Bitcoin price is hovering around $110,970 today, holding in a tight range as traders wait for a decisive move. The market is swirling inside a symmetrical triangle, with compression decreasing between $108,700 and $112,400 on the 4-hour chart. Although momentum remains slow, this pattern suggests that volatility could return soon.

Buyers hold the line near $109,000

BTC price dynamics (Source: TradingView)

Bitcoin price continues to maintain its triangle base around $108,773, where the 0.236 Fibonacci retracement and the lower Bollinger Band coincide. On the upside, the 20, 50, and 100 EMA levels are concentrated between $111,400 and $112,400 and act as short-term resistance.

A close above $112,092 could open the way to the 0.618 Fibonacci retracement at $114,700. Beyond that, the next pivot is around $117,500. If sellers regain control and break below $109,000, focus could shift to the key levels from October’s moves at $106,800 and $103,400.

BTC key technical levels (Source: TradingView)

The RSI on the 30-minute chart is around 54, indicating balanced momentum with a slight bullish trend. The higher low structure supports the idea of gradual accumulation below resistance.

Spot data that reflects the calmness before moving

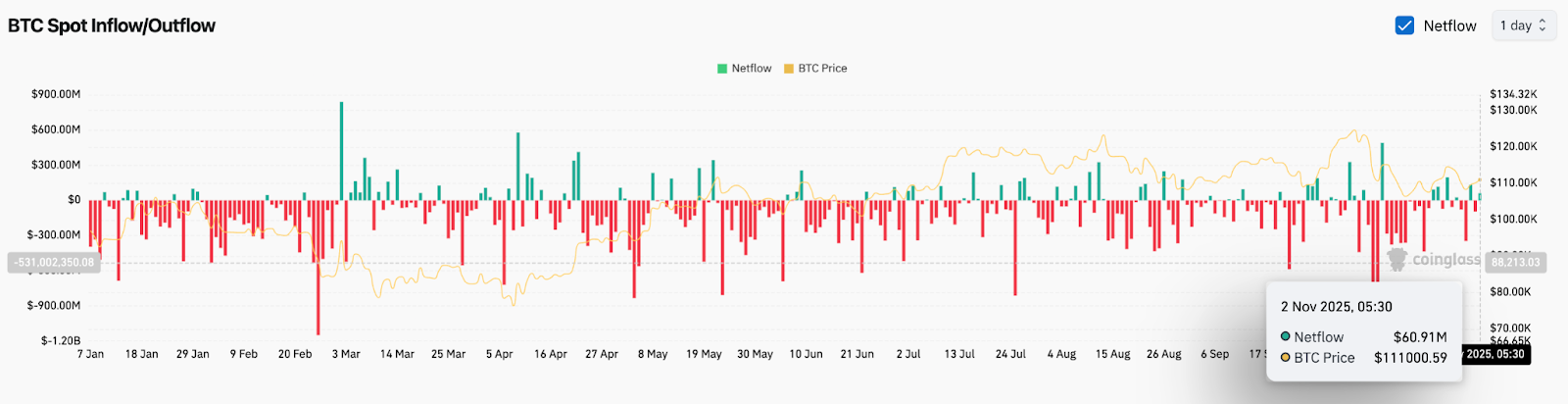

BTC Netflows (Source: Coinglass)

According to Coinglass data, Bitcoin spot inflows on November 2 were around $60.9 million, suggesting there was some light selling, but not enough to break the structure. Recent sessions have seen alternating cycles of inflows and outflows, indicating an equilibrium between buyers and sellers.

Bitcoin price today remains stable around $111,000 despite these inflows, meaning demand continues to meet available supply. Although not aggressively accumulating, the tone remains neutral to slightly positive across major exchanges.

