Ethereum continues to trade sideways, with upside momentum limited as market-wide confidence remains fragile. ETH has struggled to establish a clear trend, with price movements remaining compressed around key technical levels.

Amid mixed internal signals, altcoin leaders now appear to be relying more and more on external catalysts to trigger a decisive breakout.

Bitmine’s confidence in Ethereum’s value reaches new highs

Bitmine recently revealed that it has started staking Ethereum from its own treasury, reinforcing long-term confidence in the network. The company currently holds 4.11 million ETH, which is approximately 3.41% of the total circulating supply. This strategic allocation places Bitmine among the world’s largest institutional Ethereum holders.

Of the total holdings, approximately 40,627 ETH worth $1.2 billion has already been staked. Bitmine plans to further expand its staking operations through the Made in America Validator Network (MAVAN), scheduled for early 2026.

“At scale (when Bitmine’s ETH is fully staked by MAVAN and its staking partners), ETH staking fees amount to $374 million per year (using 2.81% CESR), or over $1 million per day,” said Galaxy Digital and individual investor Tom Lee.

The actions of Ethereum holders will be taken into account

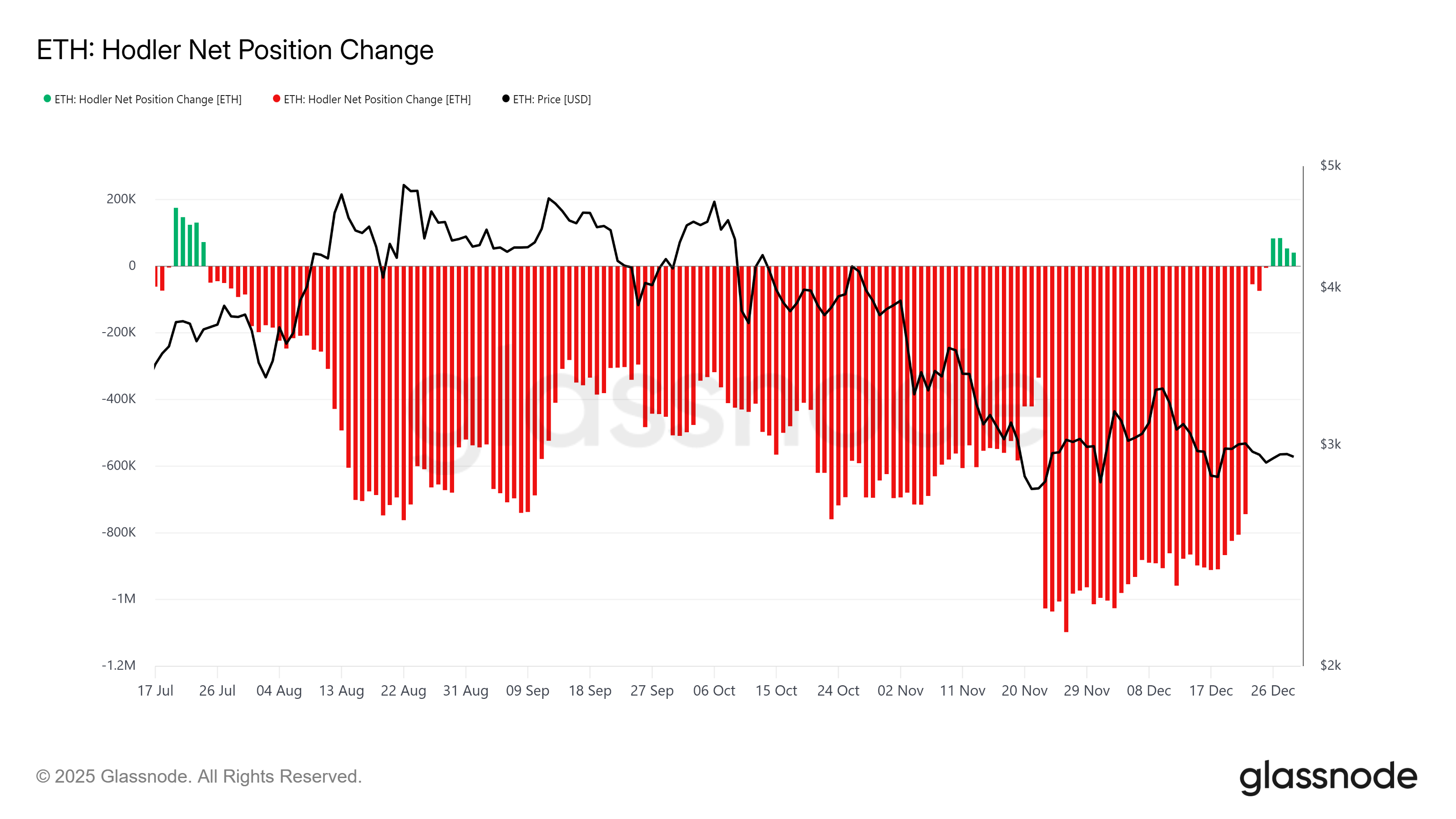

Investor behavior across the Ethereum market remains divided. Long-term holders, considered the structural backbone of the asset, have resumed accumulation after months of continuous distributions. The change follows about five months of steady outflows that had previously weakened long-term supply stability.

The new HODLing trend is constructive for Ethereum’s recovery prospects. The resilience of long-term holders often dampens volatility during periods of uncertainty. Their return to accumulation suggests an increase in confidence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum HODLer position change. Source: Glassnode

But whale activity shows contrasting signals. Over the past five days, addresses holding between 100,000 and 1 million ETH have sold approximately 270,000 ETH. At current prices, this distribution is over $793 million, adding significant supply pressure to the market.

This action shows that large holders are uncomfortable with short-term downside risks. Whale selling often reflects defensive positioning rather than outright bearish belief. Still, the decline in exposure suggests limited confidence in immediate recovery.

Ethereum Whale Holdings. Source: Santiment

ETH price waits for clear direction

Ethereum price is at $2,941 within an asymmetrical triangle pattern, showing indecision. Price remains contained between resistance near $3,002 and support near $2,902. This narrowing of the range reflects the balance of buying and selling pressures, with volatility steadily decreasing as the pattern matures.

The mix of investors makes the short-term direction unclear, but Bitmine’s aggressive staking strategy provides a bullish narrative. If optimism continues, ETH could regain $3,000 and target $3,131 by early January 2026. Therefore, a definitive close above $3,131 would be required for the breakout to be confirmed.

ETH price analysis. Source: TradingView

A correction could occur if Bitmine is unable to reconcile its outlook with broader sentiment. Furthermore, a decline below $2,902 could invalidate the pattern and send Ethereum down towards $2,796. Such a move could trigger a short-term downward trend and undermine recovery expectations.

The post Tom Lee’s Bitmine stakes over $1.2 billion in ETH as Ethereum waits for breakout trigger appeared first on BeInCrypto.