Tron founder Justin Sun asks the crypto community what’s going on with Ethereum against the backdrop of the liquidation that reached $2.1 billion in the last two weeks. On Monday, Sun pointed out the issue of high-leverage trading in the network. We thought this would cause losses in decentralized financial protocols using blockchain.

As of Thursday’s early Asian trading session, ETH was $1,880, a 51.63% decline over the past three months, hitting $3,888 in the December Bull Run. The bear has dropped its cipher by 30.6% in the last 30 days, pushing its nearly 18% per Coingecko over the past week.

Market Watchers are considering the struggle for Ethereum

Sun’s questions received considerable responses from the Crypto community. This includes Alexander, founder of the artificial intelligence Crypto Finance System Postfiat, who noted that Ethereum has been unable to sustain meaningful trading growth since its peak in 2017.

Alexander beat the network to avoid deflation when moving from Proof of Work (POW) to the Sport-of-Stake (POS) model, noting that the most actively used portions of blockchains, such as arbitrum (ARB) and base, are highly inflated or centralized.

“So please ask me a question… What is the point of a chain where the answer is: It’s the same as all other blockchains. It’s quite suppressed to move the tether and “preserve the value.” ” he said.

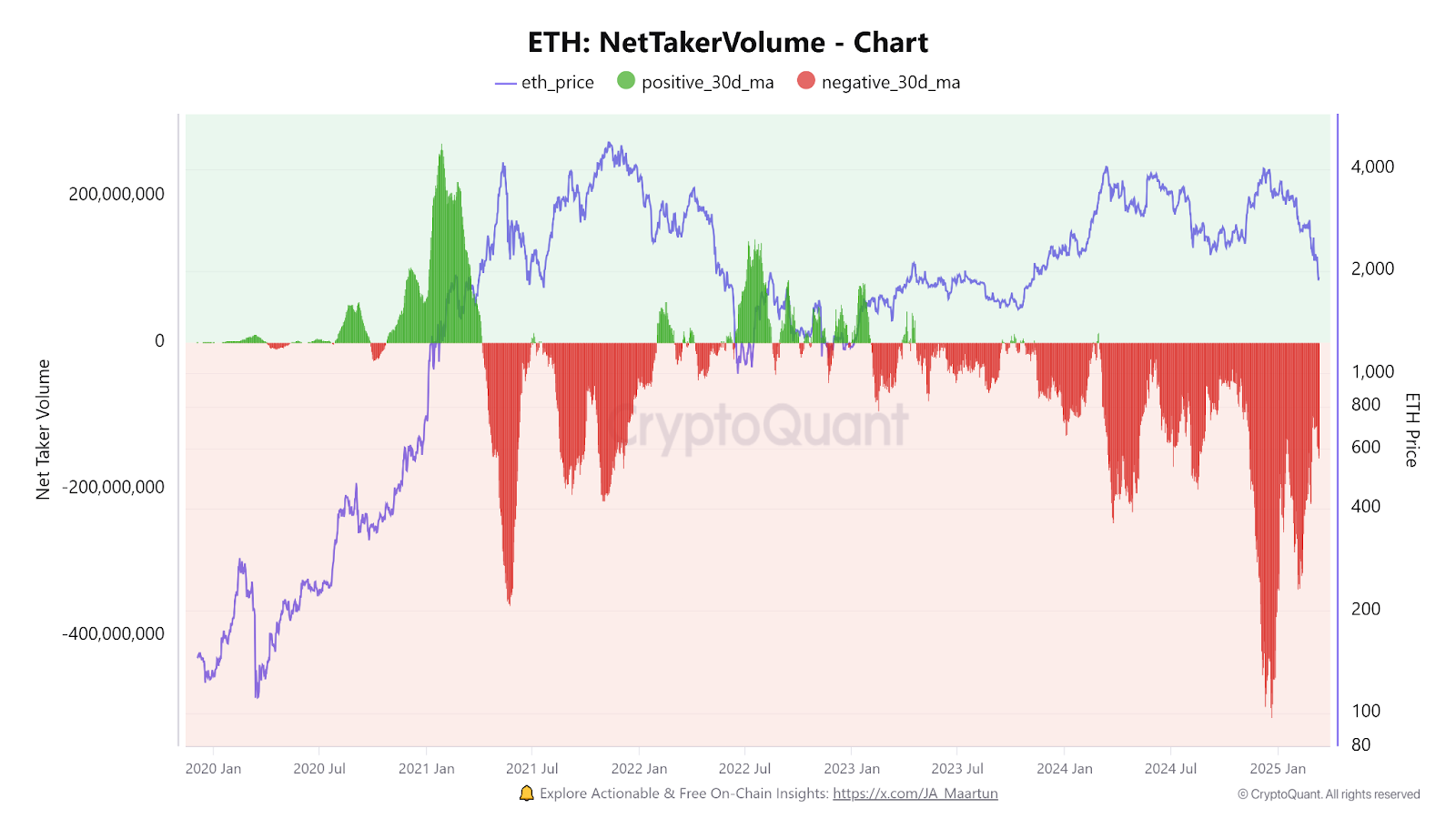

On the X Post on March 13th, encrypted CEO Ki Young Ju shared a chart showing record sales pressure on Ethereum over the past three months. On-chain data was revealed last week to be the $1.8 billion worth of ETH ETH ETH ETH ETH ETH ETHITED exchange, the largest leak since December 2022.

Ethereum price 30-day moving average. Source: Cryptoquant

According to the charts, ETH last had a positive 30-day moving average on February 26th, when Bitcoin price fell to $82,000. Coin’s 24-hour Coinbase Premium Index has also been trending in red for the past seven days, weakening buying pressure from US traders.

Ethereum’s trading volume rose 38.17% to $368.2 billion, and the favorable interest (OI) on futures also fell 2.61% to $18.05 billion, suggesting more traders will take the exits than opening new ones.

Crypto-retention data also shows that the volume of options fell by 7.43% to $663.71 million, while open interest on options increased by 2.17% to $5.777 billion, indicating an increase in demand for long-term derivative positions as traders wait where the price of ETH goes.

Will Ethereum recover?

Ethereum price action seems largely bearish for now. The bull slowly hands the bear to the market, further reducing the price of the crypto. According to Coinglas, Eth Futures liquidation has reached $43.12 million in the last 24 hours.

Of this total, $26.94 million was a long liquidation, while $16.18 million comes from shorts, indicating that the market lacks a clear direction.

Analysts outlined two possible scenarios for Ethereum’s next move. The bearish breakdown could cause ETH to fall below the $1,440 threshold and further decline to the $1,000 mark. Meanwhile, a recovery above the resistance level of nearly $1,960 will help the coin gain positive momentum.

Technical indicators such as the 32.1 relative strength index (RSI) and the 25.1 stoch oscillator (Stoch) are gaining bearish momentum as they are approaching overselling territory. Failure to hold beyond the $1,750 psychological support zone could increase sales pressure, but lower than $1,700 a day could override integration attempts and accelerate the downward trend.

One trader on social media discovered the historic ETH three years of stochastic RSI trends.

A historic ETH signal has been triggered!

Ethereum’s 3-year probability RSI hits oversold levels.

Every time this happened, there were massive gatherings! pic.twitter.com/xzdtiw5ol7

-Merlin The Trader (@merlijntrader) March 12, 2025

Still, the forecast was rejected by the commenter, saying:

“Two previous times, beware how it was during Peak Bear. It’s very anticipated. But now it’s happening during Mid Bullrun. That’s really a bad thing. It’s not supposed to happen, my guy.”