Ethereum (ETH) continues to flow into the whale’s wallet. On-chain data reveals that the whales added 800K ETH in a week, which could lead to ETH breakouts.

The Ethereum whales added 800k ETH over the past week, adding to another round of strong accumulation. The purchase extends trends from the past few weeks that whales have spent $11.9 billion Eth in one day.

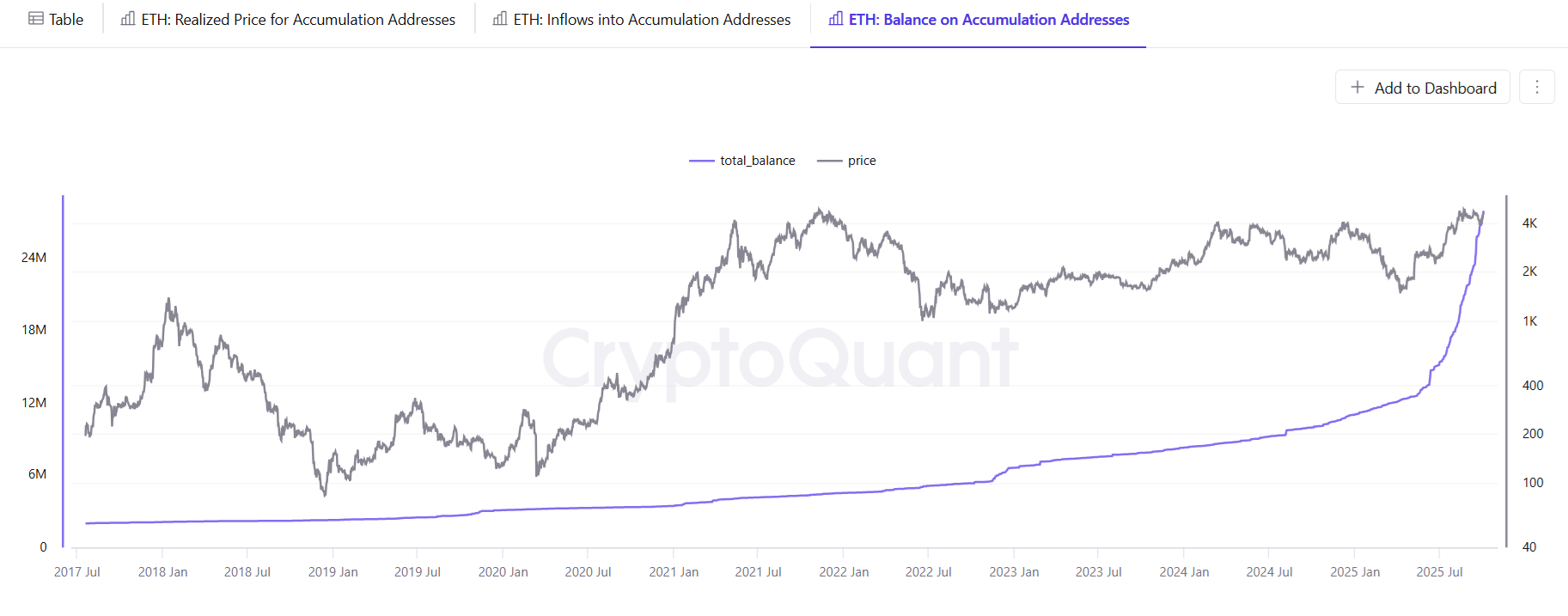

Whale accumulation increased in the second part of September and continued in October, potentially leading to ETH end-of-year meetings. Historically, whale accumulation has preceded a bullish market cycle. ETH whales also sell strategically for commercial purposes, but the overall trend in ETH is that they flow into unsold accumulation wallets in total balance ETH exceeds 27M.

Whales accelerated their purchases in September, increasing the flow of wallets with ETH over 10k. |Source: Cryptoquant

Accumulation of spots and whale purchases indicate that they are ready to establish a price floor for ETH and hold it for the long term. Most of ETH’s speculative activities take place in the derivatives market, but spot traders rely on accumulation and staking.

Fastest tendency Loading into the ETH comes from a 10k to 100k ETH balanced wallet. Accumulation has accelerated over the past month, taking more ETH from the market. Whale activity became more pronounced in the third quarter, moving on to potential year-end gatherings.

Does ETH prices follow accumulation trends?

