- Tether, the world’s largest stubcoin issuer, will create another $1 billion worth of USDT on the Tron blockchain on Friday.

- Large stubcoin influx during market gatherings often indicate fresh purchasing pressure.

- As investors report US and China’s inflation reports, tokens such as BNB, BGB, and TRX can benefit from volatile market fluctuations.

Surge in liquidity in the new $1 billion USDT Issued Signal Tron Network

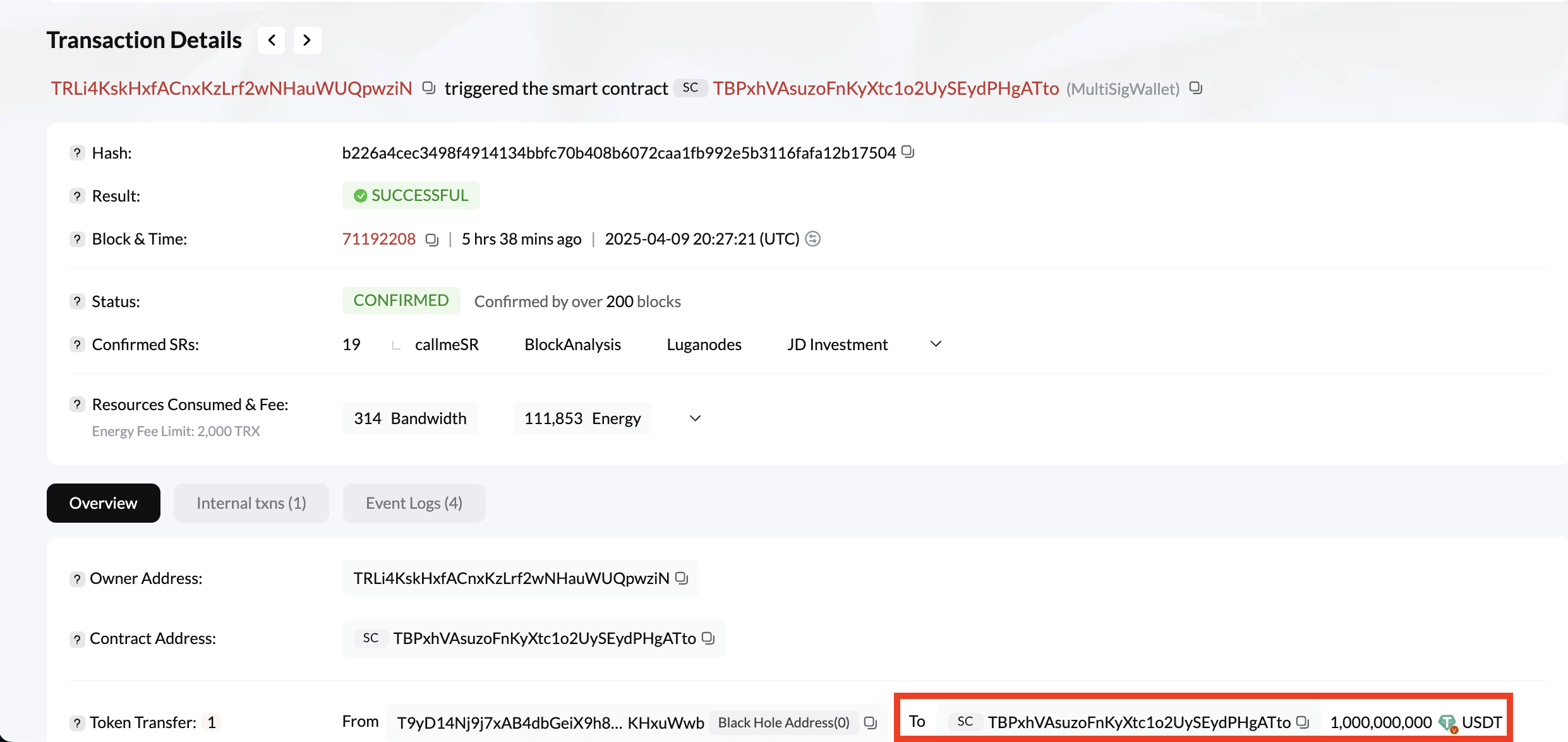

According to data from Whale Alert released Friday, Tether, the world’s largest stubcoin issuer, has minted another $1 billion worth of USDT on the Tron blockchain.

