Vitalik Sells $ETH — Big headlines, small deals

Co-founder of Ethereum Vitalik Buterin Recently sold approx. worth $1.94 million $ETHsparking a wave of bearish sentiment across crypto Twitter.

On the surface, this move seems alarming. Ethereum is already under pressure, and founder-related sales will quickly lead to insider pessimism. However, when placed in the appropriate context, the transaction itself is don’t move the market.

The sale is the part that can be ignored Approximate amount of Ethereum Market capitalization $275 billion Rounding error compared to daily $ETH Trading volume. Vitalik sold $ETH There is no consistent correlation with major price peaks or crashes, and they have been done multiple times in the past for operational, tax, and donation purposes.

The noteworthy points of this sale are: It’s not the size, it’s the timing.

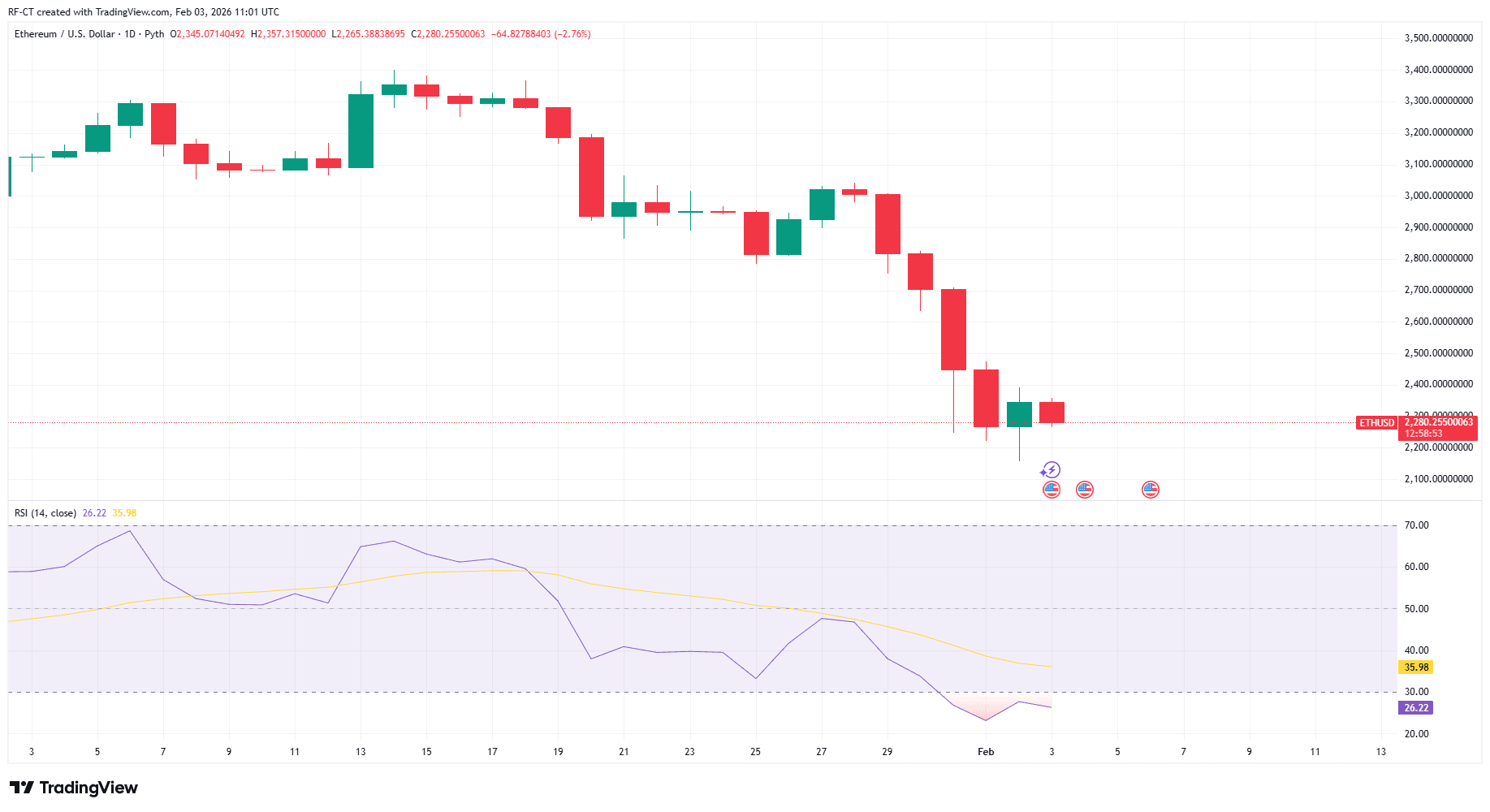

Ethereum’s chart confirms structural weaknesses

Ethereum’s year-to-date chart shows a clear deterioration in structure.

By TradingView – ETHUSD_2026-02-03 (YTD)

- $ETH It fell sharply from the $3,300-$3,400 zone.

- Currently, prices are moving around the same level $2,280

- RSI remains very oversoldStruggles to regain neutral territory

Ethereum is not collapsing, but it is collapsing Failed to attract decisive demand. Rally is sold, momentum is weak; $ETH Its performance continues to be relatively lower than that of Bitcoin.

In this environment, all negative narratives, even small founder divestitures, are ignored. Hits harder than it would otherwise.

