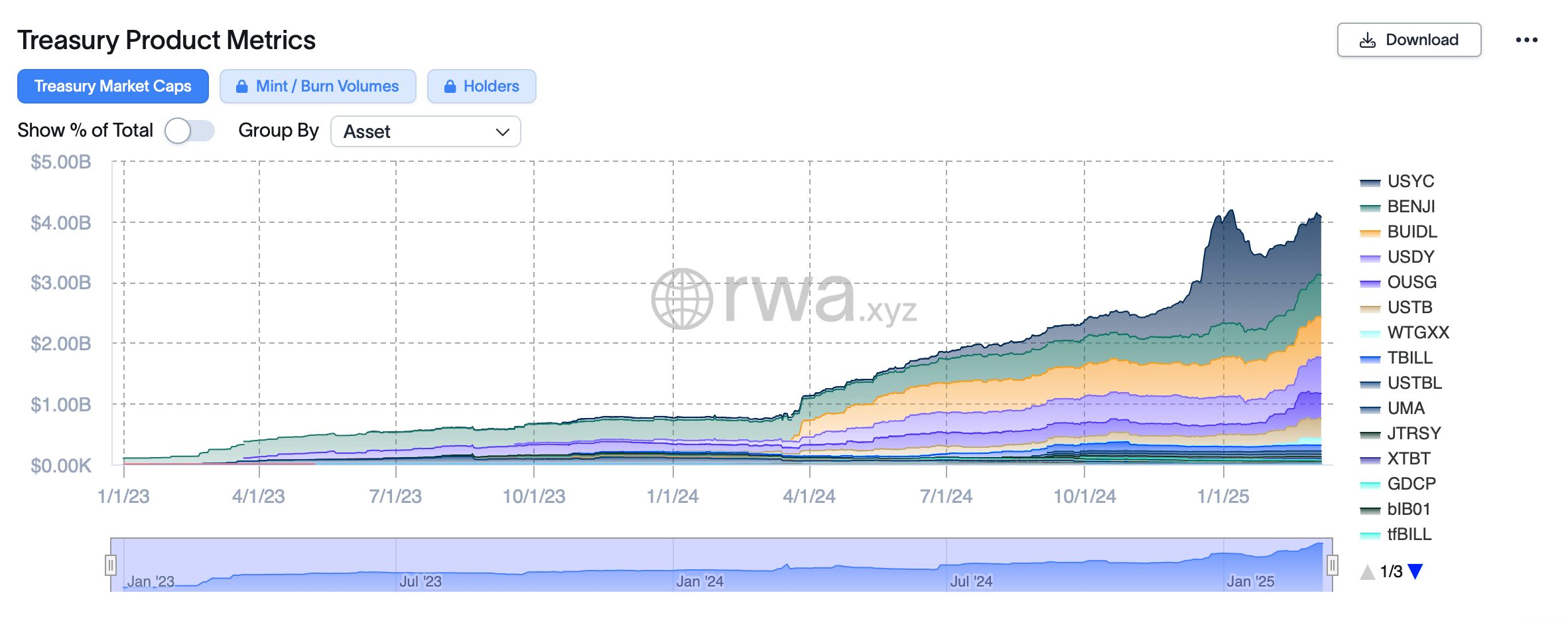

Over the past 103 days, the tokenized US financial sector has expanded by $1.57 billion, surpassing the $4 billion threshold. This is proof that it will accelerate the adoption of the system. Ruling this arena is Hasnote’s Short Duration Coin (USYC). This fuses short-term US Treasury holdings with reverse repo agreements, providing investors with a double sorting path to yield generation.

Hashnote’s USYC almost doubles as tokenized Treasury surges beyond $4 billion

Just recently, the tokenized US Treasury Department has been piled up to a $4.07 billion valuation, according to data from RWA.xyz. Essentially, a modest dent in the short-term US Treasury holdings that were sold temporarily to counterparties across the Federal Reserve Overnight Reverse Buyback Agreement (RRP). Though small, the market rejected expectations with an impressive expansion of $1.57 billion over 103 days.

