As Bitcoin (BTC) tries to regain its $120,000 resistance zone, insights from the artificial intelligence (AI) platform show that there are appropriate conditions for the largest cryptocurrency to rise to $135,000 by October 1, 2025.

The push to $135,000 represents an almost 17% increase from the press-time value of the $115,511 asset.

Bitcoin’s road to $135,000

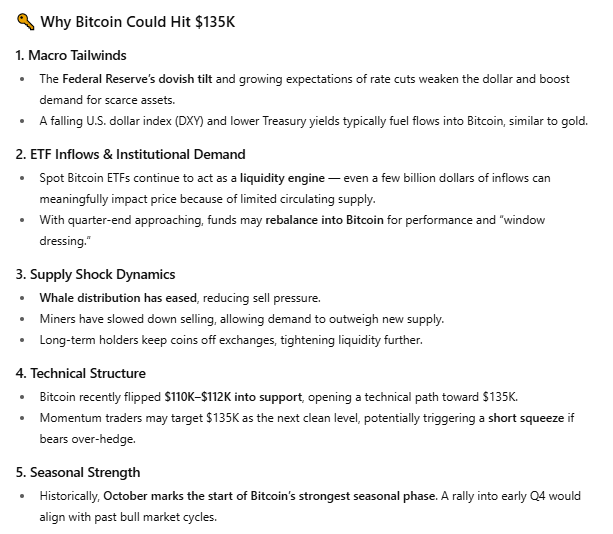

ChatGpt’s forecast shows that the road to $135,000 remains risky, but is supported by a combination of macroeconomic tailwinds, institutional demand, and a favorable market structure.

ChatGpt highlighted that the federal Reserve’s incredible stance and expectations for interest rate cuts have weakened the US dollar and increased demand for rare assets like Bitcoin. Historically, softer dollars and lower Treasury yields have leaked capital to valued alternatives, giving Bitcoin a gold-like tailwind.

He also pointed out finding Bitcoin ETFs as the main liquidity driver. The model has noted that even a modest inflow can move prices given the limited supply of Bitcoin, and that future quarter-end rebalancing could add even more institutional demand.

On the supply side, Bitcoin shows signs of a tightening market. ChatGpt observed that whales have slowed distribution, miners have reduced sales and long-term holders continue to avoid exchanges. Therefore, this reduces available liquidity and increases the impact of progressive demand.

From a technical standpoint, Bitcoin supported the $110,000 to $112,000 zone in the short term. This paves the way for $135,000, explained ChatGpt.

To this end, momentum traders can accelerate their movement, especially when short sellers expand excessively. Seasonality could also play a role, as October has historically been one of Bitcoin’s strongest months.

Bitcoin risks are heading towards October

However, ChatGpt warned that risks remained, including potential ETF spills, Hawkish FED signals, or geopolitical shocks that allow investors to point to safer assets. Large sales from whales and miners, excessive leverage leading to liquidation, and regulatory setbacks can also help to curb Bitcoin rallies.

In conclusion, CHATGPT highlighted that Bitcoin’s macrotail winding, supply dynamics and seasonal strength combination could reach $135,000 within a few weeks, but negative ETF flows, central bank shifts, or on-chain sales could halt rallies under $130,000 or trigger a pullback to support of $110,000.

Featured Images via ShutterStock