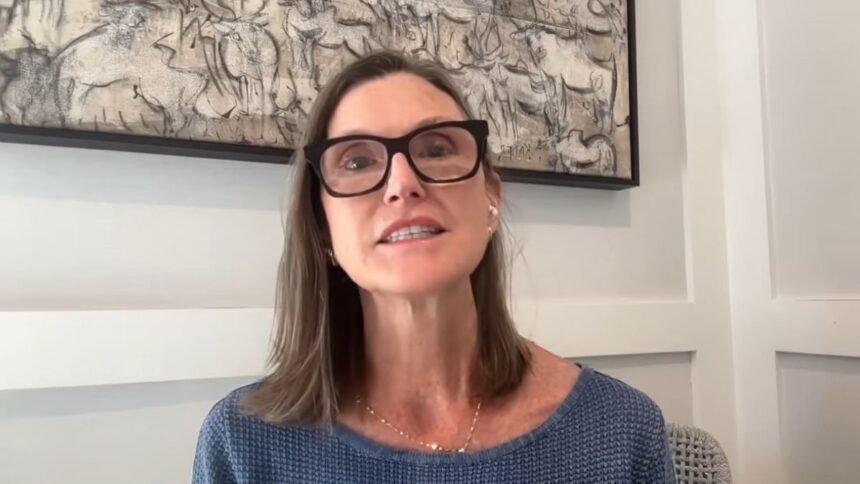

Cathie Wood, CEO of investment firm Ark Invest, has proposed a scenario in which the price correction structure of Bitcoin (BTC) has mutated. According to his vision, asset maturity will shorten the contraction period and provide unprecedented stability. In fact, experts claim that BTC is facing a shorter Bitcoin bear cycle compared to historical records.

The narrative that has dominated price analysis since Bitcoin’s creation is based on the halving, a technical event that reduces the reward for mining Bitcoin by half. Historically, halvings have characterized Bitcoin’s cycles of bull and bear markets every four years. This means that After three years of moderate and solid growth, the fourth year (2026) will be a bear market phase..

However, Wood explains, “By Bitcoin standards, we haven’t had a very strong bull cycle.” For this reason, she may test Bitcoin’s $80,000 to $90,000 range, as she believes we are already “quite advanced” in the current bear cycle,” says the businessman.

This view suggests that an expected correction after hitting an all-time high last October will Not as deep or long as previous cycles. For Wood, the resilience shown when prices rise is a sign of a paradigm shift.

“However, we believe that this test will succeed. This will be the shallowest four-year decline in Bitcoin’s short history. And we will take off again,” the businessman said, stressing that the capital structure supporting Bitcoin has gone from being purely speculative to having strong institutional elements.

Factors driving Bitcoin’s short-term bearish cycle

Wood’s thesis is based on the intrinsic value that BTC brings to the financial system. She defines this asset as “three revolutions in one.” It is a leader in the global monetary system, a technological revolution, and a new asset class.

For this reason, periods of decline tend to resolve more quickly. Institutional demands seek protection from inflation; Bitcoin’s short bearish cycle allows it to become established as the new norm in the face of crisis From the previous year.

Institutional and regulatory implications

The outlook for shorter, shallower cycles is echoed by other Wall Street players who manage Bitcoin exchange-traded funds (ETFs). Matt Hogan, investment director at Bitwise, agrees. The traditional four-year cycle could be significantly disruptedas reported by CriptoNoticias.

Hogan said the phenomenon “is driven by increased institutional interest and regulatory changes in the U.S., which have been the main drivers so far, regardless of the halving.”

Large-scale capital inflows through regulated means created a constituency that did not previously exist. Hogan attributes some of this change to favorable U.S. regulation through the creation of a national reserve for digital assets, the creation of a Digital Asset Advisory Board, and regulations such as the Genius Act.

These factors act as shock absorbers that prevent digital currency prices from falling significantly and accelerate market recovery.

Differences of opinion on the Bitcoin cycle

Despite Ark Invest and Bitwise’s optimism, not all experts agree with the idea of a short or shallow bear cycle. Henrik Seberg, chief economist at Swissbloc, warned: BTC is not a safe asset as many believe, but rather a high-risk asset.

If a global recession were to occur, Seberg said, the company “could be subject to a catastrophic decline due to its correlation to the stock market, especially the Nasdaq.”

Willy Wu, analyst and SwissBloc contributor, argues: Bitcoin is in the final stages of a bull market. Although he acknowledges there is “still a long way to go” for new gains, he expects these highs to be followed by a significant decline.

“We expect a bear market in BTC once the global macroeconomic market reverses,” Wu said, suggesting that global liquidity remains the primary driver rather than cycle shortening theory.

The resolution of this debate will depend on how Bitcoin reacts to the support range mentioned by Mr. Wood. If prices manage to stabilize above $80,000 during the coming economic turmoil, the four-year cycle theory could become obsolete, confirming that this digital asset has entered a mature phase and that the bear market is just a pause in a long-term upward trend.

(Tag translation) Bitcoin (BTC)