President Donald Trump announced he would impose 100% tariffs on Chinese goods starting November 1, in strong retaliation for China’s decision to restrict exports of rare earth materials essential to high-tech manufacturing.

The market reacted sharply to this announcement, with the S&P 500 index dropping 2.7% from the previous day. The news sparked widespread volatility across global equities, with crypto stocks posting sharp declines as investors’ risk appetite weakened.

Crypto stocks lead double-digit market decline

The flare-up of trade tensions between the US and China caused a broad market selloff, hitting crypto stocks hard. As of Friday’s close in New York, major digital asset companies were all down sharply.

Global cryptocurrency exchange Coinbase (COIN) closed at $357.01, down 7.75% from its previous closing price of $387. The stock price opened at $387.66 and fell to $351.63 during the session, reflecting investors’ increased risk aversion.

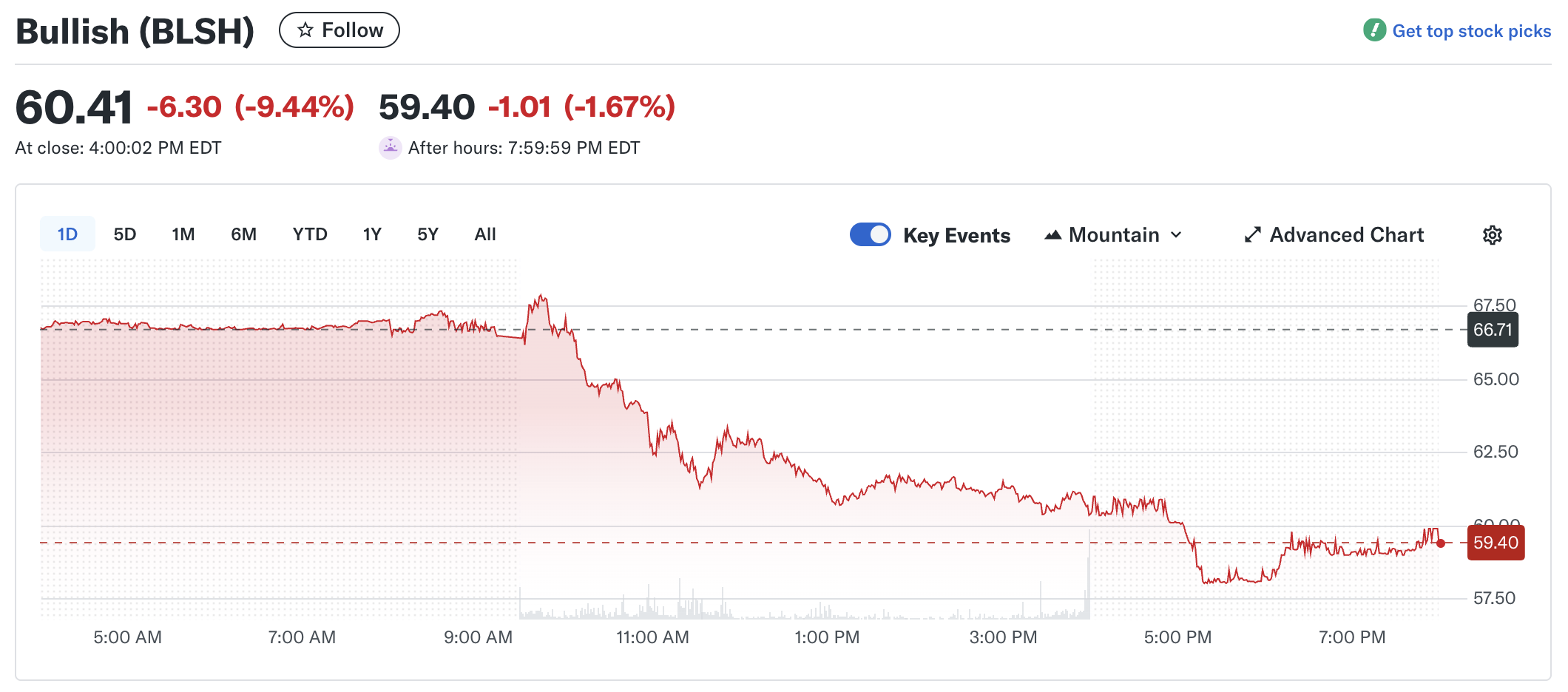

BLSH stock price performance in the past day / Source: Yahoo Finance

Cryptocurrency financial services company Blish (BLSH) also posted significant losses, dropping 9.42% to $60.37 from the previous closing price of $66.65. Shares briefly reached $68 earlier in the day, but fell to $60.25 as the broader market slumped.

Japan-based Bitcoin treasury company Metaplanet (MTPLF) closed 2.25% lower at $3.48 compared to its previous closing price of $3.56. It rose to $3.65 during the day, but that rise was short-lived as the stock fell in late trading.

Bitcoin mining company MARA Holdings, Inc. (MARA) suffered the steepest decline, dropping 7.67% to $18.65. After an early attempt at a rebound, the stock price plunged around 11 a.m. and continued to fall in after-hours trading, dropping another 1.72% to $18.33, indicating that investor concerns persist.

BREAKING: 🇺🇸 $1.2 trillion disappeared from the stock market today.

Pray for cryptocurrencies. pic.twitter.com/TiGFJBzSfb

— Ash Crypto (@Ashcryptoreal) October 10, 2025

Strategy’s mNAV highlights the risk of Bitcoin government bonds

Bitcoin financial giant Strategy (MSTR) was also hit hard by the sharp decline. On the same day, the stock price fell 4.84% to $304.79 compared to the previous day’s price of $320.29. The stock fluctuated between a high of $323.43 and a low of $303.57 during the session, showing high volatility.

More importantly, the focus has shifted beyond the short-term stock price decline to deepening concerns about the company’s fundamental valuation metrics. Analysts reported that the company’s multiple to net asset value (mNAV) fell below 1.180, its lowest level in nearly two years (19 months).

Strategy mNAV flow / Source:saylortracker.com

Jeffrey Kendrick, head of digital asset research at Standard Chartered, warned that it is essential for digital asset treasury (DAT) firms to maintain mNAV above 1.0 in order to grow their holdings. He said anything below that threshold indicates weakening balance sheets and increasing consolidation pressure across the industry.

Strategy firms and similar companies are also facing increased pressure from PIPE (Private Investment in Public Equity) financing structures used to fund Bitcoin acquisitions. According to a CryptoQuant report last month, Bitcoin government bonds tend to cluster toward discounted PIPE issue prices. This pattern caused some early investors to face losses of up to 55%.

Listed Bitcoin Treasury Company / Source: bitcointreasuries.net

Strategy currently holds approximately $78 billion worth of BTC, but its market cap is $94 billion, meaning there is a $16 billion premium. But given the company’s total profits of less than $350 million over the past 12 months, most analysts believe the premium reflects investor optimism related to founder Michael Saylor’s efforts to promote Bitcoin-backed bonds and investment products.

The article U.S. and China Tariff Concerns Hit Bitcoin Treasuries appeared first on BeInCrypto.