Later today, the US President celebrates what he calls liberation day by continuing his tariff policy to reduce reliance on foreign products. Depending on the severity of the tariff, the domestic crypto industry will suffer substantial losses.

In an interview with Beincrypto, Matt Pearl, director of the Strategic Technology Program at the Center for Strategic International Studies (CSIS), explained that taxation in China would inherently disrupt supply chain dynamics and increase operational costs for US mining.

How do customs duties on the release date have an impact on mining costs?

Today, Trump is expected to announce cleaning fees for US imports as part of the economic agenda he derived as Liberation Day. However, details about how aggressive they are and which countries are most targeted are becoming inactive.

The lack of information surrounding the event left the public in the dark, speculating what would happen next. In the case of US mining, participants will watch Trump’s announcement about China.

About a month ago, the Trump administration slapped the new 10% tariff on goods from China, in addition to the existing 10% tariffs enacted a few weeks ago. During his campaign trail, Trump proposed a border tax of up to 60% on Chinese goods.

If Trump applies further collections to China in light of Liberation Day, American Bitcoin miners must make many decisions regarding the nature and scale of their future operations.

ASIC Hardware: Important Import

Cryptographic mining relies heavily on application-specific integrated circuit (ASIC) equipment. These computer chips are built to perform the complex mathematical calculations needed to validate transactions and minify new coins. They are particularly essential in Bitcoin and other proof of work cryptocurrencies.

ASICs have become the dominant hardware in Bitcoin mining due to their superior performance over other types of hardware, such as CPUs and GPUs. They provide a much higher hashrate per unit of energy consumed and are designed for specific mining algorithms.

“This is a very R&D intensive process for creating an ASIC that is energy efficient and does everything you need in the context of Bitcoin mining,” explained Pearl.

The US relies heavily on imports of ASIC mining hardware, with a significant portion coming from China. China, a longtime US trade rival, has established manufacturing capabilities to produce advanced semiconductor chips.

