This is a segment of the Imperial newsletter. Subscribe to read the full edition.

There’s a lot of optimistic news this morning. From a venture capital standpoint, the first quarter wasn’t that bad!

Pitchbook’s preliminary data suggests that VC spending was around $4.5 billion this quarter, with half of that coming from Binance’s Abu Dhabi’s contract with MGX. It just surpassed $2 billion per quarter last year to make that number a context.

I know that if I keep up this pace, I know it’s quick to say this, but I’ve found that spending will reach $18 billion. That number is yet to approach the $33 billion salary increase in 2021, but it shows the sector is bounced back and not bubbled.

In December, Pitchbook’s Robert Le said he wasn’t surprised to see a “multiple” $5 billion quarter.

He said some of the momentum comes from massive deals over $100 million that he hasn’t seen much of this cycle so far.

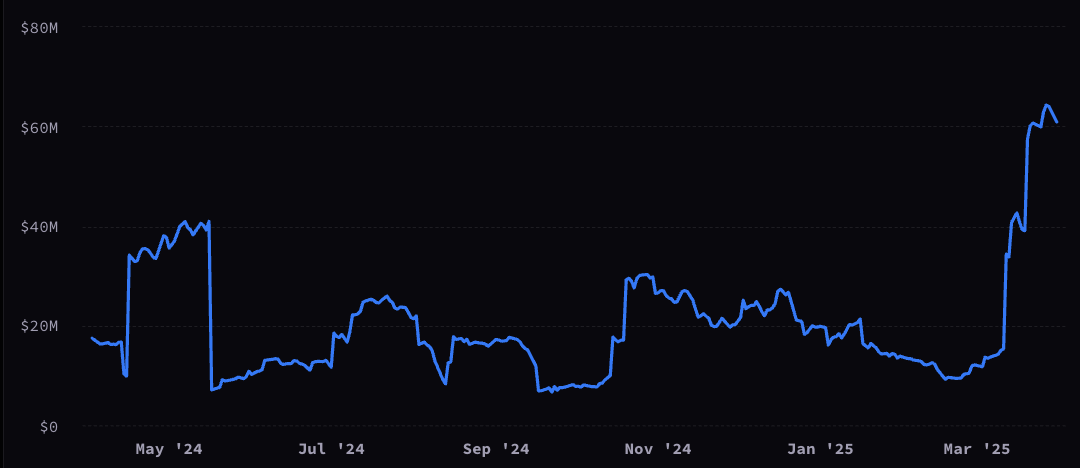

Source: Ti terminal

Currently, the average trading size in March is around $60 million, but looking at the chart above, it’s clearly a jump from the trading size we saw last year.

“I think we would expect a lot of these big deals to be funded as megafunds are back in the market.

There is preliminary evidence to support that too. Le said he heard that Katie Havn hasn’t struggled to raise $1 billion for two new funds. Interest shows that limited partners are trying to invest in some of the so-called megafunds.

“Overall sentiment” is perfectly suited to crypto VCs, even emerging partners focusing on seed or pre-seed funds.

Speaking of these small rounds, we may see more rounds at this point, but Le believes that bigger deals will recover as businesses scale. It’s the question of where we are in the cycle. For each tie data, seed stage rounds are currently the most active round type.

It is not at all surprising that Le is hoping for a project focused on the institutions that are currently most interested in.

“One great thing for startups in this space is that these institutions are more likely to partner or buy, rather than build them internally.” Le hopes this will drive “large venture funding” in the future.

On the flip side, Le doesn’t think we’ll see the flock in app tier spending – whatever serves retail, he revealed.

“The general view is that retailers are not returning to the market,” Le admitted that this idea could be “short-term thinking.” Crypto’s “Holy Grail” is the integration of retail users who use the Crypto app at their actual value. They don’t intend to come just for tokens, and some people don’t even interact with them.