The major Altcoin Ethereum has focused on a 9% increase over the past week as the broader cryptocurrency market is trying to recover from the recent low.

The rally is partly supported by a gradual revival in general market bullet sentiment, but two important on-chain metrics suggest that ETH’s momentum can be further strengthened.

ETH supply is low every year, and traders are a big bet

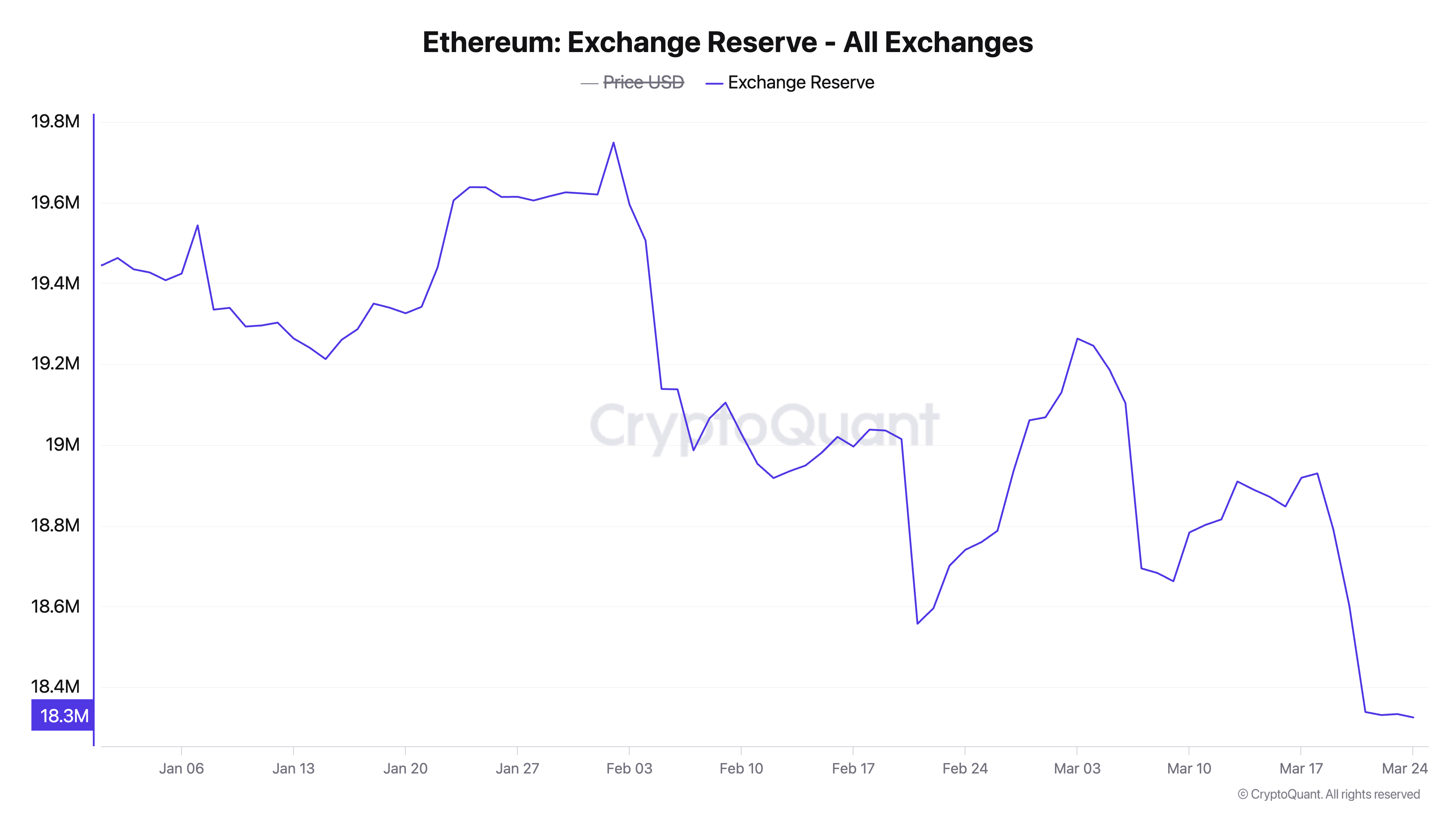

On-chain data reveals that ETH’s Exchange Reserve has dropped to its lowest level this year. At the time of this writing, the metric was ETH of 18.32 million, plummeting 7% on February 2nd from the early peak of 1974 million coins.

Eth Exchange Reserve. Source: Cryptoquant

The asset exchange reserve measures the total amount of coins or tokens held on the exchange and represents the supply available for immediate trading. If it declines, the trader will withdraw long-term storage, staking, or exchanges with spot ETFs, thereby reducing the available supply of assets.

This means that a decline in ETH supply can cause upward price pressure as low sales liquidity and stable demand tend to raise prices.

