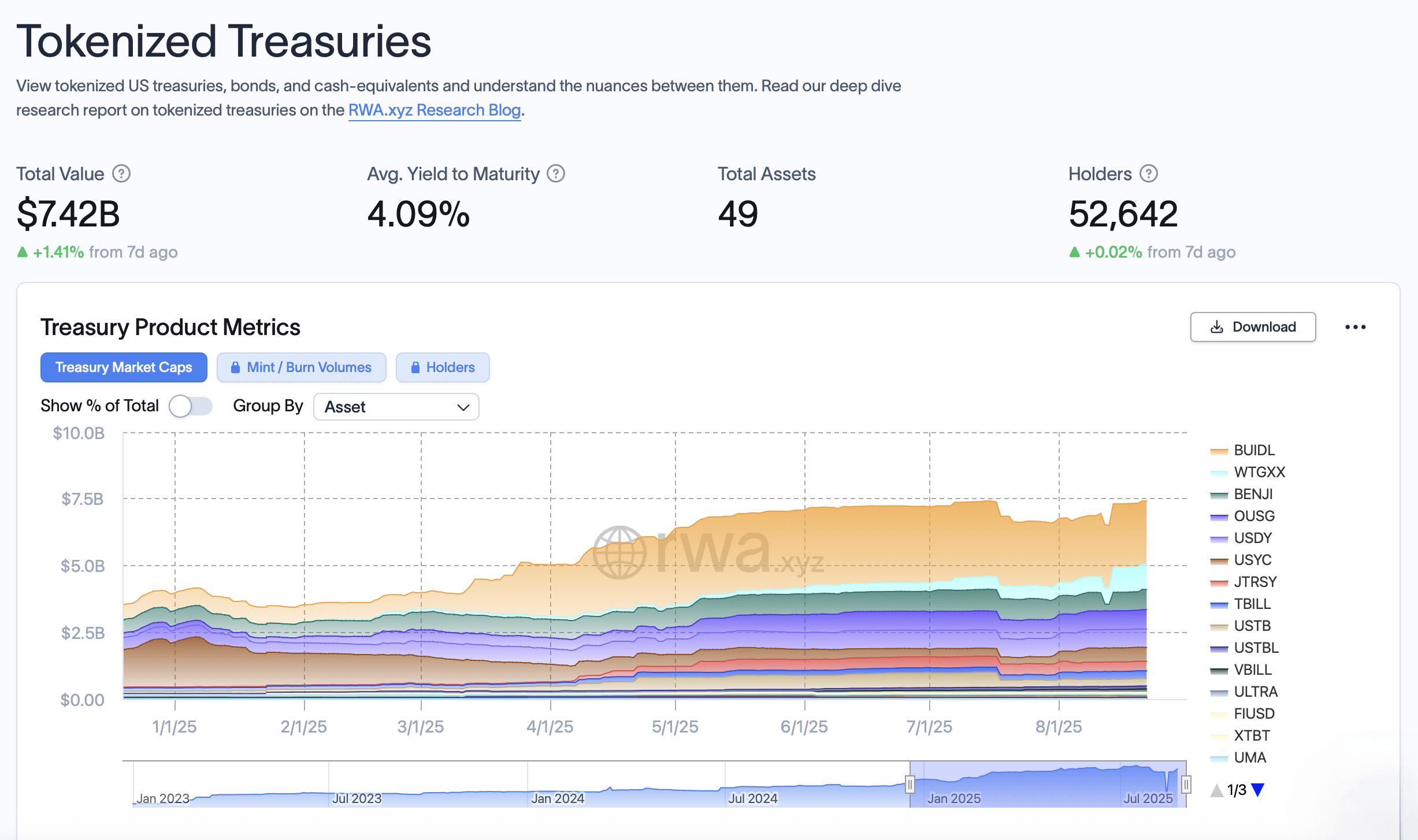

Tokenized US Treasury locked total (TVL) reached $7.42 billion on August 23, slightly surpassing the $7.41 billion record on July 16.

The agency’s US bond token reached $7.42 billion across 49 products

The latest figures from RWA.xyz show growth of 1.41% from a week ago, with tokenized bond products continuing to attract investors for on-chain exposure to government-supported assets. Currently, the market spans 49 individual assets across multiple issuers and protocols, with an average yield of 4.09% and a unique holder of over 52,600 people.

Source: RWA.xyz statistics for August 23, 2025.

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), issued through securitization, is the largest tokenized financial product with a market capitalization of $2.38 billion. WisdomTree’s Government Money Market Digital Fund (WTGXX) continues at $931 million with Ethereum, Stellar, Solana, Avalanche and Arbitrum. Franklin Templeton’s on-chain US government money fund (Benji) ranks third with $748 million hosted on multiple chains, including Ethereum, Stellar and Polygon.

To conclude the top five, Ondo’s Short-Term US Government Bond Fund (OUSG) holds $732 million, with Ondo’s US Dollar Yield (USDY) market value of $688 million. Circle’s USYC is close to $519 million and can be accessed through Ethereum, Solana and other networks.

The remaining three in the top 10 include Janus Henderson’s Anemoy Treasury Fund (JTRSY) with $357 million, Openeden’s Tbill Vault $290 million, and Superstate’s Short-Term US Government Securities Fund (USTB) with $276 million. Spiko’s US T-Bills Money Market Fund (USTBL) closed the group for $110 million, while 11th century candidate Vaneck’s VBill holds $75 million.

On the blockchain, Ethereum controls $5.3 billion with a market capitalization of $5.3 billion. Stellar accounts for $511 million, $345 million, Solana $344 million, Arbitrum $160 million, Avalanche $139 million and XRP Ledger $132 million. Collectively, these networks have witnessed the rapid expansion of tokenized bond markets, particularly Ethereum, but have diversified liquidity across several chains.

Over the past 30 days, net flows reveal changes in investor allocations. Wisdomtree’s WTGXX had the largest inflow of $444 million, followed by Circle’s USYC at $275 million and Openeden’s Tbill Vault at $102 million. Meanwhile, Franklin Templeton’s Benny experienced a $103 million spill, leaving behind $51 million plus $22 million from Anemoy’s Jtrsy and BlackRock’s Buidl.

The return to the TVL level shows continued demand for blockchain-based finance as investors seek assets that include digital, liquidity and yield. Tokenized bonds continue to be one of the fastest growing segments in real-world asset (RWA) finance, as players from institutions such as BlackRock, WisdomTree and Franklin Templeton have locked the market.