With this issue, Tether’s Tothor USDT supply will drive Tron’s total supply of more than $50 billion, strengthening its control within the Stablecoin sector.

However, Tether’s latest mint timing could link to traders looking to enter crypto positions to take advantage of potential short-term profits ahead of key macroeconomic reports from both the US and China.

Conversely, if a billion dollar inflow emerged from either or both of the world’s two biggest economies on Thursday, it could supply firepower to supply firepower.

In particular, the inflow coincided with Bitcoin prices. This temporarily surpassed $83,600 after former President Donald Trump announced a rollback on global tariffs. With CPI and PPI data looming, Tether’s $1 billion liquidity injection could provide directional momentum depending on each outcome.

TRON On-Chain Metric gets hot when Tethers combine another $1 billion in USDT

The foundations of Tron’s blockchain are flashing bullish signals supported by rafts of activity in the fierce chain amid the turbulent market.

On Wednesday, Tronscan on-chain data shows that Tether is the world’s largest Stablecoin publisher, has run an additional $1 billion USDT issue on its network.

This coincides with the dominant narrative of investors beginning to redeploy capital to crypto-risk assets.

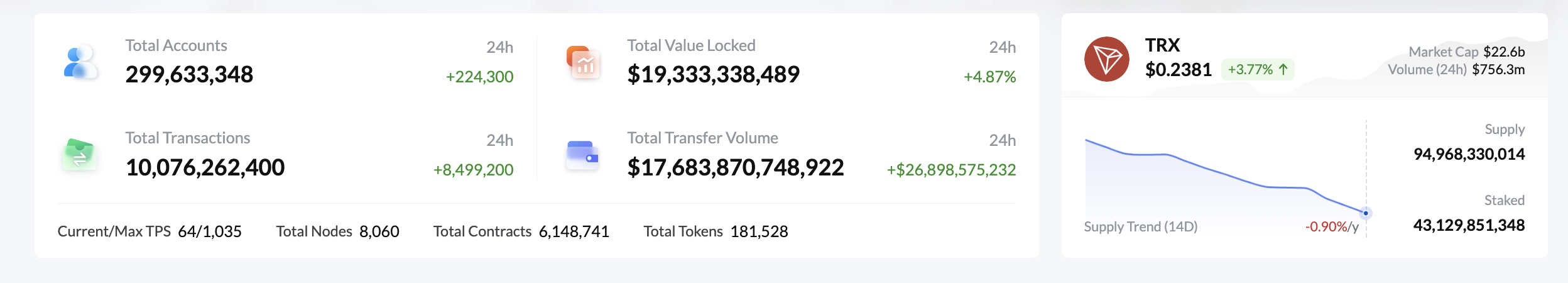

Examining this stance, Justinsan’s Tron network expansion has been significantly accelerated. According to real-time Tronscan data, the new TRX account has increased by 224,300 in just 24 hours, bringing the cumulative count to 299.63 million. This increase highlights an increase in user adoption and increased stubcoin activity as market turbulence increases.

More importantly, Tron’s daily trading numbers have increased by 8.5 million, boosting the total number of all-time highs, past 107.07 billion. At the same time, the locked total value (TVL) rose 4.8% to $19.333 billion, reflecting a meaningful injection of new capital into the Tron Defi Ecosystem.

These heading metrics are further supported by deeper liquidity metrics. Over the 24 hours, Tron’s transfer volume increased by $268.9 billion, increasing its cumulative transfer volume to $17.68 trillion. This suggests that capital is not only parked, but is actively moving within the ecosystem. This usually precedes the demand pressure on TRX.

Essentially, the dynamics of the TRX supply side draw a picture that tightens supply and strengthens investors’ sentiment after Trump’s decision to suspend tariffs on all US trading partners except China.

TRX Prices are ready for breakout amidst the wave of liquidity

Historically, fresh Stablecoin issues, especially at Tron, have preceded a surge in TRX and other related tokens. The newly built USDT fuel supply cross-border transfers, OTC desk settlements, and many of the credit loans all incur TRX gas charges.

Thus, periods of intense market volatility with traders who are putting in and out of stub coins often create a great traction in the incentives of TRX token holders, resulting in sustained buying pressure.

