Upexi, a registered NASDAQ company, has announced the purchase of an additional 56,000 Solana (SOL), worth around $7.8 million at its fees today. The company currently owns SOL 735,692 worth of approximately $1344 million. Upexi is the largest Sol Treasure Company. The company aims to keep as many sols as possible.

Despite her interest, Solana continues to shine red

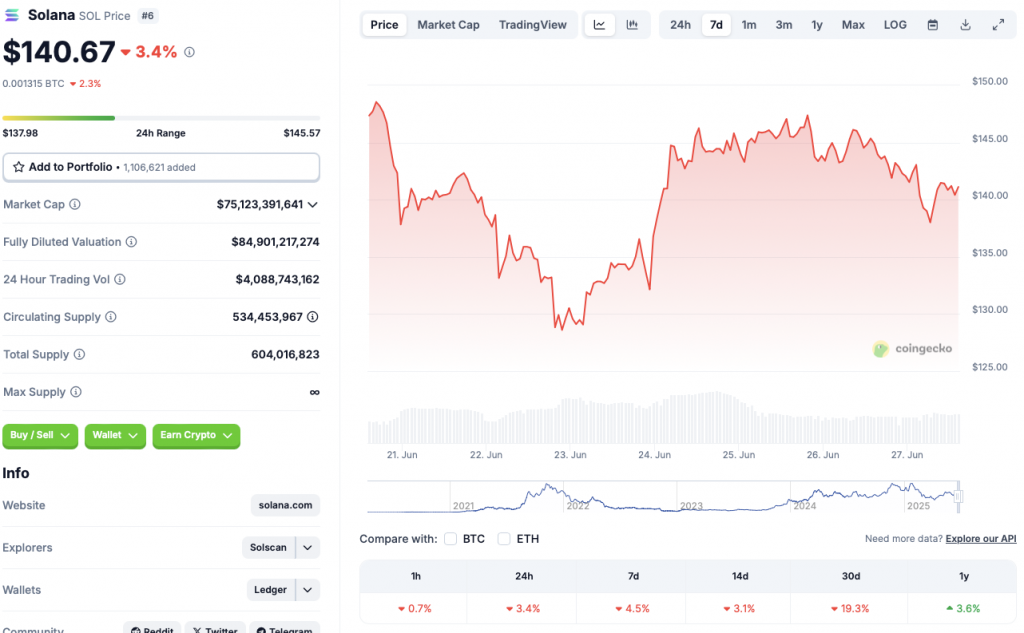

Sol spent roughly the past few months this year. Assets rose to a peak of $293.31 on January 19th this year, but have since declined more than 52%. SOL currently has a decline of 3.4% on daily charts, 4.5% on weekly charts, 3.1% on 14-day charts and 19.3% on previous month. Despite the inactive performance in 2025, Sol has maintained some profits on the annual charts, attracting 3.6% since June 2024.

The current predicament for Solana (Sol) could be due to increased volatility in the crypto market. The market has experienced a rebound after escalation in the Middle East conflict, but we seem to have hit a barrier again. Bitcoin (BTC) appears to be integrated at the $107,000 level.

BTC meetings could be due to a consistent institutional influx. The lack of retail money may be one reason why the crypto market is struggling. Retail investors are still not confident. The Federal Reserve decision to keep interest rates unchanged could have banned retail investors from stealing dangerous moves.

Solana (Sol) could see the upwards in the coming weeks. The assets have several spot ETF applications in the SEC. ETF approvals can lead to a surge in facility money. Given the shortage of retail investors, an increase in facility inflows could drive the next Sol-Rally.

Also, once retail investors regained confidence, Sol was able to see the rally. Rate reduction was the easiest way to give retail players more confidence. This possibility appears to be out of the picture for the time being.

(tagstotranslate) solana