Ethereum, a major altcoin, experienced a challenging month in March.

However, as markets begin to show signs of recovery, key questions from April remain. Will Ethereum be able to regain bullish momentum?

Ethereum’s March disaster: price crashes, activity slump, supply pressures expand

On March 11, Ethereum plunged to its two-year low of $1,759. This led traders to “buy dip” and by March 24th it led to a rally of $2,104.

However, market participants resumed profits and the price of the coin fell sharply for the remainder of the month. On March 31st, ETH fell below the key price level of $2,000 at $1,822.

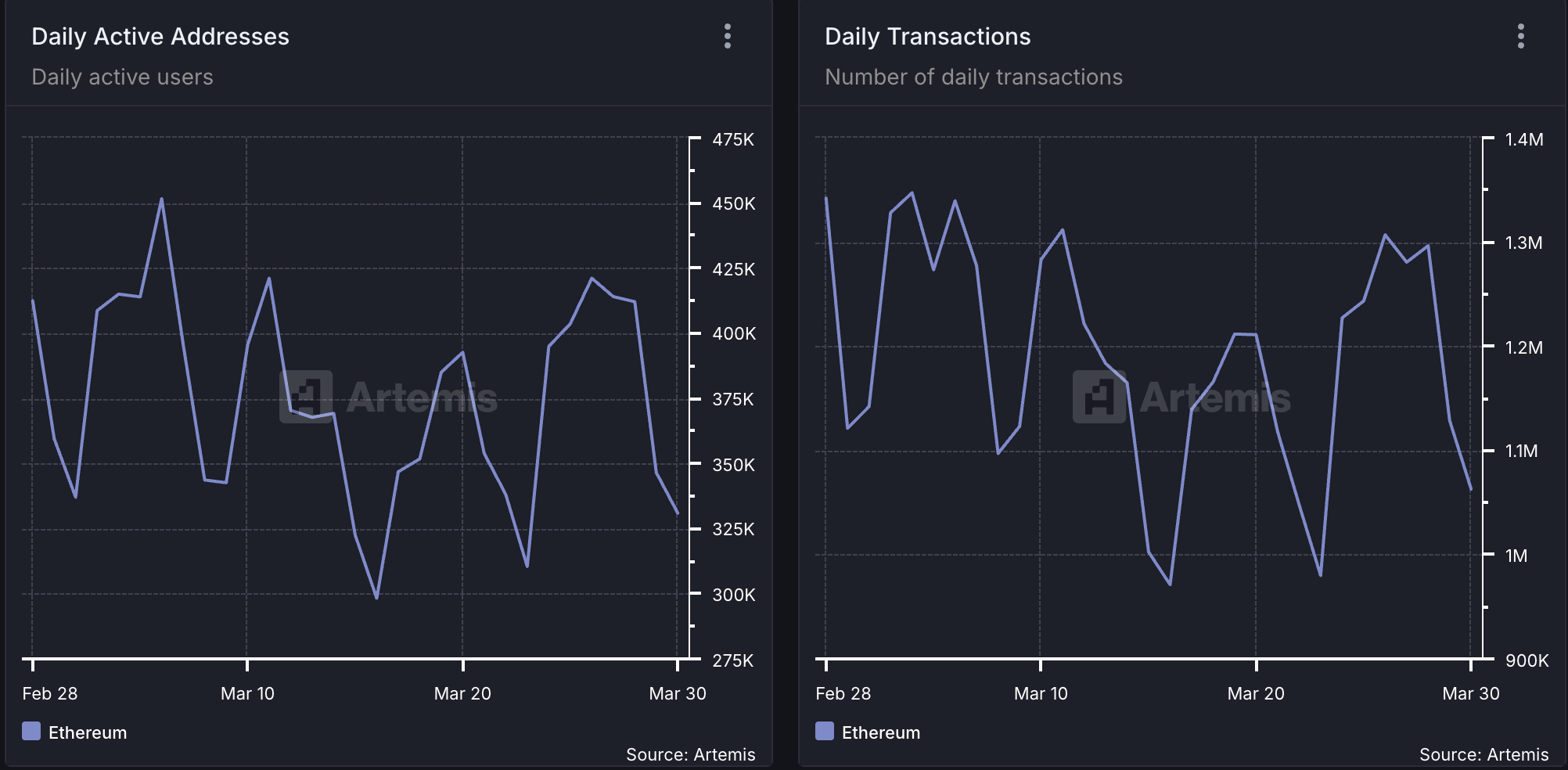

Amidst the price issue at ETH, Ethereum Network also experienced a severe decline in activity in March. According to Artemis, the daily number of active addresses that completed at least one ETH transaction fell 20% in March.

