Veteran trader Peter Brandt is a Bitcoin (BTC) could fall towards the $58,000-62,000 zone, implying a 33-37% correction from the current price level of approximately $92,400.

His prediction comes as Bitcoin continues to show multiple bearish signals, with other analysts also pointing to the risk of further decline.

Peter Brandt warns that Bitcoin could fall based on technical patterns

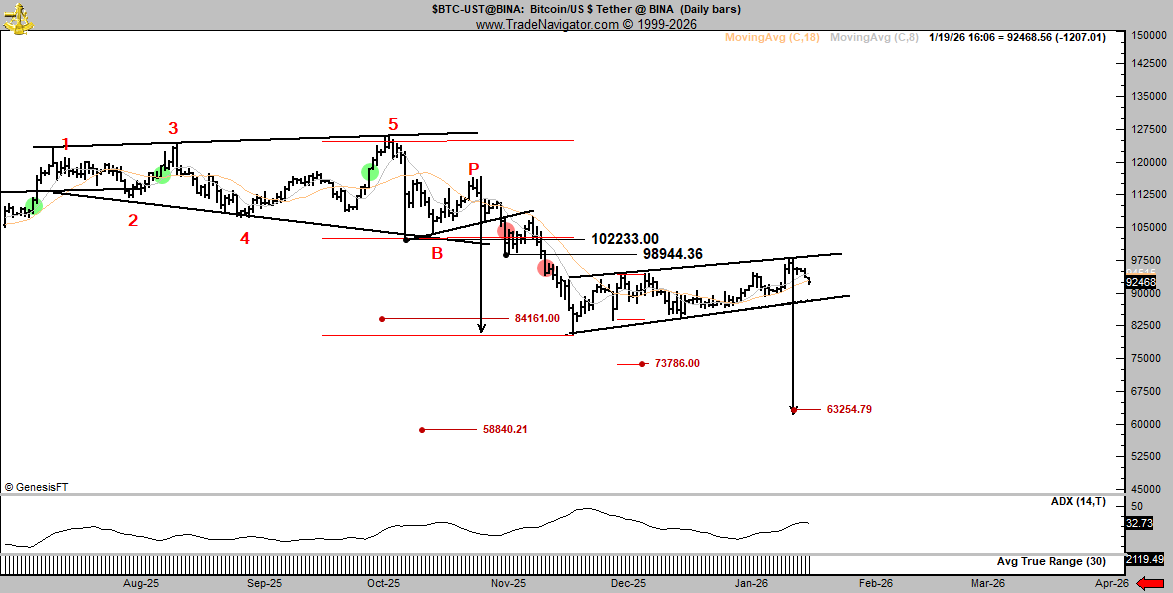

In a post on X (formerly Twitter), Brandt said that Bitcoin could fall to the $58,000 to $62,000 range. The attached chart shows that his outlook is based on the rising wedge pattern that has developed over the past two months.

“I think $58,000 to $62,000 is where it’s going.” BTC” the post said.

Peter Brandt’s Bitcoin price prediction. Source: X/Peter Brandt

The formation of an ascending wedge appears when price consolidates between two upwardly sloping convergent trendlines, with the lower trendline rising more steeply than the upper trendline.

Although technical analysis does not guarantee results, this pattern often indicates weakening momentum and a high probability of downside movement. Brandt also acknowledged the uncertainty inherent in market forecasts, saying:

“If I can’t do that, I’m not ashamed. So I don’t have to see any trolls screenshot this anymore. I’m wrong 50% of the time. I don’t care if I’m wrong.”