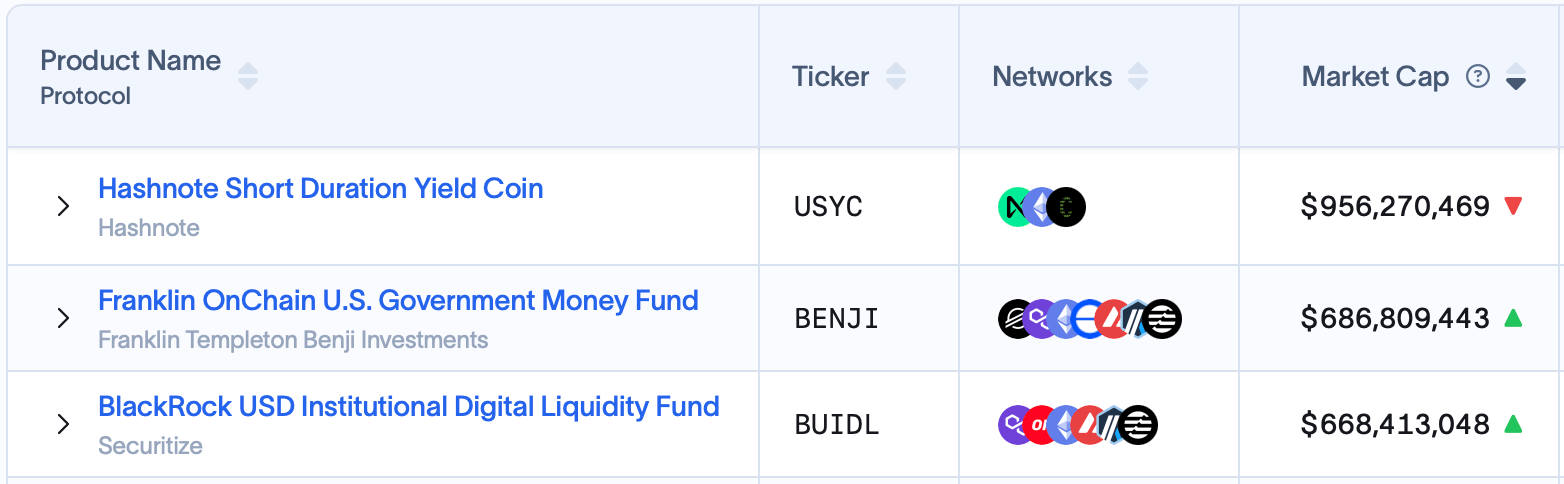

Hasnote’s Short Duration Coin (USYC), which achieved the highest position at its largest market capitalization, had reduced its market valuation balloon by November 26, 2024 from $461.2 million, today from $495.07 million to $956.27 million. Global investors outside the US can utilize this vehicle via the Hasnote International Feeder Fund or the Short-Term Yield Fund (SDYF) if they clarify the eligibility hurdle (including a minimum of $100,000 shares).

State participants must meet the Commodity Futures Trading Commission (CFTC) Qualified and Qualified Participants (QEP) criteria to access USYC through the Hashnote Feeder Fund. Following USYC, it is also known as the Franklin Onchain US Government Money Fund, known as the Franklin Templeton’s Onchain Fund. Institutional investors can join Benji through the Franklin Templeton institution’s web portal.

Benji is also available to institutional investors from several European countries, including Austria, France, Germany, Italy, Liechtenstein, the Netherlands, Spain and Switzerland. Since November 26th, Franklin Templeton’s fund has increased by $270.35 million to its current market capitalization of $686.8 million. The bronze position is BlackRock USD Institutional Digital Liquidity Fund (BUIDL), a tokenized product from BlackRock.

Buidl, distributed via securitization, is only targeted at heavyweight institutional clients (hedge funds, asset managers, multinational companies). Buidl once reigned at its highest market capitalization of $533 million 103 days ago, but has grown to $668.41 million, bringing it to third place in the rapidly evolving class. Together, the top three funds lead 56.78% of the $4.07 billion valuation of the tokenized Treasury sector.

Also notable are Ondo’s USDY ($592 million) and Ousg ($408 million), Superstate’s USTB ($328 million), Witwtree’s WTGXX ($112 million) and Openeden’s Tbill ($96.54 million). Data from RWA.xyz reveals that these initiatives boast an average annual rate (APY) of 4.2%, with 15,463 holders collectively investing in 37 tokenized financial funds. This influx of capital and participants indicates a signal in the tokenized financial market that moves from a niche experiment to a mainstream candidate.