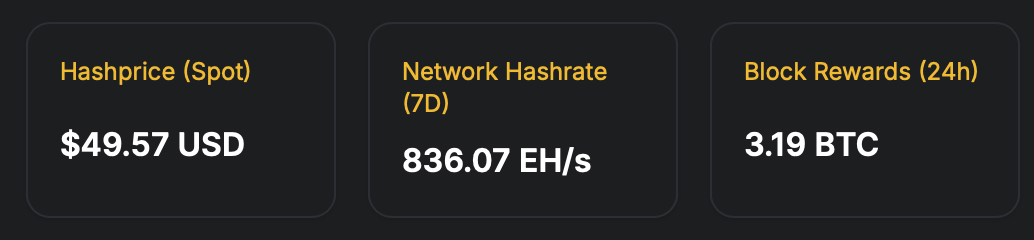

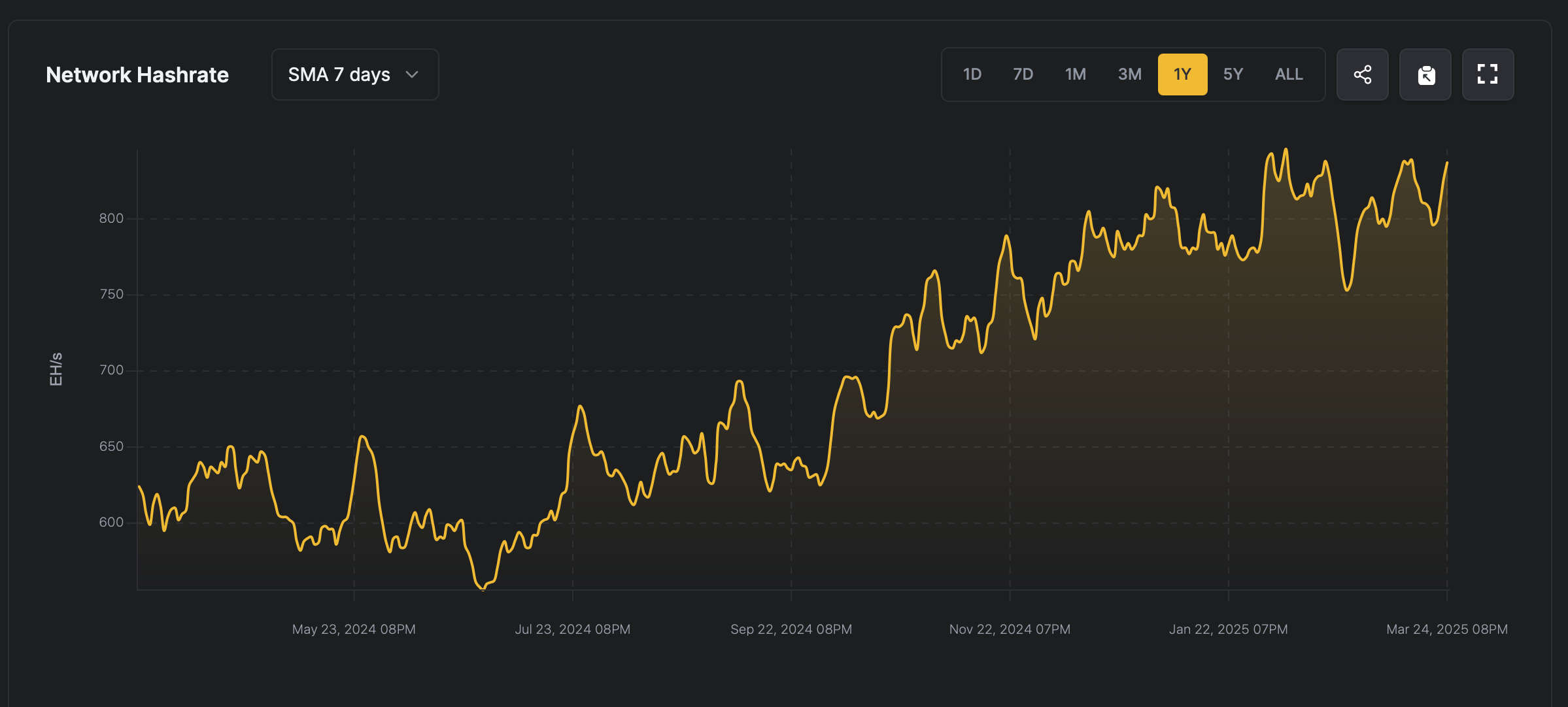

Bitcoin hashrates has steadily climbed, with the network adding 40 exhahash (EH/s) per second over the past five days, reaching 836 EH/s, approaching the historic peak of the protocol. Furthermore, due to the rising price of Bitcoin, Hashpris represents estimated daily revenues from 1 second per second (pH/s) of computational power, but also saw an increase.

