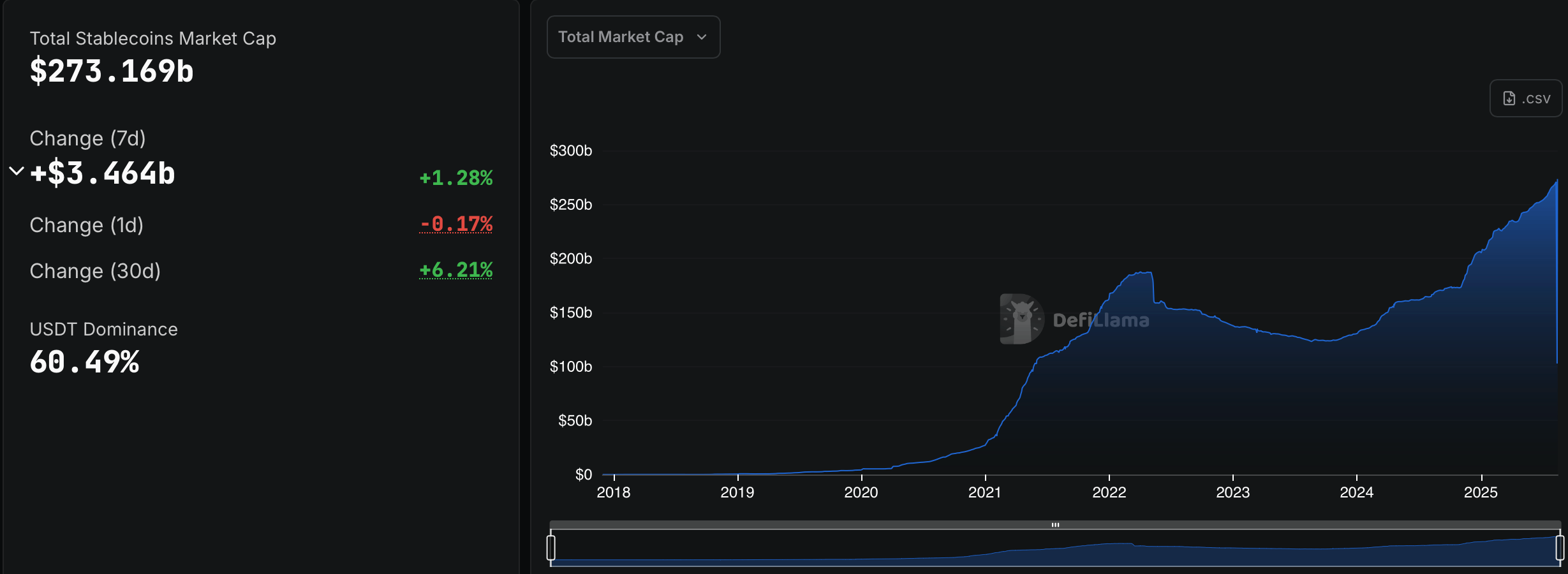

Over the past week, the Stablecoin market has expanded by 1.28%, adding $3.464 billion to a total of $27.3169 billion. Tethers (USDT) are heavyweights, commanding 60.49% of the market, and will climb the supply with approximately 730 million coins over the seven-day period.

As Stablecoin Economy pushes higher, Tether and USDC add to market domination

Tether (USDT) served as manager at the Stablecoin Leaderboard at a market capitalization of $1652.5 million, up 0.44% this week and 2.93% over the past month. In dollar terms, it would increase USDT’s market capitalization by $4.7 billion in just 30 days. USDC ranks second with $668 billion, up 3.56% in seven days and 7.56% in a month.

This week, USDC added about $2.29 billion to its market capitalization, bringing its 30-day growth to $46.9 billion. In third place, Ethena’s USDE shines at $10.99 billion, bringing it to 12.31% in a week and an eye-opening 106% that month. Sky’s Dai holds $45.1 billion, up 4.38% in a week and 4.39% in a month, while its counterpart, Sky Dollar (USDS), sits right behind $4.48 billion, soaks 11.22% per week, but advances 11.24% in 30 days.

BlackRock’s Buidl holds $2.37 billion, earning a mild 4.48% profit for a week, but has fallen sharply by 15.61% over the course of a month. According to statistics from RWA.xyz, the monthly decline dates back to pullbacks in the tokenized financial sector last month, but the market bounced 6.46% off 6.46%. World Liberty Financial’s USD1 has been closely advancing at a market capitalization of $22.1 billion, up 0.51% this week and 0.12% over the past month.

Ethena’s USDTB is located at $1.46 billion, with a modest profit of 0.34% per week and 0.76% per month. Falcon’s USDF has hit $1.23 billion this week, earning an eye-catching 86.35% over 30 days. PayPal’s PYUSD continues at $1.18 billion, reaching 15.56% or 40.26% of the month. First Digital’s FDUSD has come out of the top 10. It currently ranks 11th with a market capitalization of $1.02 billion. It earned 0.08% gain over the week, but fell 14.73% over the past month.