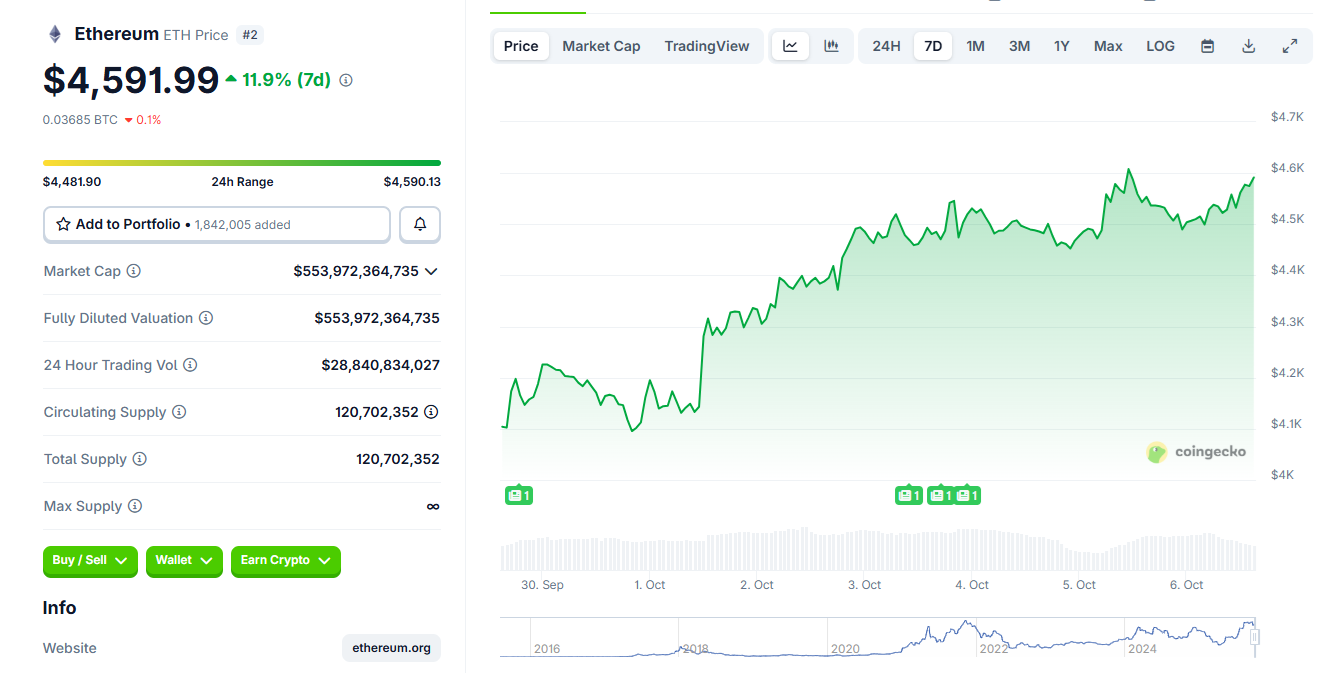

Despite the continued accumulation of ETH, token prices remain packed in the range. BTC has set a new price record above $125,000, but ETH is below the peak.

ETH expanded last week, but still, there were trades far from its highest peak ever. |Source: Coingecko

ETH is trading at $4,573.13 as of October 6th and is still waiting for a breakout. ETH expects it to be in the price range above $6,000 based on bullish forecasts. However, short-term trading could result in crashes below $4,100.

Based on the potential liquidity position, ETH is in the downside of $4,700 to $4,400. ETH is still restructuring its liquidity after a day of its highest liquidation since the bull market in 2021.

Whale also put sales pressure on ETH

Although accumulation continues, short-term for-profit sales can shake up the market. Recently, Trends Research sent ETH to Binance. It’s probably on sale.

Trend Research has deposited another $77,491 in ETH (354.5m $354.5M) at #Binance over the last 10 hours.

For the past four days, they have deposited 143,124 $eth ($642m) at #binance.https://t.co/oh2nr7xotg pic.twitter.com/yitkkuzykv at #binance.https://t.co/oh2nr7xotg.

– lookonchain (@lookonchain) October 5, 2025

Additional sales pressure came from old ETH wallets sale 1,800 tokens.

While large wallets are buying, the market still needs to absorb sales from retail. The overall bearish attitude of retail has led to ETH sales. According to the market prophet signalcrowd money is much more bearish to ETH than smart money.

Retail sales put additional pressure on prices and whales cannot always compensate. ETH is also facing demand from finance companies and ETFs. In the short term, ETH faces important Sell the wall Prices up to $4,900 or more can be short-term price resistance.