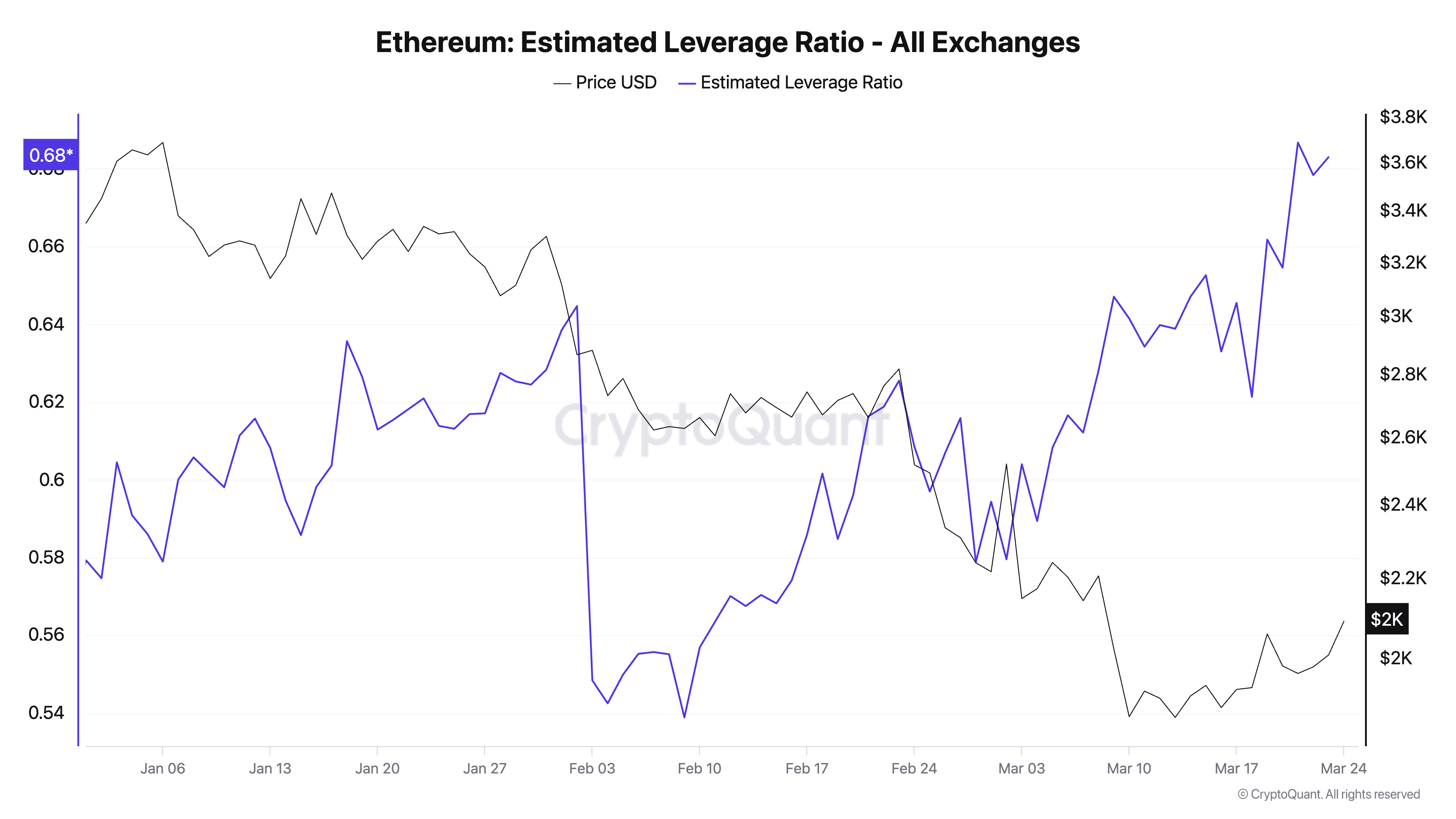

Furthermore, the estimated leverage ratio (ELR) of ETH has risen, suggesting that traders are increasingly using leverage to amplify bets on future price increases for coins.

For context, ELR witnessed a minor pullback after reaching an annual high of 0.686 on March 21. At the time of writing, ETH’s ELR is 0.683.

Estimated leverage ratio for ETH. Source: Cryptoquant

The ELR measures the average amount of leverage traders used to run transactions on cryptocurrency exchanges. It is calculated by dividing the public interest on an asset by the exchange reserves for that currency.

The rapid growth of ETH has shown an increase in risk appetite among traders, despite price issues since the beginning of the year. This trend indicates that many coin holders are optimistic about short-term gatherings and are willing to use their positions to amplify potential benefits.

ETH at Turning Point: Will the Bulls drive it to $2,224, or the Bears take it to $1,924?

ETH is currently trading at $2,089, earning 4% in the past day. The green histogram bar posted by the Elder Ray Index reflects the growing bullish bias towards Altcoin. It was 52.80 at press, the best in the last 30 days.

This indicator measures trading pressure in the market. If its value is positive, it indicates that the buyer is dominant, suggesting stronger bullish momentum and potential price increases.

If Eth Bulls has increased control, they could push Coin’s price up to $2,148.

ETH price analysis. Source: TradingView

However, once the Bears regain control, Altcoin’s value could drop to $1,759.