Etro Preparing for Turning Points: Yoni Assia, CEO of the platform that has been listed on Nasdaq since May in May, confirmed the opening to its own in an interview with Fortune Blockchain It supports millions of monthly transactions and accelerates the delivery of new digital assets such as tokenized stocks at Ethereum.

What is Etro’s own blockchain? Why is it necessary?

Assia said that Current blockchain infrastructure is not sufficient To support the vast amount of transactions managed by Etro each month. “We can’t process millions of monthly transactions on our existing network,” the CEO explains. For this reason, Etoro is considering a “light chain” connected to the main blockchain. It handles faster and cheaper operations while maintaining the security of your main system.

The company is in Advanced negotiations with four or five platforms Select a technology partner, but it has not been named yet. It is not expected to be released anytime soon, but the direction is clear. With its own blockchain, Etro aims to strengthen the entire ecosystem, from transactions to digital assets to interoperability between wallets.

What changes will happen for users with inventory tokenization?

Assia announced it Most Popular Stocks and ETF Tokenization In the US, directly at Ethereum. The tokenization process allows you to convert traditional stocks into digital ERC20 assets (Ethereum token standard) and automatically manage 24/5 trading, transfer and automatically manage stock market time limits.

Available at the time of release 100 tokenized stocks and ETFsIncludes major US names. European users will initially be accessible via a dedicated wait list, with subsequent expansion promised.

Tokenized stocks become Can be transferred between Etro Digital Walletseven regulated securities pave the way for decentralized finance. Considering that other competitors (such as Robinhood) have taken similar steps, there is a strong advantage amid many regulatory concerns.

How does Etro fit for Wall Street tokenization?

After the announcement, Bloomberg Etoro’s initiative has confirmed it follows the Robinhood initiative. Unlike Robinhood, however, Etoro chose standard technology (Ethereum, ERC20) and step-by-step access methods (initially only in Europe) to avoid the risk of controversy and regulations.

Robinhood is in trouble after it turns out that the “Openai Tokens” air route is a derivative contract rather than an actual fair. The news sparked criticism from US regulators. Etro Instead, it focuses on transparency, compliance and a step-by-step approach. Each tokenized asset corresponds to a real underlying stock or ETF.

Transferability Wallet-to-wallets provide traditional finances that are closer to the principles of Defi (decentralized finance) where control remains in the hands of the user, despite being regulated infrastructure.

What is the market response: Is ETOR losing ground?

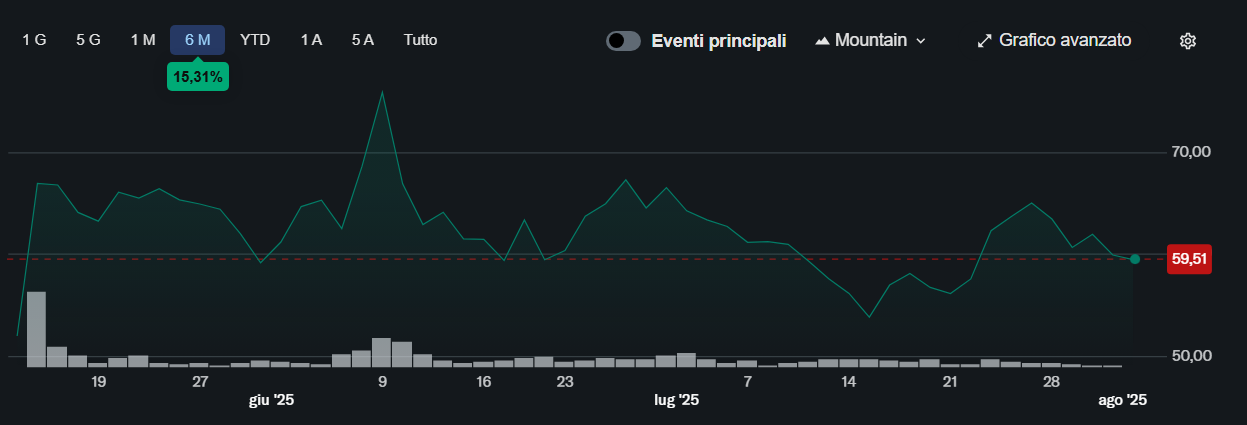

Despite the news, the price of Cultivated land (Etoro stock listed in Nasdaq) decline has occurred. -4%June 18thclose $60 Compared to records of $79 Reached June 10th due to overall loss twenty four%. The market appears to be waiting for concrete evidence on the effectiveness of the blockchain model and the true potential of large-scale tokenization.

A chart of price trends for ETOR stocks that are not listed on the stock exchange. sauce: Yahoo Finance

TradingView showed a downward trend last week, with investors looking closely at the actual adoption of tokenized stocks and future partnerships in the blockchain sector.

” `html

Etor Quotes by TradingView

{“linewidth”: 2, “linetype”: 0, “charttype”: “candlesticks”, “fontcolor”: “rgb(106, 109, 120)”, “gridlinecolor”: “rgba(242, 242, 242, 0.06)” “Volumedowncolor”: “RGBA(247, 82, 95, 0.5)”, “backgroundcolor”: “#0f0f0f”, “widgetfontcolor”: “#dbdbdb”, “upcolor”: “#22ab94”, “downcolor”: “#f7525f”, “#2294”, “#2294” “borderdowncolor”: “#f7525f”, “wickupcolor”: “#22ab94”, “wickdowncolor”: “#f7525f”, “colortheme”: “dark”, “is transparent”: false, “locale”: “en”, “chartonly”: “fals”: “scalemode”, “scalemod “Fontfamily”: “-Apple-System, Blinkmacsystemfont, Trebuchet MS, Roboto, Ubuntu, Sans-Serif”, “ValueStracking”: “1”, “ChangeMode”: “Price and Percent”, “Symbols”: ((NASDAQ: ETOR ‘), “Dateranges”, “1d | 1m”) “3m | 60”, “12m | 1D”, “60m | 1W”, “all | 1M”), “fontsize”: “10”, “headerfontsize”: “medium”, “autosize”: false, “width”: 800, “height”: 500, “notimescale”: false, false, false, false, false, false}

” `

What are the risks and benefits of an Etoro client?

Those who join the waiting list Tokenized Action You can benefit from faster trading, extended hours and greater flexibility in managing your digital assets. However, risks remain related to regulations, token volatility, and security of the blockchain infrastructure used.

ASSIA promises the greatest caution and regulatory cooperation to avoid “The case of Robin Hood”. The gradual approach, initially limited to Europe and internal etro wallets, shows caution, but also has a clear willingness to open a new season of classic trading. Tokenized assets Finally, it is open 24 hours a day, 365 days a year.

What’s happening now: Transactions and Blockchain impacts and future outlook

An announcement by Assia shows a change in pace. Hybridization between tradition and defi Currently in the operational stage, but the actual game depends on:

- Future Etroblockchain capabilities to truly support “millions of transactions”

- User feedback on tokenized inventory and 24/7 usability

- Responding to regulators and competition in the US and Europe

With competition diving into this sector and markets increasingly responding to high-tech innovation, The future of tokenized trading could change faces in the coming weeks. Follow the Etoro community and upcoming official announcements to ensure you don’t miss out on the latest information on blockchain and financial tokenization.