As Bitcoin trades at over $104,000, several large traders have launched high-risk short positions and are under the threat of sudden liquidation.

Leveraged bets against Bitcoin’s current bullish momentum are increasing, with at least three whale traders deploying huge capital using leverage up to 40 times the amount. Although these positions already owe severe, unrealized losses, ongoing financing provides limited compensation for market pressure.

Whale Wallets Face Liquidation Risk at $105,700

According to a disclosure from blockchain resource LookonChain, wallet address 0x51D9 has rolled out 40x leverage to open a short position of $93 million in Bitcoin.

Many gamblers are shortening $BTC with high leverage!

The 0x51D9 opened a short position of $93 million at $BTC with 40x leverage, with a liquidation price of $105,690.

0x5D2F opens a short position of $44 million at $BTC with 40x leverage, with liquidation price of $112,660 https://t.co/wcw1u4fdwz…pic.twitter.com/paf1lemnzp

– lookonchain (@lookonchain) May 12, 2025

A price rise of just 1.5% will cause liquidation due to BTC’s hovering of around $104,000. The calculated liquidation price is $105,700, and its location is only 1.55% away from the forced closing. For now, the transaction is at a deep, unrealized loss of over $500,000, suggesting a position entered before BTC pushed higher.

To offset the loss, Short has earned around $34,000 aggressively. However, the amount of funds remains small compared to the current drawdown.

Additionally, the same wallet used 10x leverage to place a short bet of $1.1 million on Lido Dao (LDO). The entry was incurred at $1.08162, with the current unrealized loss of $22,379. The LDO has more breathing space and liquidation occurs only when the price is between 79% and $1.9761.

Independent $44 million shorts will see $515,000 in unrealized losses

Another wallet, identified as 0x5D2F…8AB39BB7, used 40x cross leverage to win a short position of $44 million in Bitcoin at $103,494.40.

The position, already underwater, shows an unrealized loss of $515,348.53 BTC It is currently trading at $104,720. This position significantly increases the liquidation price at $112,660, allowing a buffer of about $9,000 before closing.

Despite unrealized losses, the position has won $51,711.71 in positive funds. This reflects the continued dominance of a long-term interest in the broader market. However, if upward momentum continues, such short positions can be forced to buy back, which can increase volatility.

The third whale goes for $95,969 with 40 times more exposure

Elsewhere, the third trader start It’s a $69.7 million Bitcoin short with 40x leverage, with an entry price of $95,969. The liquidation threshold was particularly pronounced at $103,470. Bitcoin priced at $104,088 and the trader has already been liquidated.

Large shorts have already been settled

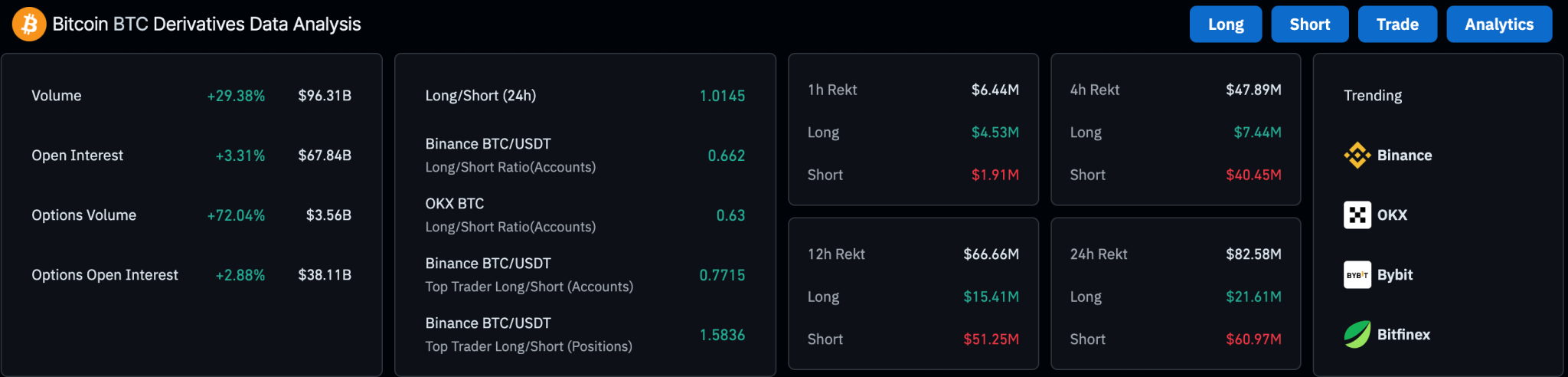

Over the past 12 and 24 hours, the Bitcoin (BTC) derivatives market has seen significant short-range liquidation, indicating strong upward price pressures. In the 12-hour window, $66.66 million was settled and $51.25 million was settled from the shorts.

Bitcoin liquidation data

Similarly, the 24-hour period wiped out a position of $82.58 million compared to the long, which was just $21 million.