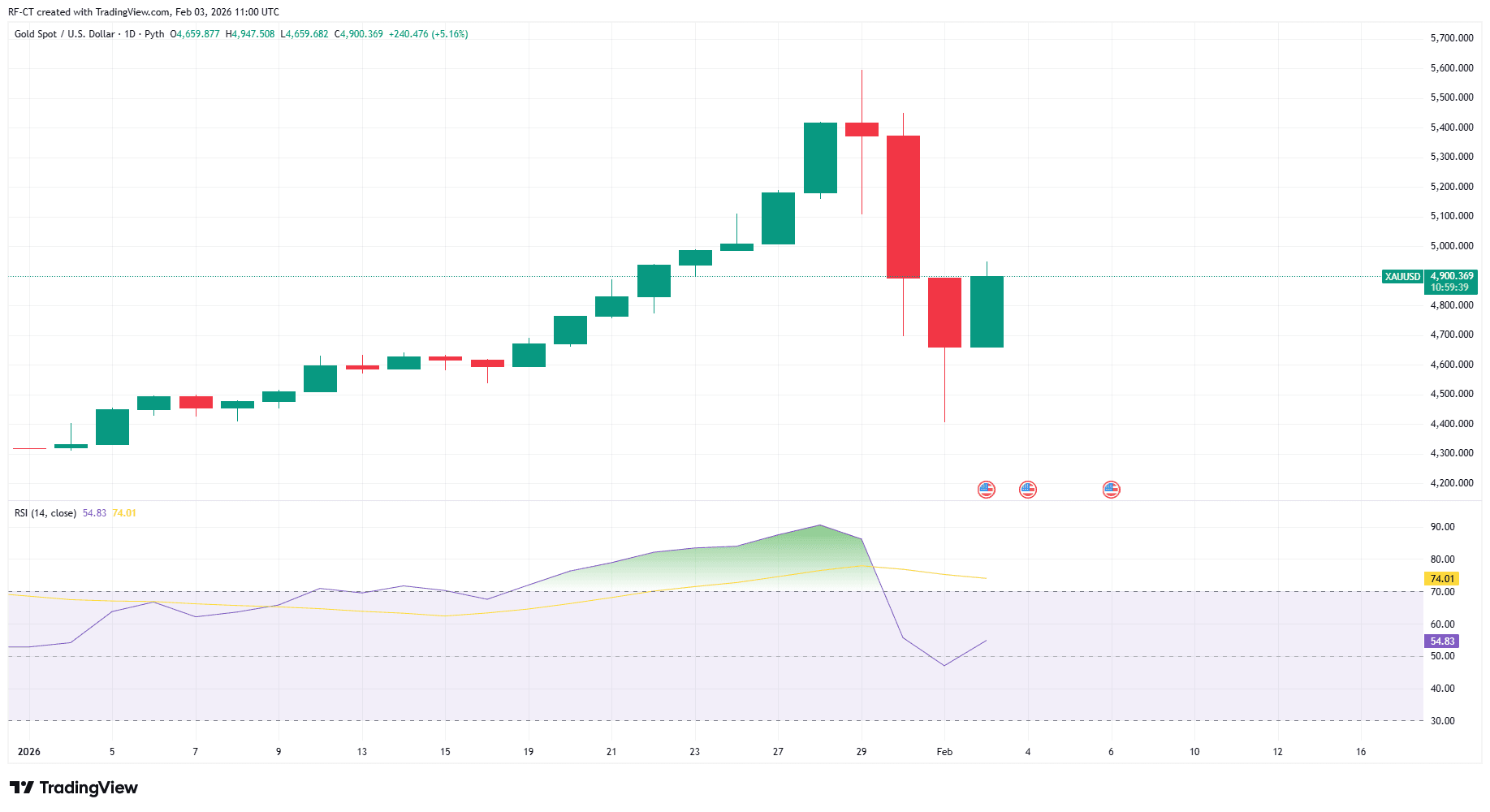

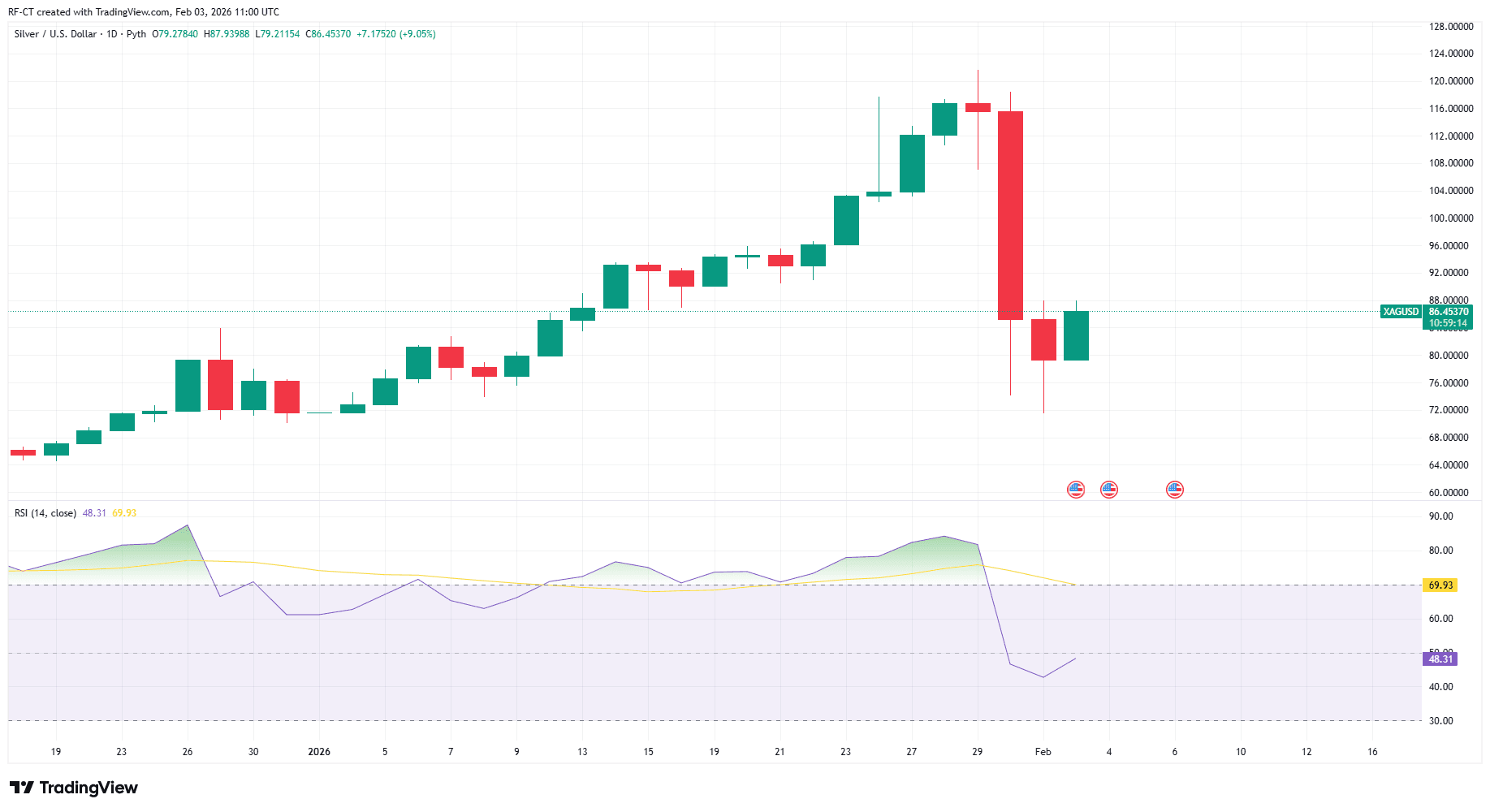

Meanwhile, gold and silver are exploding

While emotions are being discussed about cryptocurrencies, Hard assets are making decisive moves.

- gold soared upwards $4,900increasing market value by trillions of dollars in a matter of days

Provided by TradingView – XAUUSD_2026-02-03 (YTD)

- silver spike on top $85recording near-vertical profits

By TradingView – XAGUSD_2026-02-03 (YTD)

- Both assets remain Strong year-to-date outperformance

This is not retail speculation. The speed, scale, and consistency of movement strongly indicate that: Rotation of institutional capital and macro capital.

In particular, gold and silver soared. in front Cryptocurrencies have reacted – a typical signal that traditional macro hedges are accumulating first.

