US President Donald Trump’s nomination of former Federal Reserve Chairman Kevin Warsh to head the US central bank sends mixed signals for the cryptocurrency market and the liquidity of the US dollar, market analysts say.

President Trump nominated Mr. Warsh, a Bitcoin supporter, on Friday, and assuming the Senate confirms him, he will replace Jerome Powell, whose term ends in May.

Warsh’s nomination could mean the Fed will continue its rate-cutting path. However, it also suggests that broader market liquidity is expected to “stabilize rather than meaningfully expand,” according to Thomas Perfumo, global economist at cryptocurrency exchange Kraken.

He told Cointelegraph:

“This maintains a mixed macro backdrop for Bitcoin and cryptocurrencies that is sensitive to overall liquidity conditions, perhaps even more than changes in the federal funds rate.”

However, Perfumo said investors may be disappointed by Warsh’s “skepticism about balance sheet expansion.” Quantitative easing includes policies such as quantitative easing, which involves buying bonds to lower borrowing costs and stimulate economic activity.

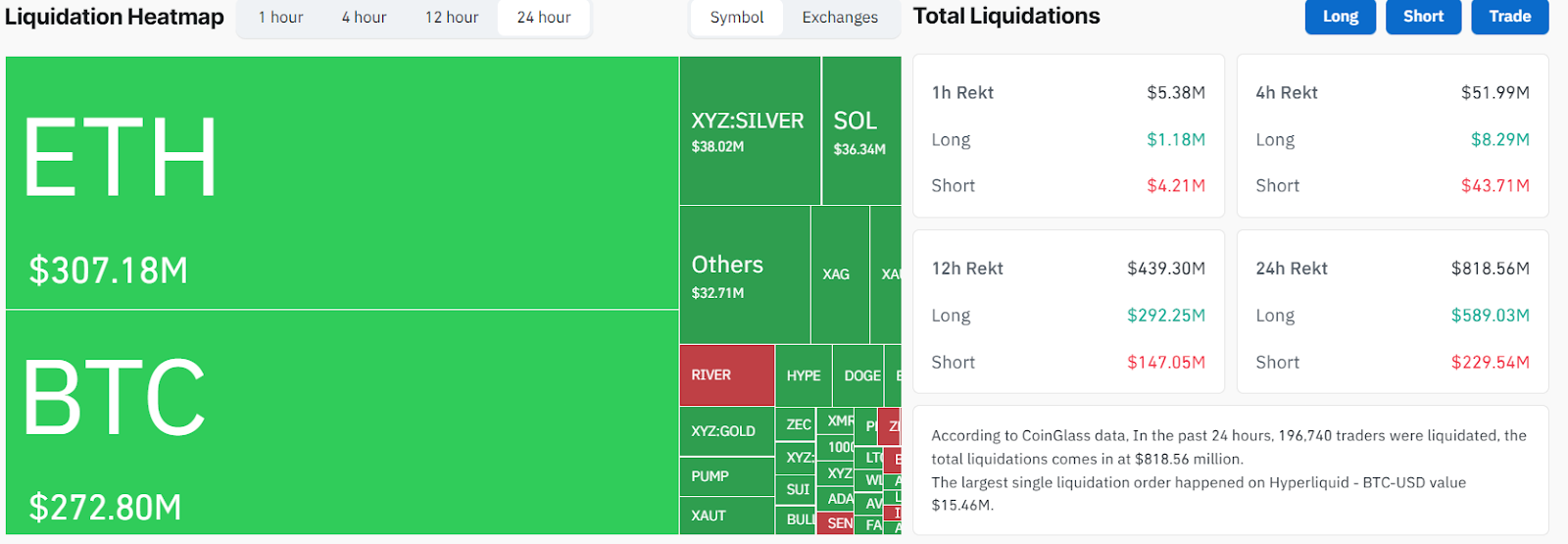

Cryptocurrency market liquidations in the last 24 hours. Source: Coinglass

Related: Cryptocurrencies lose speculative edge as AI and robotics attract capital: Delphi

The comments came just after the cryptocurrency market lost $250 billion in market capitalization over the weekend as part of a broader selloff that affected stock markets and precious metals.

Popular analyst Raul Pal pointed to the U.S. liquidity drought, rather than crypto-specific events, as the main reason for the collapse in cryptocurrencies and stocks, Cointelegraph reported early Monday.

Related: Top Bitcoin mining stocks rise as hashrate drops due to US winter storm

Market crash due to Warsh appointment and liquidity concerns: Pucklin

Nick Pucklin, an investment analyst and co-founder of the education platform Coin Bureau, said Warsh’s appointment raised liquidity concerns among investors and was a major reason for the sell-off in cryptocurrencies, stocks and precious metals.

