The recent blockchain reorganization in which networks discard blocks and track long chains revealed weaknesses in the Proof of Work (POW) system highlighted by Monero’s August 2025 ordeal and previous disruptions across other blockchains.

Decode the chain

A blockchain reorganization, or Reorg, occurs when a chain of blocks is abandoned in favor of a competitive version with a larger cumulative proof (POW), effectively rewrites a portion of the ledger. Reorgs rolls back transactions on orphaned blocks, sends them back to Mempool and sends them back to exclude exclusions.

This allows the attacker to spend coins on the discarded chain, but can still be held after a reorganization. In August 2025, Monero endured repeated Reorgs tied to the Qubic Mining Pool, which accumulated a dominant share of the hashrate. Qubic publicly described this effort as an experiment, using the Pow setup to mine Monero blocks and claim rewards.

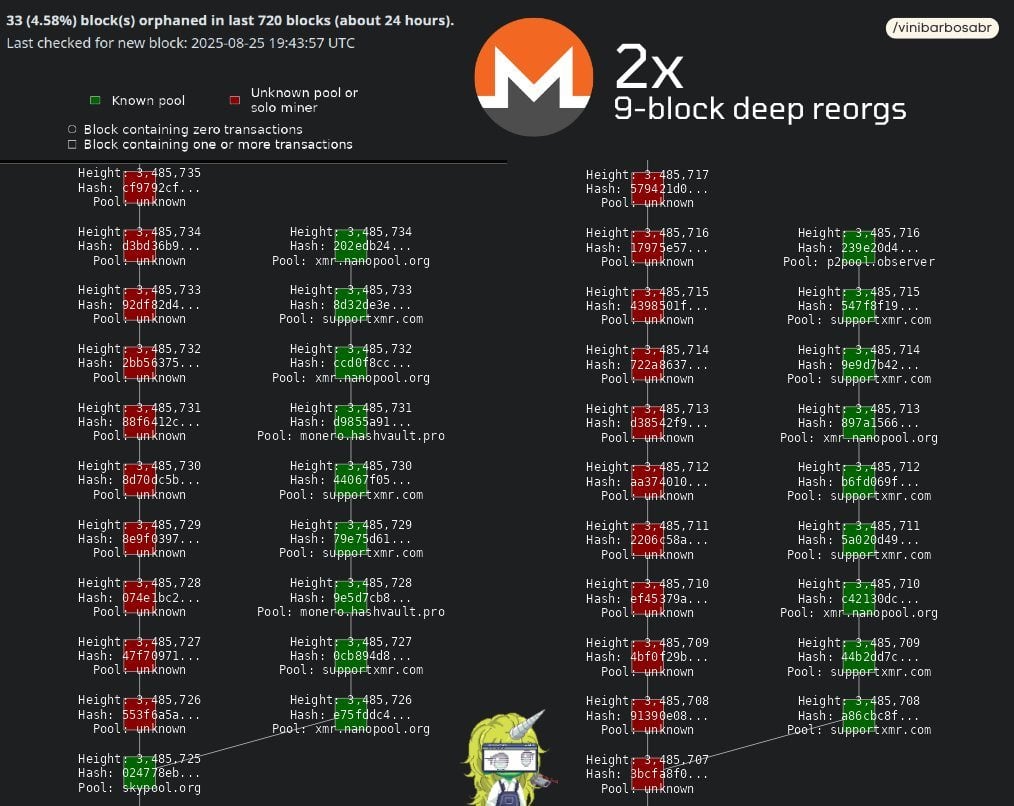

Image source: Vini Barbosa. X Account Vini Barbosa reported that Monero had breeded two nine blocks within 60 minutes from blocks 3485726→3485734 to 3485708→3485716.

Its strength first enabled a 6-block roll and showed how the ledger could be rewritten. A few more later, two recently reported nine blocks of Leorg were performed. Monero’s Reorgs originated from Qubic’s excellent hashrate, allowing private mining of long chains and forced nodes before revealing it. Risks include double spending, transaction censorship, and headaches for erased blocks.

Exchanges like Kraken Susped Deposits later requested a confirmation of 720, exceeding the normal 10, preventing losses. The confusion sparked debate by revamping the Monero consensus, suggesting that from merge mining with Bitcoin to geographically distributed hardware, it weakened a large pool and led to dash chain locks where the masternode blocks lock blocks.

In August 2021, Bitcoin SV faced similar tests when unknown miners controlled more than half the hashrate and pulled out a massive 100 block of reported röorg. The event split the chain into three versions, giving it credibility. The cause comes from stealth miners who build hidden chains, leading to familiar risks: double spending, instability, and shaking self-confidence.

Reorgs emphasizes the stochastic finality of Pow. Transactions are safer with additional confirmations, but a 51% advantage can override them. Both episodes reveal Reorgs as a natural correction tool that twists the attack method, facilitating the call to more powerful decentralization and hybrid protection.

The Monero and BSV experience reveals the duality of Reorgs, which, in healthy operations, is devastating when weaponized.

Bitcoin (BTC) is much more expensive to attack because it has a very high hashrate advantage compared to other POW blockchains. The network runs on hundreds of exhash (EH/S) per second with globally distributed mining farms operating specialized ASIC hardware.

To reorganize the Bitcoin chain, attackers must secretly marshall most of their hashrate. This is a feat that requires billions of dollars for mining rigs, industrial-scale infrastructure and enormous amounts of electricity. The required level of investment makes such an attempt economically irrational.

Monero (XMR) and Bitcoin SV (BSV) are much cheaper to attack as the POW system operates at some of the Bitcoin hashrates and the mining entrance costs are dramatically lower.