Cryptocurrency research firm Alphractal has published a new statement analysing Bitcoin’s current market position and highlighting the importance of key indicators in determining future price trends.

According to Alphractal, Bitcoin is approaching a critical level of long-term realised value metrics that have historically served as a key support or resistance zone. Maintaining a position above this level is considered a bullish signal indicating the strength of the market and the potential continuation of the upward trend. However, if this significant threshold is below, it could indicate the onset of a new bear cycle.

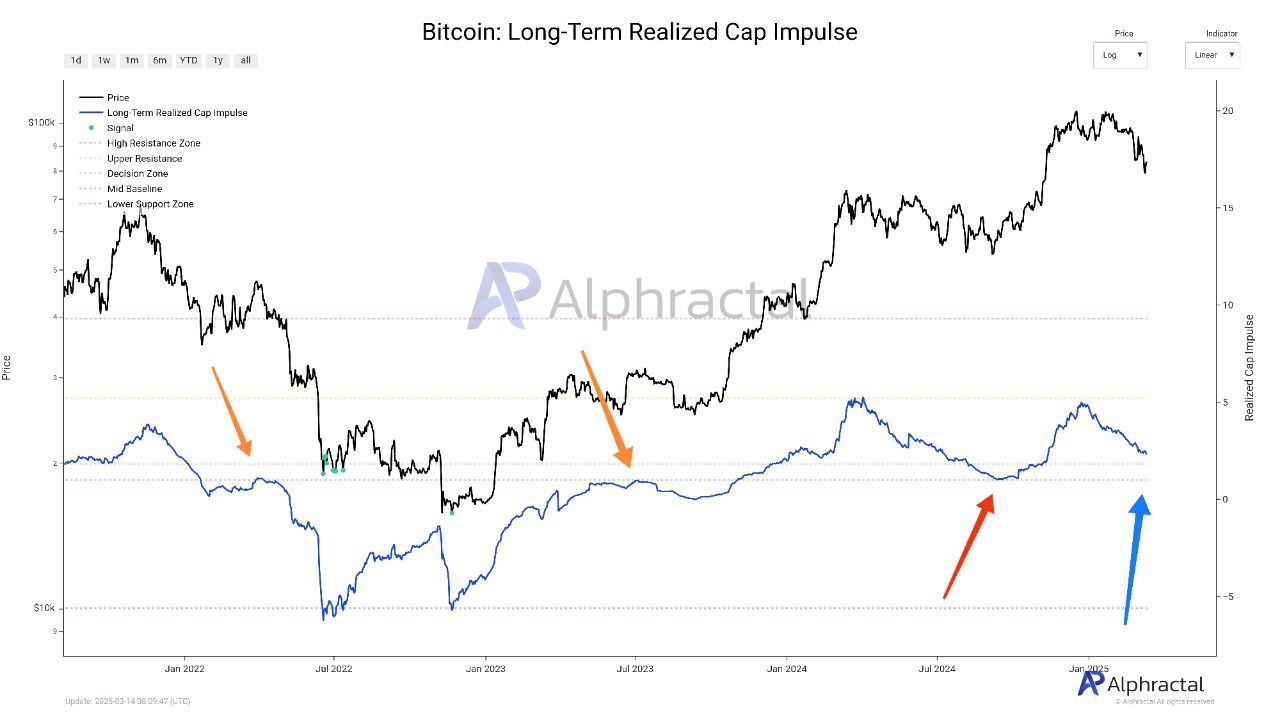

Long-term realised capital impulse metrics shared by Alphractal.

By focusing on longer windows, long-term realised capital impulses can help identify changes in structural markets that are not visible in short-term analysis. It also sheds light on large capital flows and provides valuable context for investors looking to make data-driven decisions based on past market behavior.

Bitcoin is trading at $84,780 at the time of writing, earning 5% in the last 24 hours.

*This is not investment advice.