America’s dependence on Chinese hardware equipment

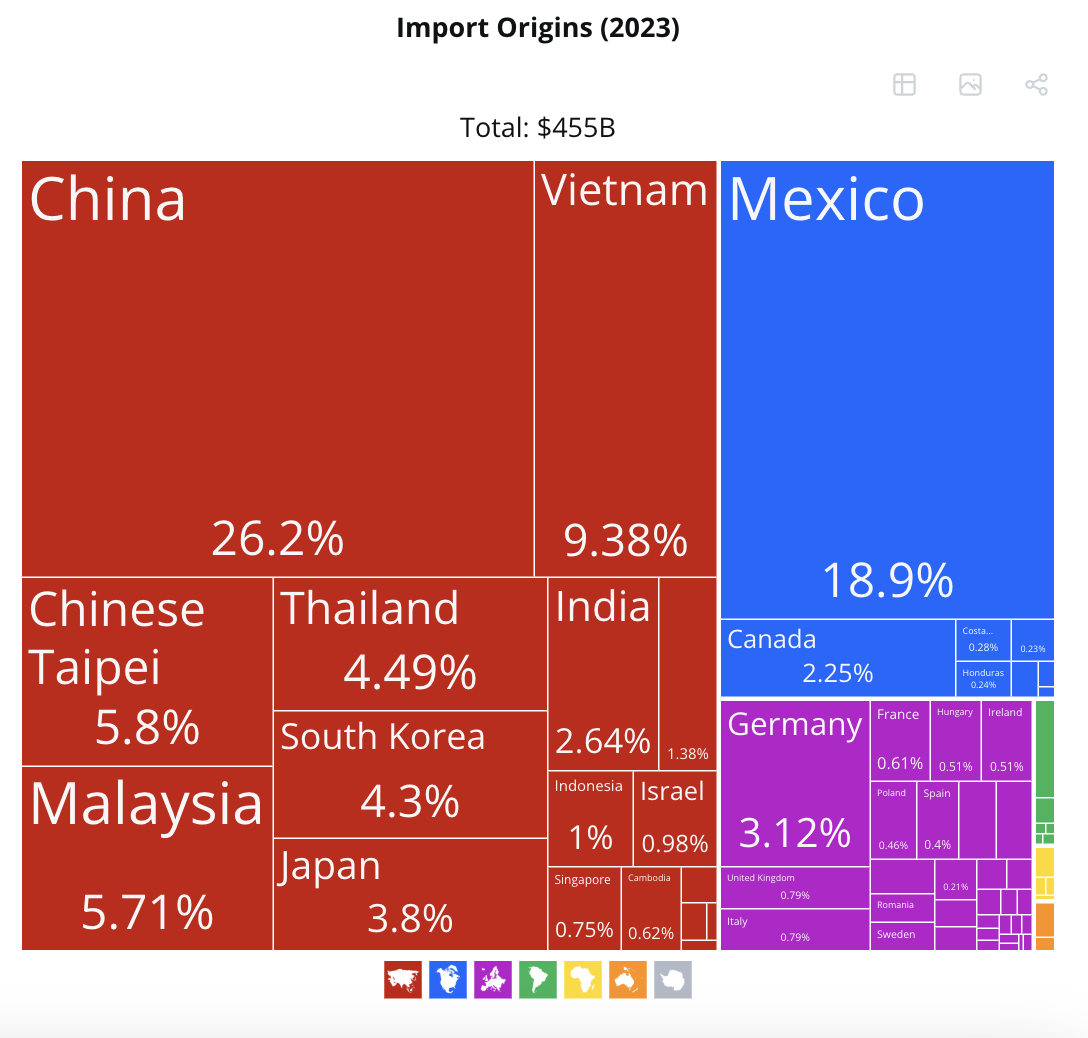

In 2023, the US became the world’s largest importer of electrical machinery and electronics, according to data from the Observatory of Economic Complexity (OEC). That year, it imported $455 billion worth of hardware, including integrated circuits (ASICs), semiconductor devices, and electrical transformers.

The US imports the largest electrical machinery from China. Source: OEC.

Electrical machinery and electronics were recorded as the second largest import category, with China supplying its total of $119 billion, and comfortable integration of its position as the top US vendor.

In January 2025 alone, exports of electric machinery and electronics in the US accounted for up to $19 billion, imports reached $41.3 billion, with most imports coming from China.

Given the US’s heavily dependent on China for this specialized hardware, tariffs imposed on electronic imports from China directly affect the costs of US ASIC mining hardware.

Though not too serious, Trump’s first term tariff policies offer a glimpse into the potential impact on crypto miners.

Lessons from Trump’s First Terminology

In June 2018, US trade representatives reclassified Bitmain, a Chinese Bitcoin mining hardware manufacturer, from “data processors” to “electromechanical devices.” Bitmain, in particular the “Antminer” series, is a major manufacturer of ASIC mining hardware.

By reclassifying the hardware, a 2.6% tariff has been added to the existing 25% tariffs on Chinese products. This effectively increased the total tariffs on the US transport of Chinese crypto mining equipment to 27.6%.

Mining hardware costs are one of the biggest input cost operators in the face of the American mining business. Following the tariff hike, crypto miners have confirmed that production costs will inevitably increase significantly.

The possibility of further increases could be further increased after the current cumulative 20% tariffs on Chinese goods and the announcement of Trump’s release date suggests similar or more severe effects.

“In the short term, (US mining) is extremely vulnerable, especially since most of the Bitcoin mining equipment comes from China. ASICs are not easy to produce, which raises the prices of US Bitcoin mining equipment.

Aside from an increase in costs, tariffs cause disruption in the supply chain dynamics of hardware mining.

Supply Chain Disruption: The Coming Threat

According to Pearl, US crypto miners can expect delays and shortages in hardware mining hardware if Trump applies further tariffs on China. His judgment is primarily based on the fact that this has already happened.