As a result, the network’s monthly transaction count also plummeted. The number of transactions completed with Ethereum fell 21% in March, totaling 1.06 million during the 31-day period of reviews.

Ethereum Network Activity. Source: Artemis

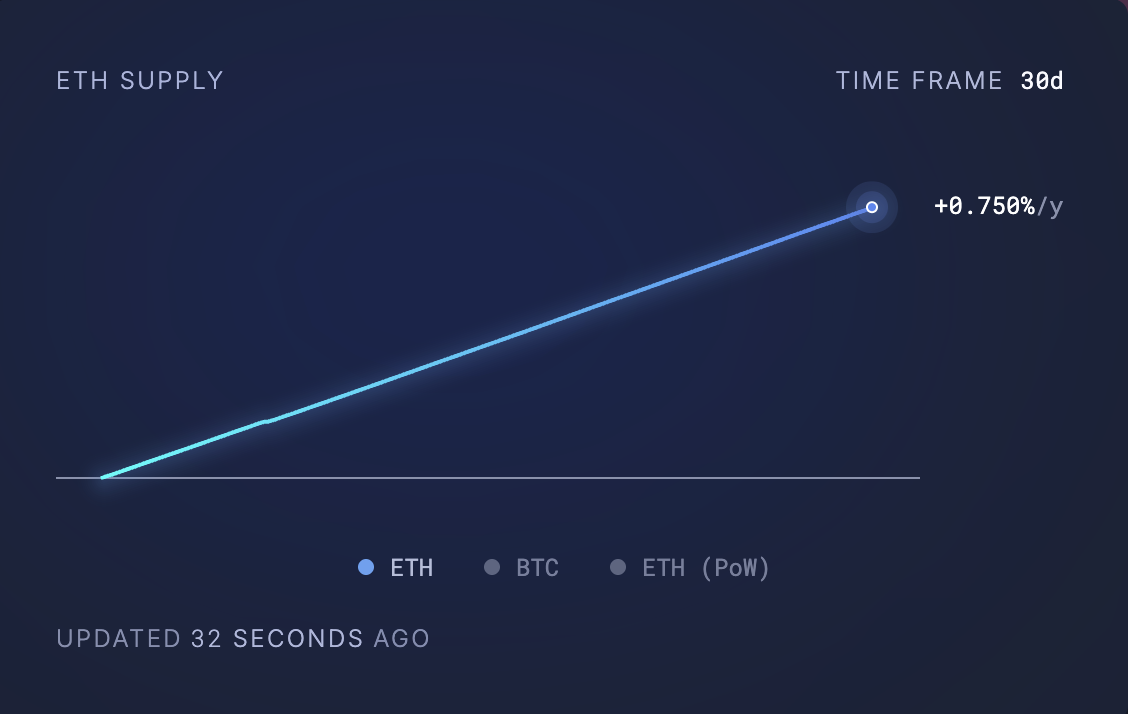

Generally, as more users trade and engage in Ethereum, the burn rate (a measure of ETH tokens permanently removed from circulation) increases, and a dynamic contribution to the deflationary supply of ether. However, when user activity decreases, ETH burn rates decrease, and many coins are circulated, increasing circulation supply.

This was the case with ETH in March, when the surge in circulation was circulating. Ultrasound Gold data shows that 74,322.37 coins have been added to the circulation supply of ETH over the past 30 days.

Circulating Ethereum supply. Source: Ultrasonic Money

Typically, a surge in the supply of such assets without absorbing the corresponding demand increases downward pressure on prices. This risks ETH to extend its decline in April.

What’s next for Ethereum? Experts say inflation may not be a major concern

In an exclusive interview with Beincrypto, Intotheblock research analyst Gabriel Halm said ETH’s current inflation trends “may not be a major red flag” should be wary in April.

Halm said:

“Although Ethereum’s supply has recently stopped being deflationary, the annual inflation rate was 0.73% last month, dramatically lower than Bitcoin, and for investors this medium level of inflation is conditional on the responsibility of network users’ activities, developer recruitment and implementing agencies.”

Furthermore, as to whether Ethereum’s decline played a key role in Ethereum’s recent price struggle, Halm suggested that its impact could be exaggerated.

“Historically, Ethereum supply remained deflationary from September 2022 to early 2024, but the ETH/BTC pair is still declining. This suggests that macroeconomic, broader market forces can play a much more important role than just changing token supply.”

Comparison of ETH/BTC market capitalizations. Source: IntotheBlock

Halm said what ETH owners should expect this month:

“In the end, whether the decline in Ethereum and rallies in April are likely to rely more on market sentiment and macro trends than on short-term supply dynamics. Still, it is essential to look at network developments that could promote updated activities and strengthen ETH’s key position in the broader crypto landscape.”