This is a segment of the LightSpeed Newsletter. Subscribe to read the full edition.

Decentralized wireless company Helium plans to pour 100% of its helium mobile subscriber revenue into HNT Token Burns, tweeted yesterday by co-founder and CEO Amir Haleem.

It is not clear whether helium is planning to buy HNT in the open market or simply burn tokens from the Treasury Department, but the initiative is being implemented “with the exception of odd logistics this week.”

In any case, this is an estimated $2.3 million monthly total revenue charge, otherwise helium parent company Nova Labs is currently redirected to HNT token holders.

HNT is a native SPL token for helium and moved from its own L1 Appchain to Solana in April 2023.

When a user pays USD to use a network of helium, it is exchanged for HNT under the hood and burned for 0.00001 $0.00001 of a consumable fixed price token called “data credits”.

Today, helium has around 1.1 million users every day across 108,850 hotspots.

The majority of helium revenue is driven primarily by offloading WiFi carriers, rather than their own mobile virtual network operators (MVNOs).

If a major carrier, such as AT&T or T-Mobile, is near a helium WiFi spot, it can automatically shift that data into a helium network and pay helium per helium.

In this way, major airlines avoid additional CAPEX while successfully improving customer coverage in difficult or obscure places to service.

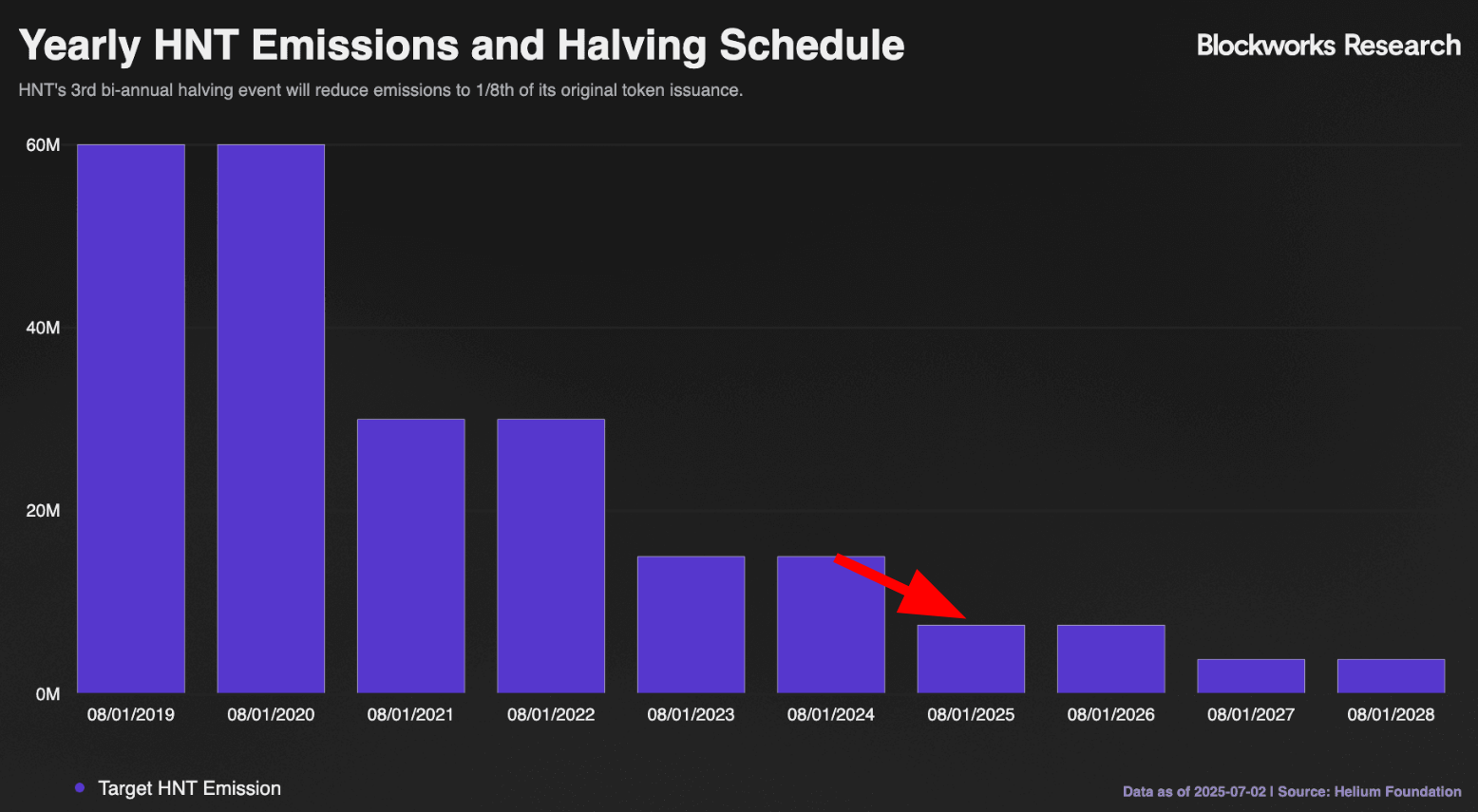

Earlier this month, helium experienced biennial emissions, halving its annual HNT emissions from 15 million to 7.5 million.

Source: BlockWorks Research

Source: BlockWorks Research

Both mechanisms are half the emissions and burns in the circulating supply – which can create a net deflation effect on the HNT token.

Nick Carpinito from Blockworks told me: “Amir’s announcement puts immediate deflationary pressure on HNT by burning tokens equivalent to Helium Mobile’s subscriber revenue.

“The specific mechanism remains to be seen (whether Nova Labs will burn from the Treasury, buy in the open market, or whether this applies to gross and net revenue), but this represents a key step to integrating NOVA Labs’ off-chain revenue stream directly into HNT’s talknomics, as was expected in the July analysis.”