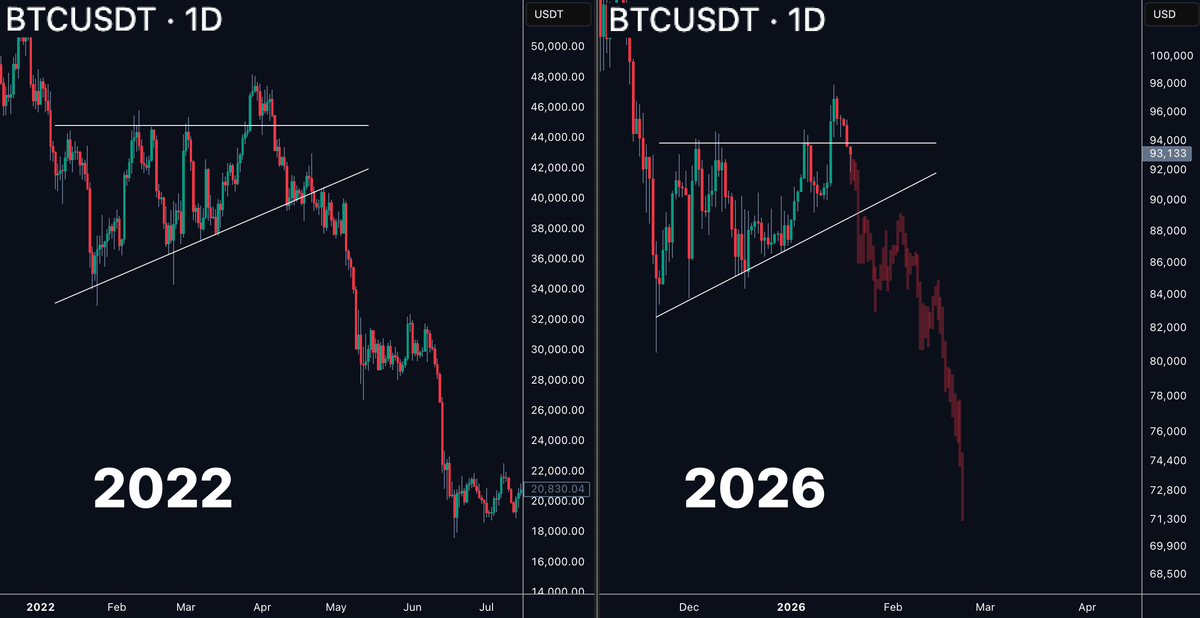

In addition to Brandt, several market watchers are highlighting additional bearish scenarios. One analyst pointed out the similarities between Bitcoin’s current price structure and the 2022 market cycle, claiming that the asset is “an exact repeat of the 2022 fractal.”

The analyst shared the comparison, noting that in both cases Bitcoin staged a rescue rally that stalled below horizontal resistance. This move ultimately formed a bullish trap before the price fell below rising support.

In 2022, that support was lost and the decline accelerated sharply. The analyst said similar momentum is currently unfolding and could be accelerating the downside.

Finally, BeInCrypto has also identified 5 major bearish signals for Bitcoin, further strengthening its downside potential. Nevertheless, some analysts take the opposite position.

Analyst Ted Pillows noted that year-over-year liquidity growth in the US bottomed out in November 2025, which also coincides with Bitcoin’s local bottom.

Pillows said U.S. liquidity conditions have since started to improve, which he believes could support a rally in cryptocurrencies.

“Liquidity in the US is improving now, which is one of the reasons why I expect crypto to rally. It’s that simple.”

$BTC It is still trending up on the weekly chart.

We have tested the same support line three times now and it continues to hold.

This last rally around $93,000 indicates that buyers are still intervening.only for BTC If we break above this trend line, the trend remains bullish.

The next level to focus on is… pic.twitter.com/XPCC3K0ME6

— CryptoKing (@CryptoKing4Ever) January 19, 2026

OG Bitcoin whale resurfaces amid mixed market outlook

On-chain data suggests that long-term holders are also becoming more active, while technical and macro indicators are sending mixed signals. Blockchain analysis platform Lookonchain reported that Bitcoin OG whale, which had been inactive for a long time, has moved to 909.38. BTCthe equivalent of approximately $84.62 million in a new wallet 13 years later.

Upon receiving each BTC It was valued at less than $7, an increase of approximately 13,900 times its previous value. Such whale movements often garner attention by suggesting either a potential sale or strategic repositioning by early adopters.

In another update, Lookonchain has identified another OG that is offloading its holdings. Obtained 5,000 whales BTC Twelve years ago they were $332 each. This holder recently sold 500 pieces BTC The total amount is worth $47.77 million and extends a pattern of systematic sales that began in December 2024.

“Since December 4, 2024, he has sold $.BTCa fire sale of $2,500BTC($265 million), with an average price of $106,164. he still has $2,500BTC($237.5 million), with total profits exceeding $500 million,” the post reads.

As such, Bitcoin is currently at a crossroads. Technical patterns and historical fractals point to the risk of a more severe correction, but improving US liquidity conditions suggest macro tailwinds could eventually support the rally again. What will ultimately materialize remains to be seen.

The article Veteran trader Peter Brandt’s Bitcoin predictions suggest over 30% correction appeared first on BeInCrypto.