Gas usage is a proxy indicator of economic activity in some major chains. Tethers appear as the top gas burner for Ethereum and major EVM compatible chains.

Conduit research tracked economic activity Gas usage Over the past year, we have profiled some of our major chains. The Ethereum ecosystem, including L1 chains, L2 networks and EVM compatible chains, has emerged as a major hub for tether activities. Tether smart contracts are close to most of these chains.

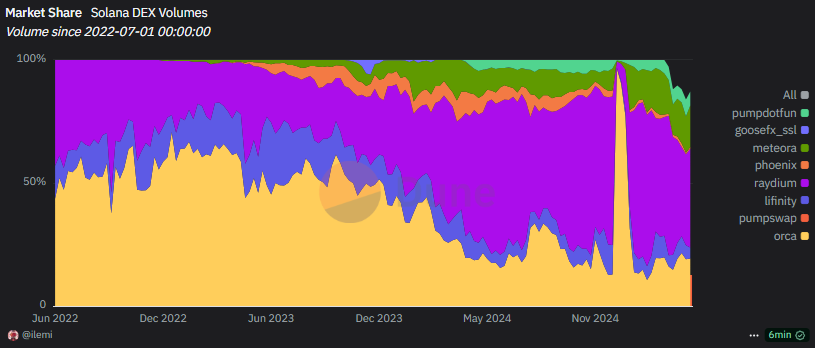

Conversely, Solana has emerged as a chain of dex trading, with Raydium burning the most gases in the last 12 months.

Conduit Report tracks EVM networks such as Ethereum, Solana, top L2 chain gas, and Avalanche. All of these chains use a gas calculation format. This is the cost of the user and the source of the validator’s income.

Tethers are key gas burners for multiple chains

Tether issued USDT tokens as native assets across multiple chains. At Ethereum, USDT Smart Contract burned more than $70 million in gas for the 12 months ended in April 2025. The Stablecoin smart contract is second only to the Uniswap router, which burned more than $189 million in gas at Ethereum.

Uniswap and Tether often exchange locations as top gas burners depending on the time, user activity, and the presence of other busy contracts. In the short term, USDT is on fire 6.8% Of all Ethereum gas, however, the share has increased to 11.75% over the past 12 months.

The contract version of Tether is also Tron, OP Mainnet’s main gas burner, and is the second most active contract in the Avalanche and BNB Smart chain. In the case of BNB chains, the use of USDT is associated with small transactions for payments and transactions. The contract will burn more than 30% of the chain’s gas for the past 12 months.

Gas burners use up resources from the client side, reflecting the true feelings of the user. For Ethereum, this means that Stablecoins is one of the top use cases, even when the network has relatively low traffic.

The following apps include Dex Router Contracts, Trading Bots, and aggregator apps such as 1inch and Cowswap. The choice of gas burner apps is mostly limited to Defi, with no other use cases like gaming or NFT.

Solana turns into a chain of DEX activities

The top app for Solana of the observed period is Raydium, the main DEX. Raydium burned 41.81% of all Solana gas.

Raydium was Solana’s top gas burner due to its status as a major Dex. |Source: Dune Analytics

The photon trading bot consumed more than 20% of Solana’s gas. Pump.Fun and Jupiter Aggregator consumed an additional 33% of the network’s gas.

Solana still carries over 87.2% Trading bots Users are up from 86% in the past few weeks. The Solana Ecosystem showed divergence from the EVM compatible chain and has been transformed into a high speed network for DEX swap.