“The market is digesting Mr. Warsh’s views on future Fed policy, especially central bank balance sheets, which he said are ‘trillions and trillions bigger’ than necessary,” the analyst told Cointelegraph, adding:

“If he does indeed adopt a policy of shrinking balance sheets, the market will need to consider a reduced liquidity environment, one that is not supportive of either risk assets or precious metals.”

Still, questions remain about Mr. Warsh’s interest rate policy and the extent to which he is “going to align” with President Trump’s push for low interest rates, Pucklin said.

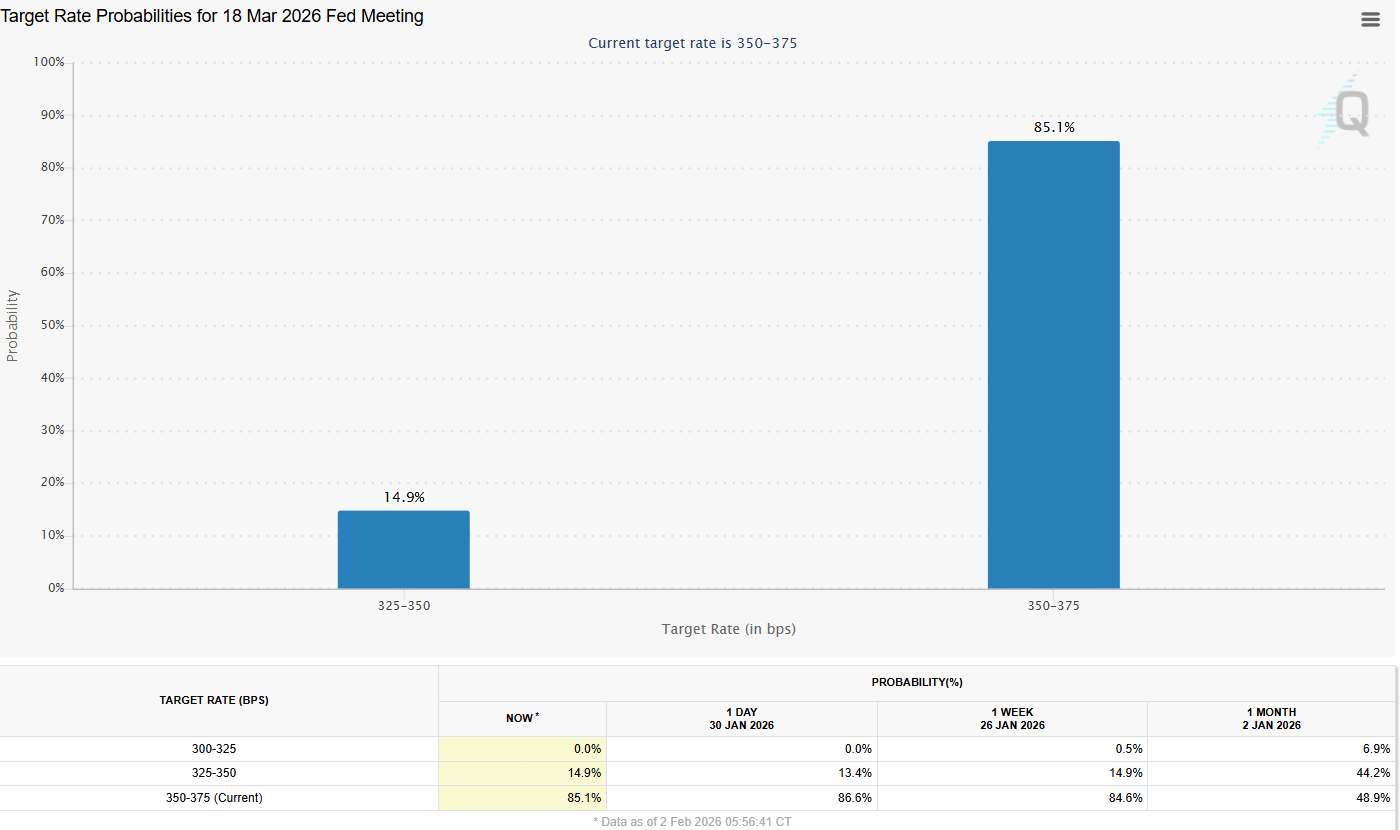

Expect interest rate cuts. Source: CME Group

Rate expectations have remained largely unchanged since Warsh’s appointment, with 85% of market participants expecting rates to remain unchanged at the next meeting on March 18, according to data from CMEG Group’s FedWatch tool.

Interest rate policy expectations for the June 17 meeting were also stable, with 49% expecting a 25 basis point cut, up from 46% the previous week. This will be the first Federal Open Market Committee meeting after Chairman Powell’s term ends in May.

magazine: Author of the Mysterious Mr. Nakamoto — Finding Satoshi Will Damage Bitcoin