The World Liberty Financial community is casting near-indifferent support behind new governance measures aimed at strengthening the value of its native token, WLFI.

The proposal, introduced earlier this month, will directly acquire fees collected from protocol-owned liquidity (POL), to buy back tokens in open markets and destroy them forever.

The vote, held on September 11th, remains active until September 18th, but has already gained overwhelming community approval.

More than 99% of votes representing approximately 1.5 billion WLFIs support the measure, governance records show. About 5.8 million people have chosen to abstain, while under 2 million tokens have been cast against it.

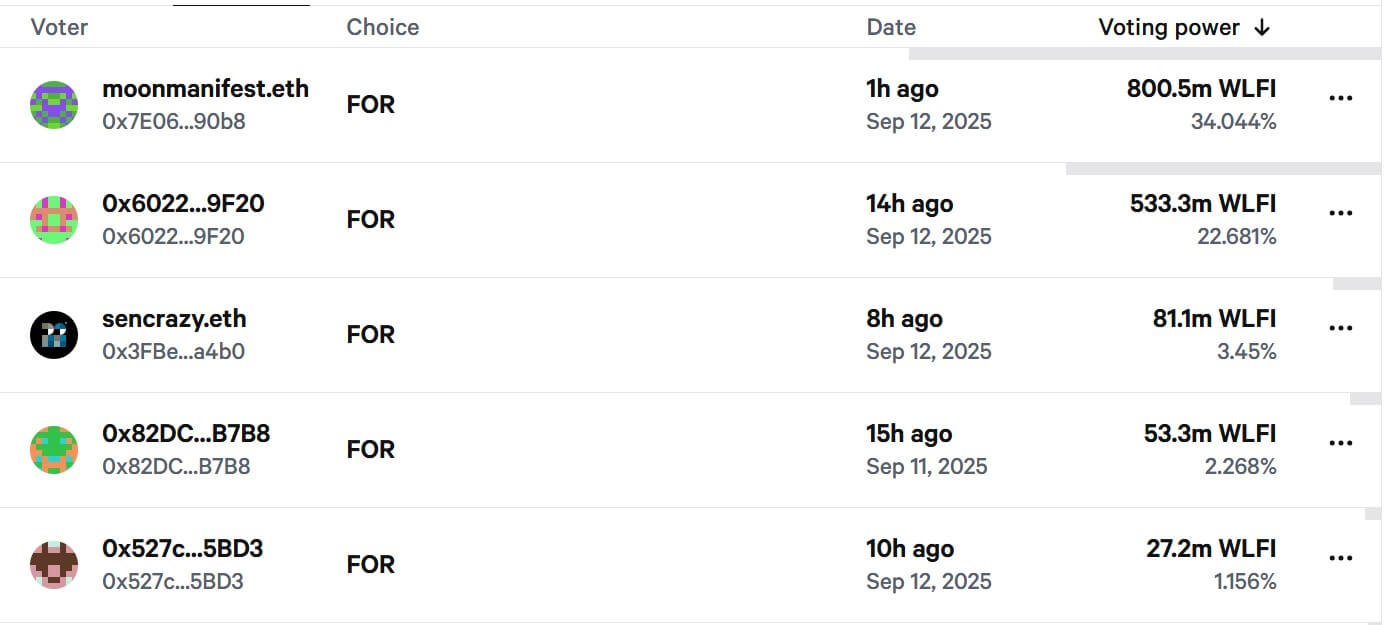

Meanwhile, an analysis of voting patterns showed that at the time of reporting, more than 56% of the responsible persons in “yes” votes are only responsible for two whale addresses.

This shows that WLFI holders of whales are significantly distorting governance votes in their favour.

Therefore, it is not surprising that the market has not yet responded favorably to this move. Data from Encryption It shows WLFI, which has fallen more than 35% since WLFI was launched earlier this month, is trading at $0.1992.

The buyback programme applies to Pol fees acquired in the liquidity pools of Ethereum, Binance Smart Chain and Solana, but excludes funds from independent liquidity providers.

Project leaders suggest that the scope can expand over time to include other revenue channels. WLFI’s Dylan said:

“This is just the first part of the deflation mechanism. Burning tokens under a non-inflating model is a great strategy. WLFI not only incorporates multiple deflationary features, but also has components that generate real profits. All of these are sustainable in the long term.”

Additionally, supporters of the Defi project say the move is designed to make WLFI scarce by reducing supply, an approach that many blockchain projects use to enhance long-term value.

By consistently removing tokens from the circulation, the plan is about to shift more WLFIs into the hands of committed holders rather than short-term speculators.

To set the programme stage, the team recently destroyed 47 million WLFI tokens worth more than $11 million. These tokens were drawn directly from unlocked Treasury Reserve and sent to designated burn addresses, marking the first major step towards the continuous burn model.