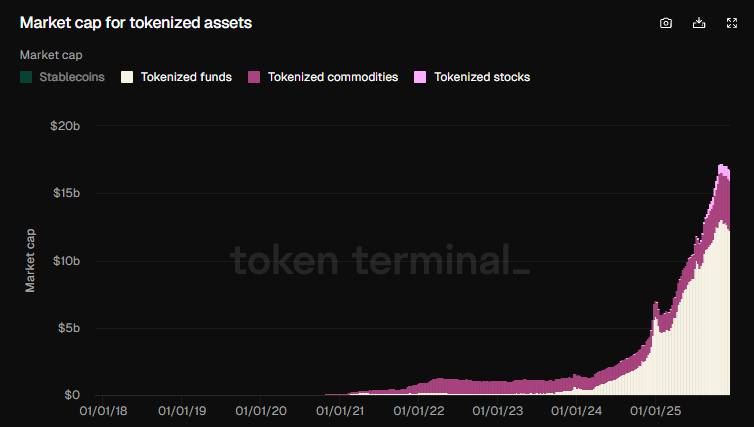

The combination of increasing token supply and rising market prices has pushed tokenized stocks and products to peak valuations. Stocks and commodities are still the smallest class of tokenized RWA, but have been growing actively over the past few months.

Based on Token Terminal data, tokenized stocks and products have reached the highest valuation. Asset tokenization is one of the growth stories of 2025, with more platforms looking to add their own equity standards.

Tokenized products reached $3.7 billion in December, largely based on the performance of gold. Tokenized stocks are floating around $808 million. The growth of tokenized products relies primarily on Tether’s gold-backed tokens. Tether has also set the industry standard for gold reserves.

Despite silver’s recent rapid expansion, there is very little precious metal present in tokenized assets.

Tokenized stocks are the latest trend and have shown rapid growth over the past few months. |Source: Token Terminal

Tokenized stocks are difficult to fully describe as there are several standards and platforms. Ondo report $368 million With tokenized stocks. XStocks Report 300 million dollars Token units excluding Chainlink (LINK) market capitalization.

Other markets also exist with different approaches to tokenization. However, in 2025, the tokenized stocks of Ondo and XStocks transformed into industry leaders.

Tokenized stocks reach a wider investor base

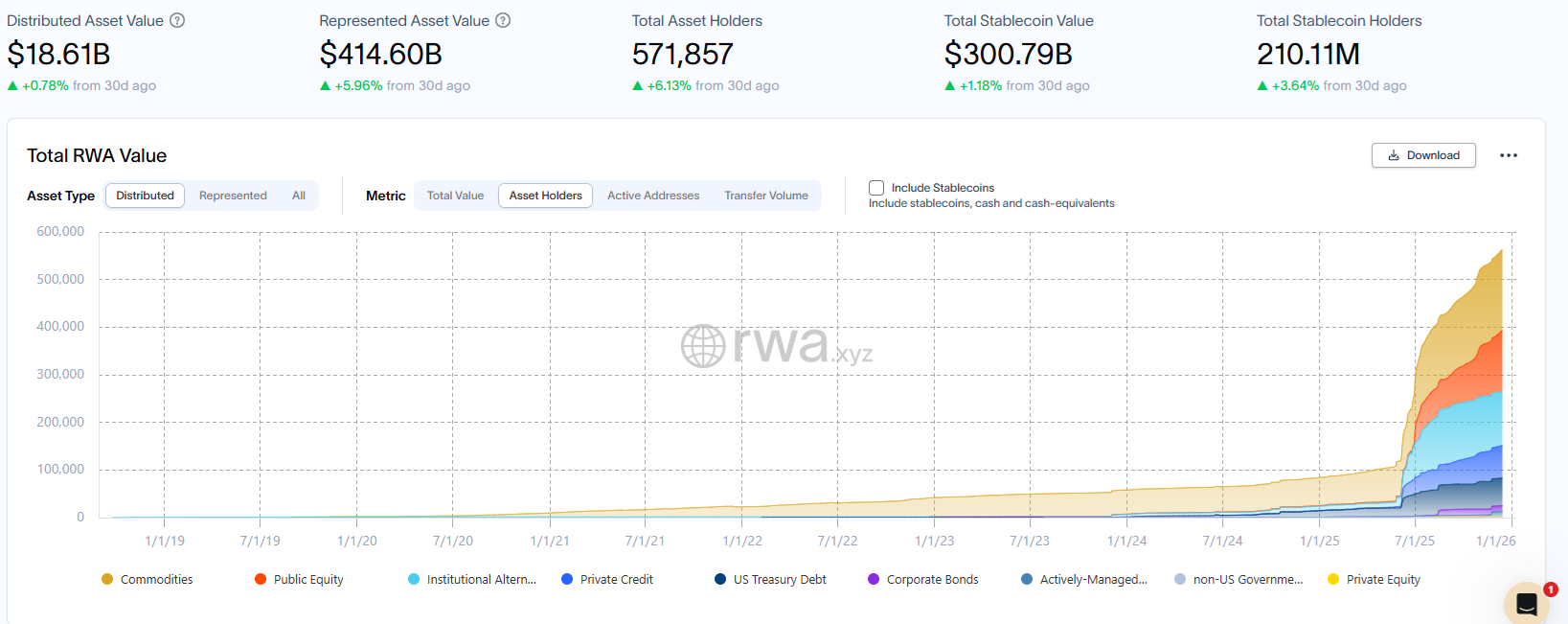

Tokenized stocks are seeing record adoption based on new wallet additions. Stablecoins make up the majority of tokenized RWA, but more wallets are moving to commodities, stocks, funds, and private credit.

In addition to the increased adoption of tokenized products, 2025 also saw an increase in ownership of tokenized stocks. |Source: RWA.xyz

Throughout 2025, ownership of various tokenized asset classes expanded rapidly. Although the number of wallet owners has increased to over 571,000, they are still only a fraction of traditional stablecoin owners. However, with the growth of infrastructure, tokenization is proving to be a permanent trend.

XStocks solves bridging

One of the issues with stock tokenization is how corporate events such as splits and dividends are reflected on-chain.

Recently, XStocks introduced XBridge, which allows you to move stocks between Solana and Ethereum. While simple tokens are bridged daily, tokenized equity bridges can pose challenges due to the different ways corporate events can be reflected.

Introducing xBridge

xStocks can now be moved freely between chains. Using @chainlink’s CCIP as the cross-chain infrastructure, xBridge is the first bridge to connect Solana to Ethereum and more, maintaining rebases for tokenized stocks.

The future is open, configurable, and omnichain. pic.twitter.com/x1zD436500

— xStocks (@xStocksFi) December 12, 2025

This bridge is the first step to launching XStocks on multiple chains while preserving the exact value and functionality of each tokenized share.

Tokenized stocks are one of the driving forces behind Solana adoption. Recently, tokenization of stocks has become mainstream. fastest growing Solana assets replace previous stars like meme tokens.

Competition is also emerging from other platforms, such as Robinhood’s stock tokenization. decision. Overall, the appeal of tokenized stocks is growing after a long season of betting on tokens with no inherent backing.

Stock tokenization allows international traders to easily access US stocks. In 2025, international investors aim to take advantage of the growth of US companies, creating tensions in the legal status of US companies. tokenized assets.

Some of the tokenized stocks available are permissionless, while others are tied to fully vetted KYC accounts on centralized exchanges.