U.S. Treasury Secretary Scott Bessent announced today that a proposed $2,000 tariff check for Americans would require Congressional approval. President Donald Trump has proposed tariff checks for working families, but estimates suggest the program could cost the country up to $600 billion..

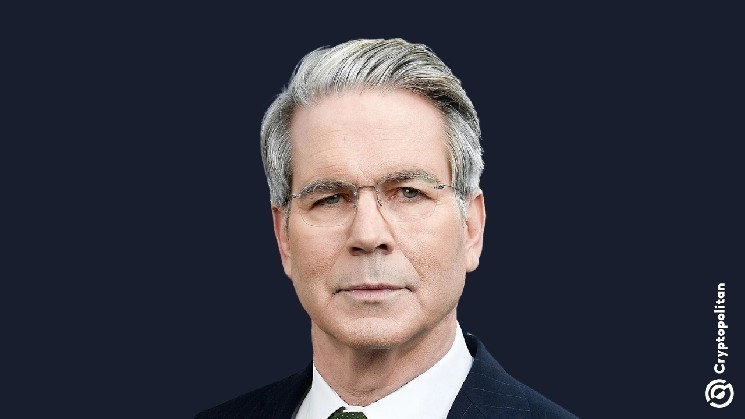

Speaking on Fox News Sunday Morning Futures, Bessent emphasized that the Trump administration does not have the unilateral authority to approve large-scale direct payments. He emphasized that parliamentary approval is needed to form a government.

The benefits are targeted at working families and will include income limits as part of the administration’s broader economic solution, Bessent said.

Bessent says Americans with incomes over $100,000 won’t receive a penny.

The idea of paying a tariff dividend was first unveiled by current President Donald Trump in August. He noted that billions of dollars in tariff revenue will fund direct redistribution of funds to Americans.

society based on his truth postPresident Trump said the dividend would be at least $2,000 per person for most Americans, except for high-income households. He added that the rest will be used to reduce the national debt.

President Trump described the payments as a way to return tariff revenue to the people while achieving the goal of reducing the national debt.

Scott Bessent suggested the payments could come in the form of customs tax breaks rather than checks. This can potentially exempt you from taxes on tips, overtime pay, and Social Security. He stressed that formal plans have not yet been finalized. Bessent also pointed out that any payments would be targeted at working households and would have income limits that exclude high-income earners.

For example, the COVID-19-era stimulus package targeted individuals making less than $75,000 a year and couples making less than $150,000 a year. The Treasury Secretary reiterated that all policy options aimed at supporting working families are on the table.

According to a recent Cryptopolitan reportBessent also noted that Americans earning more than $100,000 a year may not receive a penny from the proposed $2,000 salary.

This is not the first time Trump has advocated for such an initiative. In the era of COVID-19, the president proposed $2,000 pandemic relief payments at the end of 2020. The initiative was enacted in part through the American Rescue Plan and in collaboration with President Joe Biden.

Approximately 476 million payments have been made to U.S. households in three rounds totaling $814 billion, based on U.S. Treasury data.

Paul Kruger says President Trump’s efforts are highly irresponsible

Nobel Prize winner Paul Krugman explained President Trump’s recent effort to offer a $2,000 salary is extremely irresponsible. It warns that repeated large-scale cash injections could lead to inflation. He also criticized the plan, citing the federal deficit approaching $2 trillion.

The Committee for a Responsible Federal Budget, a nonpartisan watchdog group, estimates that the $2,000 tariff check could cost the U.S. about $600 billion if modeled similar to the COVID-19 stimulus package.

The cost would be nearly double the $300 billion in toll revenue estimated by economists in 2025. As of September, only $195 billion had been raised. The Commission argued that customs revenue alone would not cover the cost of the proposed payments.

Source: U.S. Department of the Treasury, Committee for a Responsible Federal Budget (CRFB.org)

In addition to the collection of revenue shortfalls, some customs duties based on revenue estimates are imposed under the International Emergency Economic Powers Act (IEEPA) and are subject to review by the Supreme Court. Customs law experts say if the courts strike down the tariffs, it could reduce available funds under the projected $300 billion in revenue, temporarily increase borrowing needs and further complicate fiscal planning.

Despite pushback from several officials, President Trump and his administration framed the plan as a solution to rising costs of living. So far, this proposal has not reached formal development. It remains subject to the fate of Congressional action and legal consequences on tariffs.