As the hashrate approaches peak, Bitcoin Miners navigate tight margins

On Tuesday, March 25th, 2025, Bitcoin Miner saw an improvement in revenue compared to the previous week. On March 18th, the estimated one pethash per day was $46.21. Today, it rose to $49.57, according to statistics collected by HashrateIndex.com.

Bitcoin Hashprice, hashrate, and average 24-hour block rewards via HashrateIndex.com on March 25, 2025.

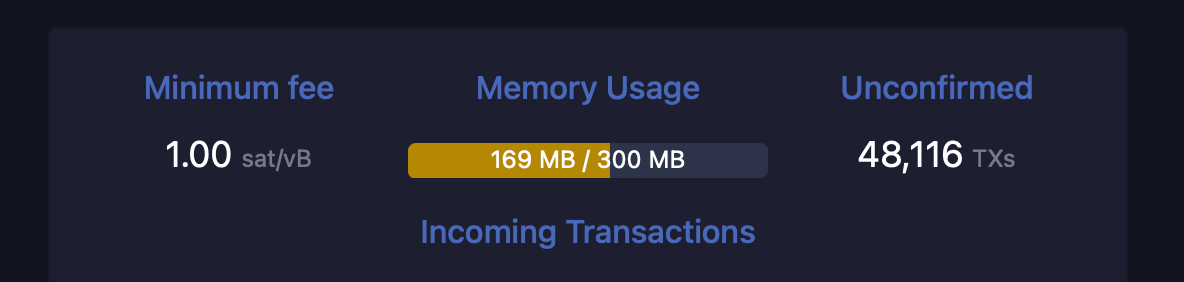

The rise provided a modest relief to miners who had experienced more severe margins during the first three weeks of March. Data in Mempool.space shows network activity pickups in 48,116 unconfirmed transactions sitting at Mempool by 6:30pm on Tuesday.

Currently, Mempool has around 48,116 unconfirmed transactions awaiting confirmation. Source: mempool.space.

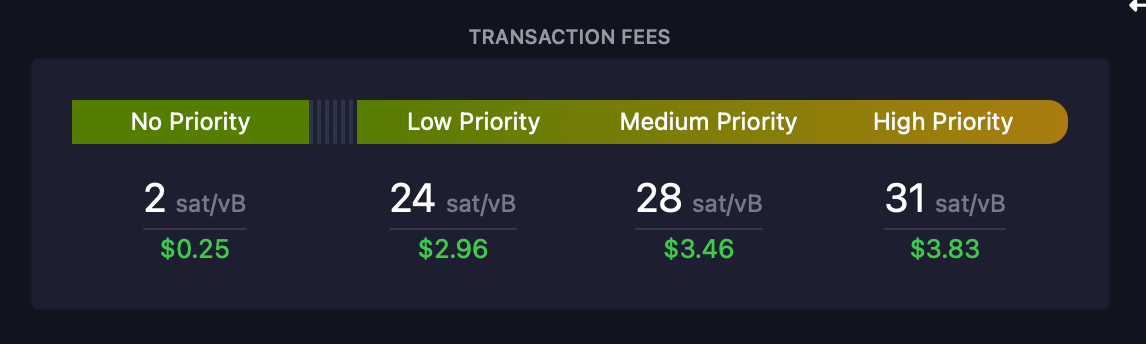

Transaction fees have also increased. At the current rate of 31 atoshis (sat/vb) per virtual byte, a higher priority transfer costs $3.83. The recent rise in BTC prices is a major factor in the rise in revenue, as transaction fees account for only 2.14% of total revenue over the past 24 hours.

Bitcoin fees have been increasing recently. Source: mempool.space.

The latest price movement also saw a higher hash rate, with the network increasing 40 EH/s from 796 EH/s on March 20th to 836 EH/s today. This upward trend coincides with a 1.43% difficulty adjustment made two days ago at block height of 889,056.

The mining difficulty is currently set at 113.76 trillion, just below the 114.17 trillion record high, recorded six weeks ago at block height of 883,008. Current changes in network dynamics suggest miners’ recalibration periods, balancing operational costs with difficulties and price-volatile revenues.

Bitcoin Calculation Power (7 Days Simple Moving Average) via HashrateIndex.com on March 25, 2025.

Minor profitability appears to be increasingly linked to BTC’s market value, as transaction fees still play a small role in revenue. As the protocol inch towards the historic threshold, participants may need to adapt their strategies to tighten margins and navigate evolving network conditions.

On the other hand, advances in application-specific integrated circuit (ASIC) hardware may also contribute to increased computational output. Empirical analysis shows that variations in Fiat valuation precipitation in Bitcoin correspond to the adaptation of network hashrate and appear after a time delay of 1-6 weeks.