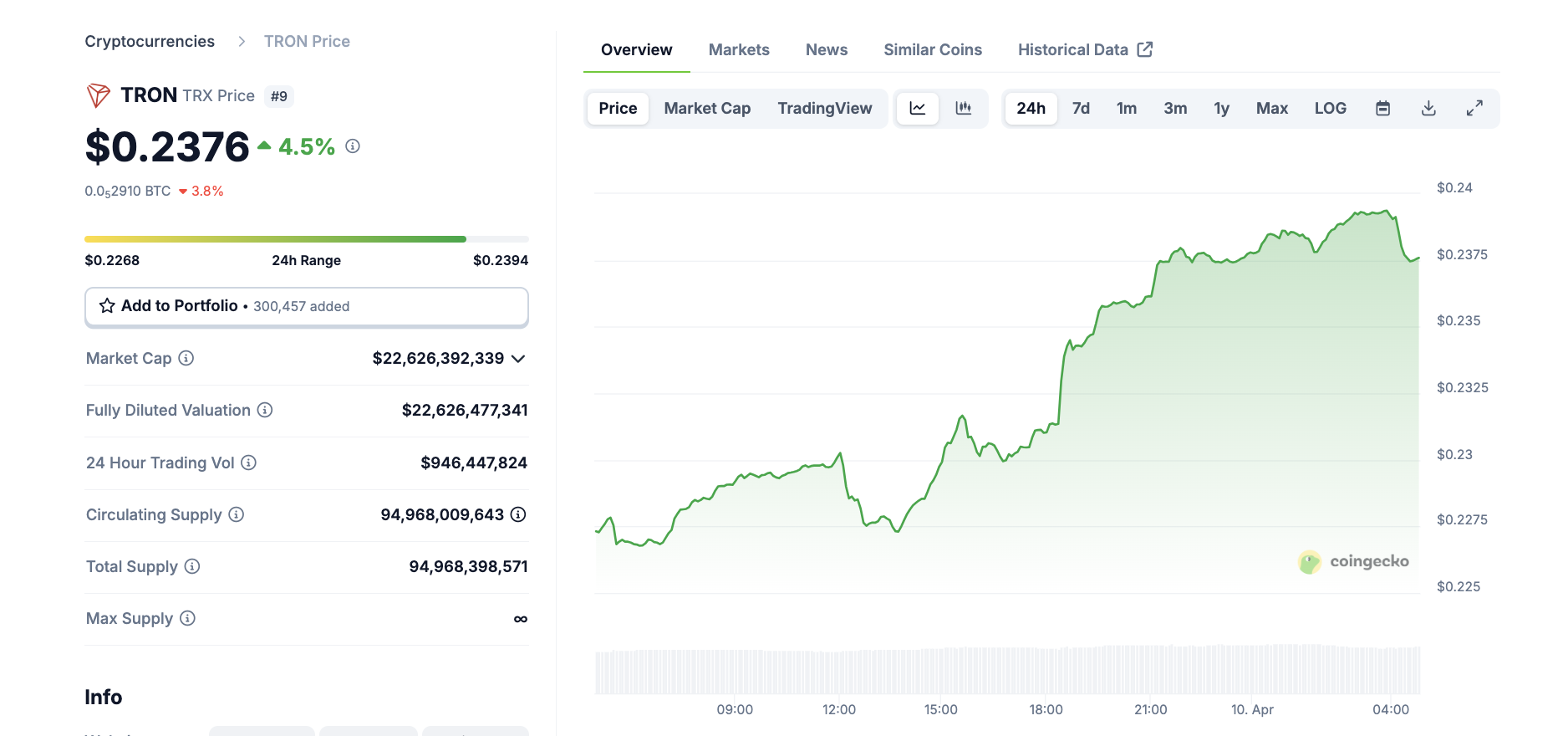

Tron (TRX) Price Action, April 10th | Source: Coingecko

Market sentiment is beginning to coincide with chain strength as TRX prices rose 4.5% during pressing Thursday, reaching $0.2831 and 24-hour trading volume of $946 million.

Furthermore, TRX exchange balances have declined sharply over the past 48 hours as investors move tokens to private wallets, piles and signal dependence on sellers’ pressure and long positioning.

Upcoming macroeconomic data checks Dovish’s inflation trends, and TRX could break through a level not seen in 30 days, at a level close to $0.135. This allows the current TRX holder to acquire another one 4.7% Profit in the short term.

Share: Crypto Feed