Tron’s native token, TRX, surpasses Dogecoin (Doge), effectively becoming the eighth largest cryptocurrency by market capitalization.

The move marks a pivotal moment for blockchain networks preparing to be made public through a $210 million reverse merger.

Tron tips dogcoin over by market capitalization – what drives the shift?

This is not the first time Tron has surpassed Dogecoin in its market capitalization metric. I did that recently just two weeks ago, but this lasted only a short time.

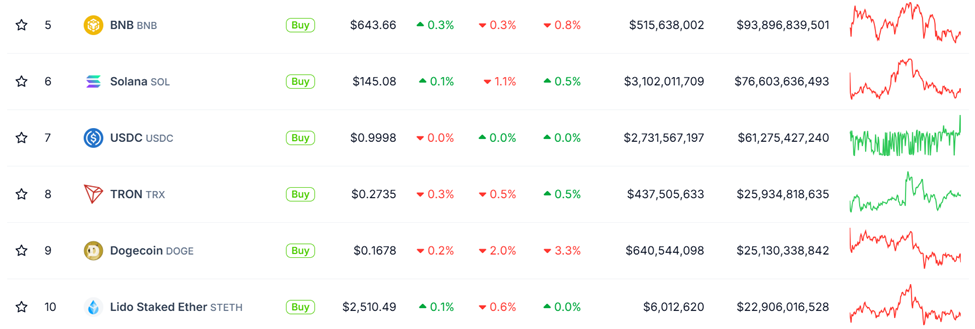

Coingecko’s data shows the TRX’s market capitalization is $25.93 billion, significantly higher than Dogecoin’s $25.13 billion.

Tron’s Trx defeats Dogecoin (Doge) by market capitalization. Source: Coingecko

This range will lead to a surge in USDT transactions across emerging economies and developed countries. This traction gradually strengthens Tron’s status as a critical global payment railway.

“Tron is more than just an emerging market story. Tron’s USDT drives substantial payments across both developed and emerging economies. StablecoinUtility is truly global,” Tron Dao said in a post.

TRX has been 12% since May, but Dogecoin has declined by over 30% and is overwhelmed by decline wholeMeme coin cents.

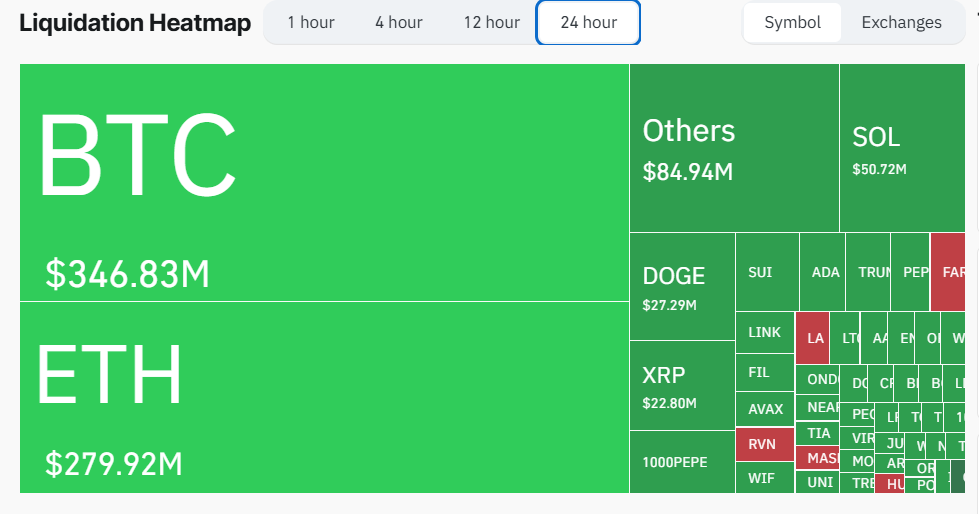

Market capitalization of the meme coin sector. Source: CoinMarketCap

Against this backdrop, Doge’s weekly trading volume has plummeted by more than 80%, highlighting investors’ preferences for utility-driven assets.

Beincrypto has reported on Tron’s upcoming IPO. The network is set to be made public through a $210 million reverse merger. Future public offerings position Tron as one of the first major cryptocurrency payment infrastructures to leverage the US capital markets.

Vinance drives Tron’s USDT liquidity when the network becomes the payment backbone

Data from encryption highlights the scale of its usage. The Binance Exchange process processes $2 billion to $3 billion in USDT transfers via Tron Daily, consistently representing more than 65% of total USDT activity in the chain.

“Binance is the biggest driver of USDT liquidity on the Tron network,” the Analytics company said.

Tron’s low fees and quick payment times make it an ideal option, especially for the large-scale stubcoin movement.

This efficiency has now attracted attention from analysts comparing Tron’s role in Latin America with the role of legacy payments giants.

“Tron+USDT has as important $V and $MA in the west as payment rails to South America and other emerging markets. Or Alipay or Wechat Pay is in China. TronInc. could be a Visa IPO moment on the Latam payment rail,” said one user on X.

The on-chain research firm Artemis has repeatedly felt emotion, observing that Tether and Tron are going beyond the story of emerging markets, and developing countries are heavily dependent on the pair.

Market response reflects this changing perception. While TRX is steadily increasing in adoption and investor confidence, the meme coin-driven narrative is shaking.

The reallocation of capital to Tron shows a deeper trend in traders to prioritize utility, scalability, and stable liquidity over the hype cycle.

With Tron heading towards a public list, there is a market cap momentum and persuasive claim as the backbone of real-world crypto payments could go even better.

Networks are increasingly positioned as a core component of the global financial system. This is a major exchange like Binance drives large USDT volumes every day on Tron, and institutional traders are monitoring Stablecoin flows as liquidity signals.