“We’re already seeing delays. We’ve already seen customs and border patrols take time to look at equipment and clear it through customs. And you also had a US postal service that has very temporarily suspended package shipments from China,” explained Pearl.

Two months ago, the US Postal Service (USPS) announced that it had temporarily suspended package delivery from China shortly after Trump imposed a 10% tariff on Chinese imports. The USPS revealed that the suspension stemmed from removing the exemption, bringing tax-free, untested cargo to under $800.

“USPS and customs and border protection will work closely to implement the new China’s efficient collection mechanism to ensure minimal disruption in package delivery,” the post office said in a statement.

However, the suspension was reversed within 24 hours. However, with new tariffs on the horizon, a similar situation unfolds, threatening to backlog the mining plans of American Bitcoin Miners.

“When (Trump) imposes tariffs, it becomes even more important, increasing costs, pushing down the amounts sent, increasing uncertainty about whether customs, border patrols or others will slow things down when they reach us.

If tariffs continue, US crypto mining companies will need a significant long-term restructuring.

Will we miners move due to customs duties?

There is no evidence that the American crypto mining company moved due to Trump’s tariff policy during its first presidency, but this option is this second reasonable result.

“I think the difference this time is that there is more uncertainty. The president appears to be more focused on tariffs, and so far there seems to be a lack of permanence in the administration’s decision. There is a tariff levies, but we will adjust or increase them. We,” Pearl told beincrypto.

French Digital Minister Clara Chappaz proposed this week to monetize EDF’s surplus energy through Bitcoin mining. EDF is the largest state-owned energy company in the country. According to Chapappaz, this approach will help reduce the company’s debt. Many in the wider crypto community have celebrated the idea.

If Europe surrenders to these strategies, do you feel that American companies tend to move their operations overseas? Pearl says yes, but Europe is not my favorite region.

“I think that labor costs are more expensive in Europe, so there could be a lot more deficits to allow infrastructure and actually build infrastructure. I think that the transition to Europe and the labor barriers are more likely to have other regulations and labor barriers than the transition to other parts of Asia,” he said.

However, simple transfers do not rule out the need for access to a consistent ASIC supply.

Impossible results

So far, no country has been able to produce ASICs to match the size and speed of China. It could also be China’s greatest interest to move its business to the US.

“Some Chinese companies that produce this equipment may actually discover US manufacturing capabilities and not be subject to customs duties. But it involves relocating the facility and getting permission. It will take time and won’t happen tomorrow.”

However, given the hostility between the two countries, this seems unlikely.

Ultimately, domestic production provides the best path to self-sufficiency in the United States. However, it can be a complicated and long process.

Bringing operation to land and field

Under Biden, Congress approved the Chips Science Act in July 2022. The law was designed to enhance domestic semiconductor manufacturing in the United States.

Although ASIC equipment is not expressly single, the provisions strongly encourage and encourage the transfer and establishment of any type of semiconductor production within the US border, including those associated with ASICs.

“If the (Trump) administration doesn’t try to revert some of what’s done under the Chips Act in terms of moving manufacturing capabilities to the United States, US companies could develop competitive ASICs over the next few years.

Two days ago, Hut 8, the leading North American Bitcoin mining company, is partnering with Eric Trump to launch American Bitcoin and turn it into the world’s largest pure playminer.

The initiative coincides with President Trump’s goal of bringing production back to the US, but Hut 8 relies on ASIC hardware, like other American miners. This creates a potential conflict with his tariff policy.

In the interim, US miners will need to tackle existing dependence on China’s ASICs.

American companies will continue to bear the impact of Trump’s tariffs on important Chinese crypto mining hardware. This continues until the US is able to efficiently carry out a wider range of manufacturing and production on land.

If Trump’s release date announcement includes further tariffs on China, domestic mining companies, large and small, will see production costs rise significantly. Disturbing tightly interrelated supply chain dynamics also disrupt operations. It has not yet been decided how they will respond.