Famous asset manager Fidelity highlights Bitcoin’s unique features and capabilities in a recent report compared to other cryptocurrencies.

Buttressed Bitcoin exception in a recent Coin Report publication shared on Friday Tweet. The $6 trillion asset manager discussed the facts, strengths and weaknesses of pioneering cryptocurrency, including potential use cases.

Bitcoin as a valuable store

A loyal brand Bitcoin A term used to classify assets that retain purchasing power over time as a potential reservoir of value. Interestingly, this clear quality is rare not only in the digital asset industry but also in the global financial markets, putting Bitcoin on its exclusive list.

Bitcoin has been growing for many years, surpassing the best asset classes in the world. In particular, BTC outweighs even gold, an asset considered the highest valued storage of the past five years. Major cryptocurrencies are up 951% within this time frame compared to a medium 57% increase in gold.

Meanwhile, Fidelity emphasized that Bitcoin’s potential as a valuable store is in a better caliber than other cryptocurrencies. Others have performed strong like its closest competitor, Ethereum, but no one has done it on the same level as the native tokens of the first fully distributed electronic payment system.

There’s only one bitcoin

Additionally, the asset manager highlighted the unique strengths of Bitcoin, decentralization and security. For example, there are only 21 million assets that exist. It is a demonstration of its finite nature.

This limited cap, in addition to the well-structured issuance rate of Bitcoin, promotes its value and establishes its role as a new storage and ambitious financial benefit. Meanwhile, as demand has reached an insane level, watchers claim they will soon be buying from Bitcoin.

Bitcoin is also decentralized, spurring the consensus mechanism for its proof. With no singular or central control, the network achieves consensus through the voting process, thereby eliminating the need for intermediaries.

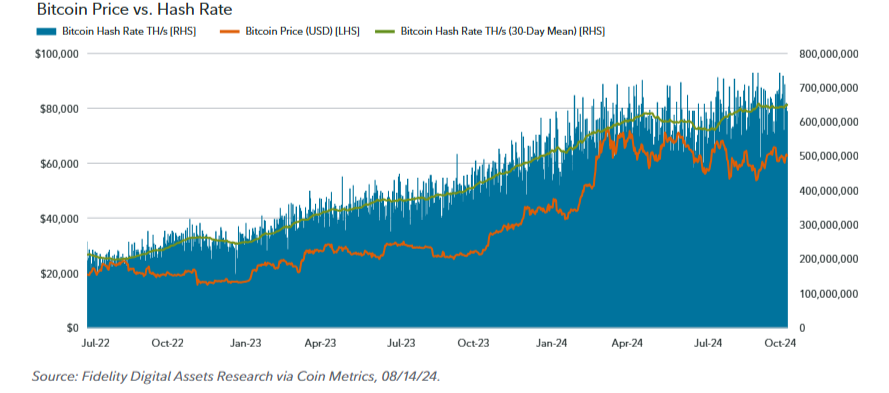

Meanwhile, Bitcoin is becoming increasingly difficult to attack and compromise. Increased prices of nodes, miners and assets made it practically and cost-wise impossible for one individual to control up to 51% of their computing power.

Bitcoin hashrate and price lurry establish security

Surprisingly, this is the only missing piece that will get Bitcoin back on track to solve blockchain tri-remas and drawdowns of scalability.

For one, Bitcoin networks are ranked as one of the slowest in the sector, and this decentralized nature plays an important role in this regard. It can handle just 3-7 transactions per second compared to newer chains like Solana, which has 4,000 TPS.

Essentially, Fidelity values Bitcoin and predicts its value will continue to rise along with its increased potency and rarity. We didn’t predict the asset price trajectory, but there is a prediction that it will rally. $200,000 This year and $1.5 million Over the next five years.