconciliation, compliance testing, and processing efficiency. More detailed data means less manual work and less chance of error. Regulators believe that increased granularity will help improve transparency and monitor financial crime.

Connection to market innovation

This standard aligns with developments in tokenization, programmable payments, and central bank digital currency initiatives. SWIFT conducted a trial linking its interface to a distributed ledger network to test how tokenized assets, or CBDCs, can be moved between different systems.

These trials are exploratory and not a full production deployment, but they demonstrate how messaging migrations support future interoperability.

Industry expectations after cutover

Observers expect attention to shift to experimentation with tokenized securities, on-chain payment models, and nascent CBDC interoperability frameworks in early 2026. The ISO 20022 structured data model is considered a prerequisite, allowing traditional institutions to interact with digital asset systems through standard fields and consistent formats.

Operational readiness and risks

Banks still preparing are facing increasing urgency. SWIFT has warned that failure to meet the November deadline could result in business interruptions, higher processing costs and reduced efficiency. Several regional central banks and industry associations have launched preparedness programs to support testing and training.

Industry players believe the cutover will create a more standardized environment for core cross-border payments. They expect improved data quality, operational efficiency, and the ability to adapt to new payment technologies.

The full impact of the transition will become clearer once ISO 20022 is fully implemented and market participants adjust their systems and processes.