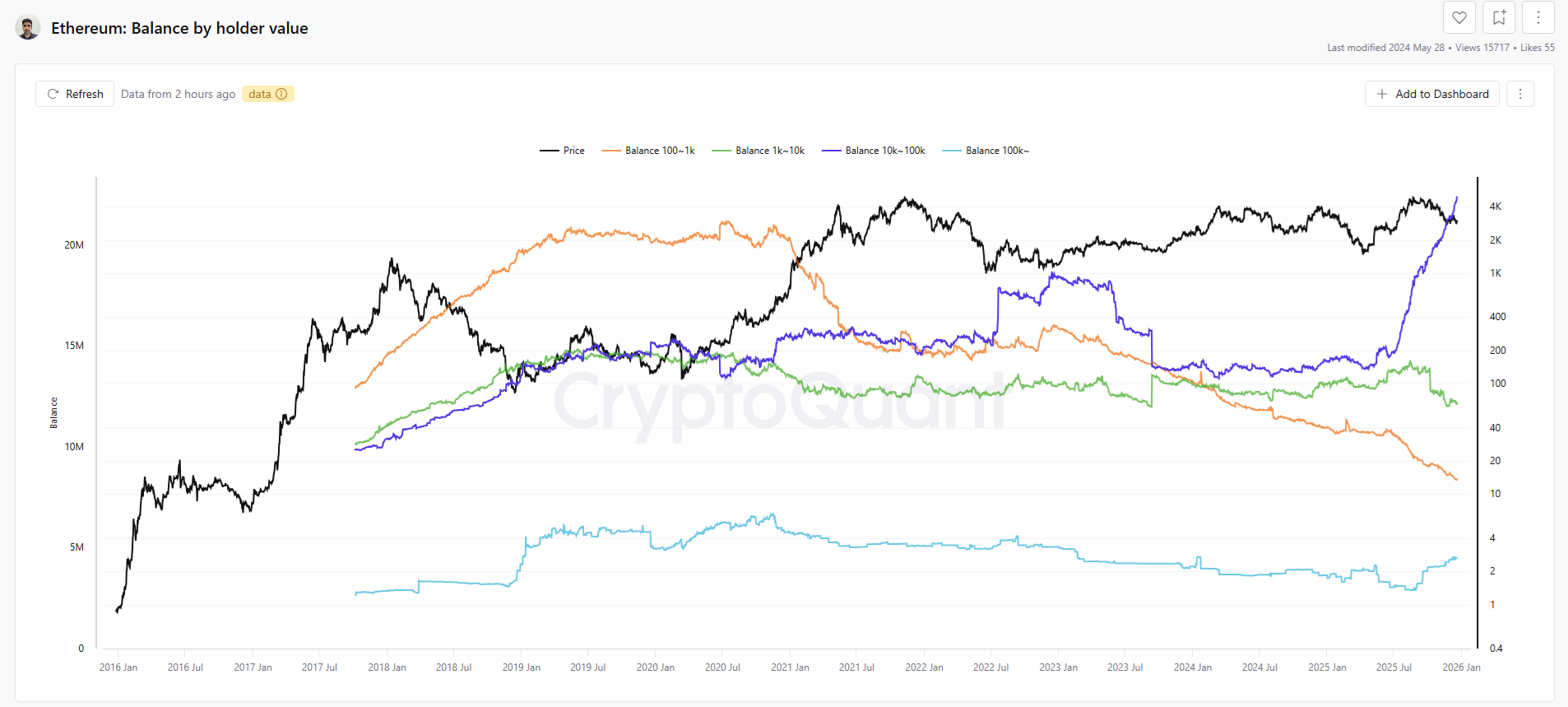

In 2025, ETH recorded significant inflows into whale wallets. As retailers parted with the coin, large holders continued to accumulate.

Towards the end of 2025, ETH wallets with balances between 10,000 and 100,000 ETH will be the primary holders. The ETH whale continued to increase, especially in the second half of 2025.

ETH is undergoing a major change in its holding structure, with tokens flowing out of exchanges and into new self-custodial wallets. In 2025, retail sentiment remained depressed while whales took advantage of the DeFi tools available on Ethereum.

The amount of small wallets holding 100 to 1,000 ETH has been decreasing since 2024. Inflows into the big whale wallet are growing at an even faster pace and now holds over 22 million tokens.

The ETH balance of whale wallets ranging from 10,000 to 100,000 ETH rapidly expanded in 2025 due to buying during the market downturn. |Source: Cryptocurrency

The largest wallets, probably belonging to exchanges and treasuries, hold about 4.47 million ETH and may not have much influence.

The recent whale group continued to buy close to realized prices, even though they didn’t make big gains. of whale movement This is not considered a bear market for ETH, but rather an indicator of an expected breakout.

Big whale buys ETH momentum

There is also a pattern in the large wallet collection to avoid the market peak and buy in 2025. Whale accumulation occurs at levels where ETH is considered undervalued.

Whale-level holdings also provide support for ETH at around $2,800. Whales become active on ETH at prices below $3,000, with prominent buyers like Seven Siblings wallet Becomes active from November.

The active buying pace indicates that whales may be more confident in ETH’s potential. The current whale purchases did not occur in a hype cycle. Instead, whales entered the market during a period of market panic and falling prices.

The whale buying occurred as ETH retail sentiment was near an all-time low. At the same time, derivatives traders also became cautious. ETH sentiment has fluctuated between neutral and fearful trading over the past few months.

ETH whale expands silent accumulation with long-term confidence

Whales also accumulated ETH while ETF buyers sold off their holdings. The presence of ETH in the new whale wallet shows long-term confidence from crypto insiders, setting the stage for one of the biggest reserve-building events.

ETH remains potentially important to DeFi activities and even mainstream finance. ETH accumulation continued despite the absence of an altcoin market. ETH could be the key to the creation and use of stablecoins, one of the fastest growing sectors in 2025.

Ethereum remains an important network for some DeFi protocols, currently holding 95% of the liquidity for protocols such as Sky (formerly MakerDAO).

ETH is also the key to liquid staking, which is of greater benefit to whales. ETH reserves can also be used to generate new cryptocurrency-backed stablecoins or as collateral for lending protocols. However, DeFi usage is also becoming an arena for whales and more experienced traders, leading to the formation of a new population of whale wallets.