Futures and options show neutral sentiment

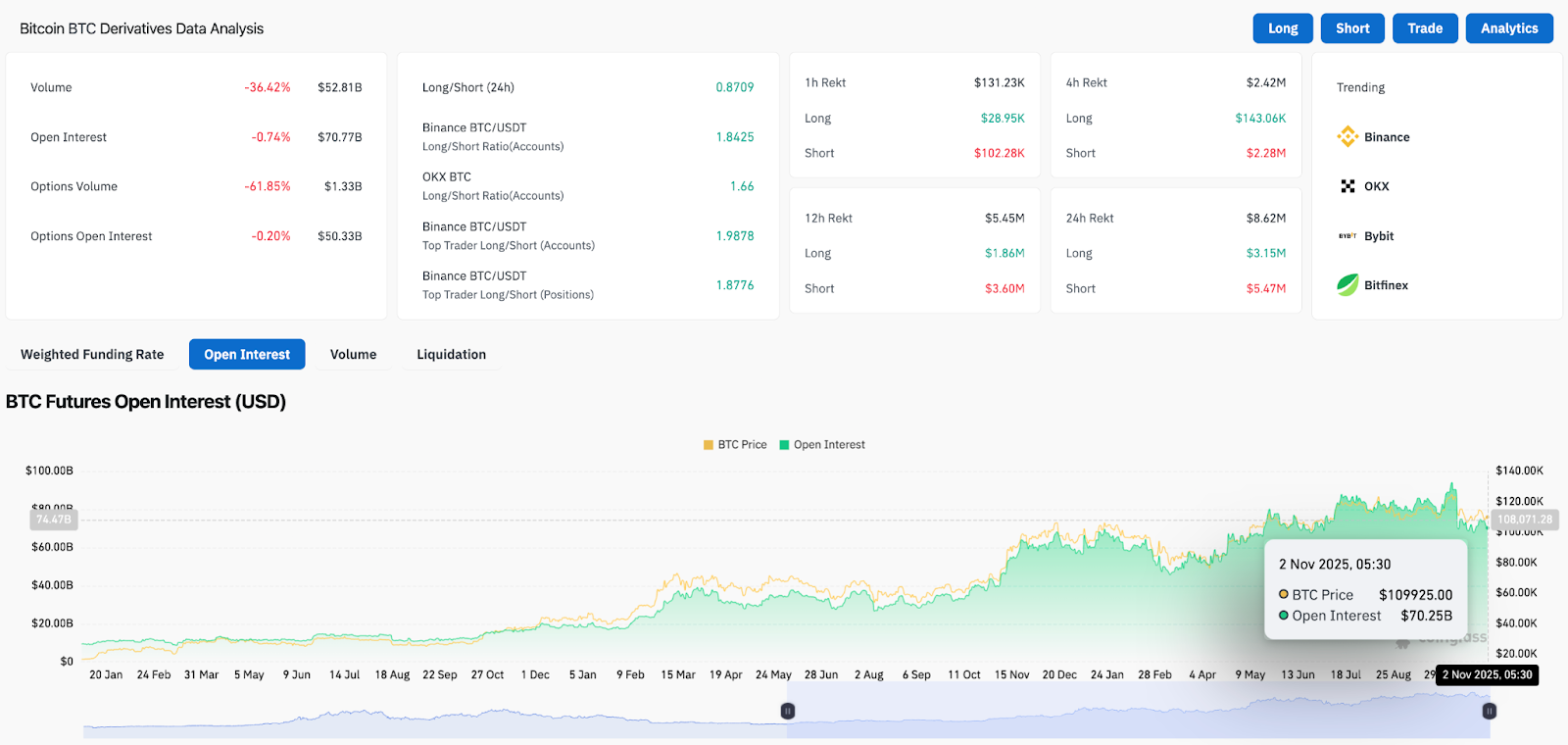

BTC derivatives analysis (Source: Coinglass)

Open interest in Bitcoin futures was approximately $70.7 billion, down less than 1% from the previous day. Options volume is down more than 60%, indicating traders are reducing leverage and waiting for clearer direction.

Across major platforms, the long/short ratio is skewed towards longs. Binance and OKX both have numbers close to 1.8, suggesting cautious optimism among participants. Top traders also remain net long, reinforcing the view that the market as a whole is expecting an eventual breakout.

This positioning could amplify the move once price breaks free from its current structure. If the $112,000 resistance breaks, stop orders and new longs could accelerate momentum towards the $114,000-$117,000 zone.

Outlook: Will Bitcoin Rise?

Short-term Bitcoin price predictions are balanced between caution and opportunity. If the price closes above $112,400, the bullish path could extend to $114,700 and then $117,500. A sustained breakout from this structure could also lead to new inflows and unwind short positions.

If the price cannot sustain above $109,000, there is a risk that the near-term structure will weaken and it will fall towards $106,000. However, as long as Bitcoin remains above $103,400, its long-term momentum remains intact.

The upcoming sessions are likely to define the next multi-week trend. Market compression, neutral sentiment, and stable on-chain data all point to one conclusion. Bitcoin is poised for its next decisive move, and traders are keeping a close eye on who will give in first.

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to conduct due diligence before taking any action related to our company.