US spot crypto exchange-traded funds (ETFs) recorded nearly $670 million in inflows on the first trading day of the year.

This sharp rise shows that investor appetite is rising again after a period of stagnation until 2025.

Bitcoin ETF tops the list with $471 million inflows

On January 2, the Spot Bitcoin ETF led the digital asset class’s strong start to 2026, pulling in $471 million in net inflows.

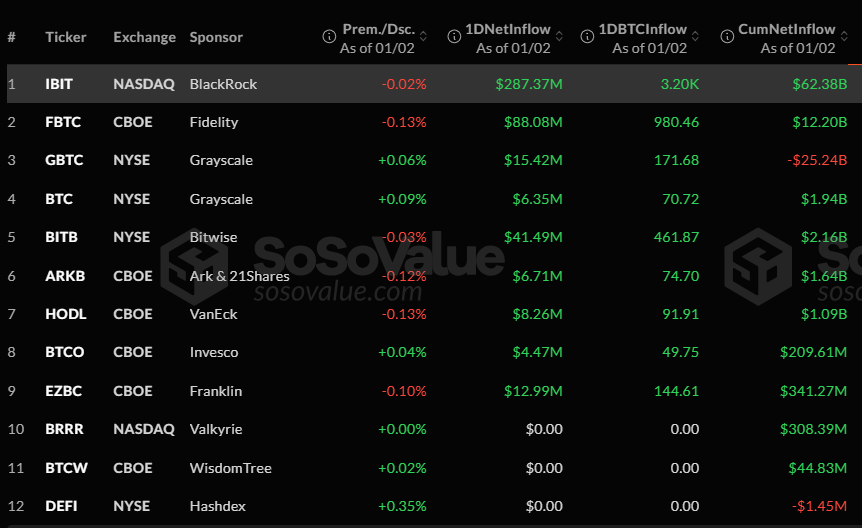

BlackRock’s iShares Bitcoin Trust (IBIT) led the sector, attracting about $287 million in new capital, according to data from market tracker SosoValue.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) followed with $88 million, while Bitwise Bitcoin ETF (BITB) recorded inflows of $41.5 million.

Grayscale-converted Bitcoin Trust (GBTC) and Franklin Templeton’s EZBC also saw positive movement, posting $15 million and $13 million, respectively.

US Bitcoin ETF daily inflows (Source: SoSo Value)

Meanwhile, this collective surge represents the group’s second-highest daily inflow since Nov. 11, surpassing its Dec. 17 peak of $457 million.

This robust activity suggests that institutional investors are reallocating capital after a period of tax loss recovery and capital withdrawals in late December.

Ethereum and other altcoins are performing well

Notably, the sector’s positive sentiment extended beyond Bitcoin to become the second-largest digital asset.

The Ethereum fund reported total net inflows of $174 million. Although different from the 2025 trend, Grayscale Ethereum Trust (ETHE) matched this cohort with inflows of $53.69 million, according to the data.

Grayscale Ethereum Mini Trust followed closely with $50 million, followed by BlackRock’s iShares Ethereum Trust (ETHA), which secured $47 million.

Meanwhile, investment products linked to assets with smaller market capitalizations also recorded gains, reflecting broader market participation.

XRP-related funds recorded inflows of $13.59 million, while Solana-based ETFs added $8.53 million.

The Dogecoin ETF saw modest inflows of $2.3 million, the highest single-day inflow for a specific asset class since its inception.

Market analysts see coordinated inflows across Bitcoin, Ethereum, and alternative coins as a potential indicator of a trend reversal.

The uniformly strong performance across these ETFs suggests that U.S. investors are increasing their exposure to the crypto sector as the new fiscal year begins.

The article US Crypto ETF sees $670 million inflows on first trading day of 2026 appeared first on BeInCrypto.