this is not $ETH The Story — It’s the Story of Capital Rotation

The real point is not that “Vitalik is bearish.”

It is as follows:

capital is in motion Toward assets with a clear macro narrative And move away from assets that have reached a dead end in the story.

Now:

- gold and silver are benefiting inflation hedge, Financial reliability concernsand geopolitical risk

- Bitcoin is increasingly being treated as digital macro collateral

- Ethereum lacks a strong and urgent narrative to regain capital

$ETH It’s not abandoned, it’s abandoned. priority is temporarily lowered.

Why is Vitalik’s sale important psychologically rather than structurally?

If Ethereum is in a strong uptrend, this sell-off will hardly be recorded.

Instead, it looks like this:

- Reinforces existing bearish bias

- highlights $ETHlack of momentum

- functions as sense of speednot a catalyst

the market is reacting emotionallynot analytically.

What to watch next

For Ethereum to regain momentum, the market will likely need:

- Bitcoin stabilizes and rises further

- Cool the metal without disintegrating it

- renewed $ETH– Specific catalysts (ETF flows, resurgence of the scaling story, or $ETH/BTC inversion)

Until then, Ethereum will remain vulnerable to: headline-driven pressureEven if the fundamentals behind those headlines are tenuous.

conclusion

vitalic sales $ETH teeth That in itself is not a bearish signal..

But there comes a moment when capital has a clear advantage. Hard assets and macro hedging Regarding crypto assets that depend on stories.

Ethereum is not going to break, it is waiting.

For now, gold and silver are in the lead.