Gold-backed IRA provider SmartGold could move $1.6 billion of arched assets through a partnership with tokenization platform Chintai Nexus, opening the door for tokenized gold investments through voluntary US individual retirement accounts (IRAs).

Each gold token can support physical bullion one-on-one and deploy it as collateral across distributed finance (DEFI) lending protocols, the company said Tuesday.

This structure works by having investors purchase and store safe gold through SmartGold’s voluntary IRA. The Chintai then tokenizes the holdings and issues digital representations directly linked to the physical assets.

These tokens can be used as collateral for platforms such as Morpho and Kamino, allowing investors to access the liquidity of US dollar removal. The borrowed capital can be reinvested in other yield-generating strategies, but the underlying money is preserved and the account’s tax deferral status is preserved.

A voluntary IRA will benefit from the same tax benefits as a traditional or loss account, but you will have access to a retirement planner on a wider range of assets, including cryptocurrency, private equity, and real estate. According to the Pacific Premier Trust, they account for 2% to 5% of the $10.8 trillion held at the US IRA.

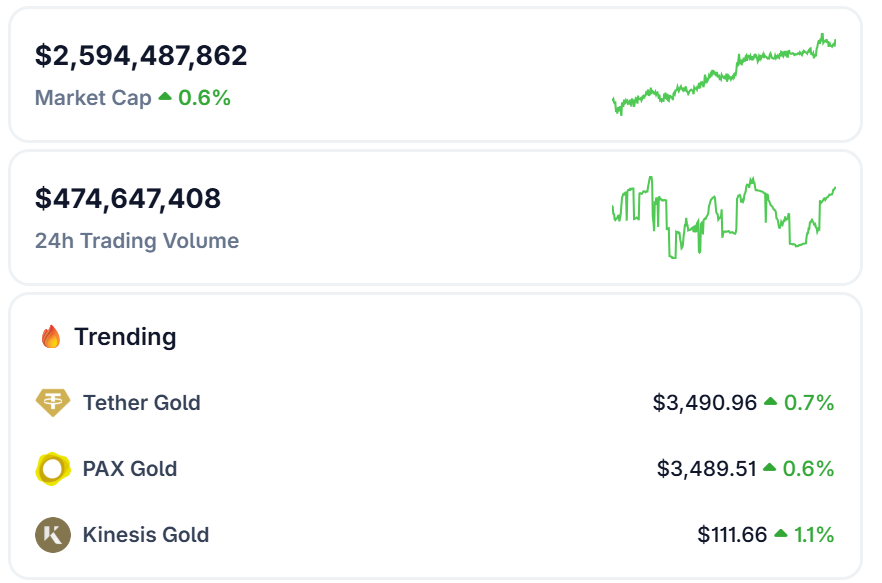

Tokenized gold market statistics. sauce: Co Ringecko

SmartGold – Chintai launches occur amid increasing demand for tokenized gold. International Precious Metals Bullion Group has deployed tokenized products throughout its supply chain, while Stablecoin Issuer Tether gained traction with Tether Gold.

Meanwhile, medical technology company BioSig recently pivoted towards tokenization through a merger with real-world asset platform Streamex. The total organization has secured $1.1 billion in growth funds to make gold and other products on-chain.

Related: Why Tokenized Gold Beats Other Paper Alternatives – Gold Dao

Gold: The original hedge gains momentum

While many Crypto supporters have emphasized Bitcoin (BTC) as “digital gold” that could sustain its shortage, divisiveness and purchasing power, this year’s original inflation hedge was a standout performer.

Comex Gold Futures rose to a record high of $3,557 on Monday, extending Yellow Metal’s year-to-date profits to 34%.

Demand is supported by geopolitical and political uncertainty, heavy central bank purchases, persistent concerns about inflation and the broader economy.

As the Wall Street Journal reported, Gold also benefited from a growing number of questions about the independence of the Federal Reserve as US President Donald Trump criticizes the agency for not cutting it aggressively enough.

sauce: Garrett Goggin

At the Jackson Hole Symposium last month, Federal Reserve Chair Jerome Powell indicated that rate cuts could be on the table in September as policymakers shift their focus to the labor market.

Related: Dollar stability suspected Trump will kick out Federal Reserve Governor