Interest in privacy coins is shifting towards lower cap privacy altcoins. Last month, capital inflows shifted from large-cap stocks like Zcash (ZEC) to mid-cap altcoins like DASH. This month, attention has been focused on low-cost stock projects like Coty (COTI).

What are the advantages investors have in Coty now? And how long will the rally last? We’ll go into more detail in the next analysis.

Record-breaking month at COTI

Coti (COTI) is a privacy-focused blockchain platform that leverages Garbled Circuits technology to provide programmable privacy and give users flexible control over their data.

Founded in 2019, COTI initially focused on fast and low-cost payments. However, it has recently pivoted significantly towards privacy solutions and is now integrated into over 70 blockchain networks, including Ethereum.

“Privacy is not a feature for the next cycle. It is the infrastructure that will unlock the next trillion of value on-chain. RWA, DeFi, and AI agents all require programmable privacy. Capitals are waking up to this reality.”

— Shahaf Bar-Geffen, CEO of Coti.

This approach has convinced many investors that COTI has an advantage over other privacy coins such as Zcash. ZEC’s recent rally is also inspiring current COTI holders.

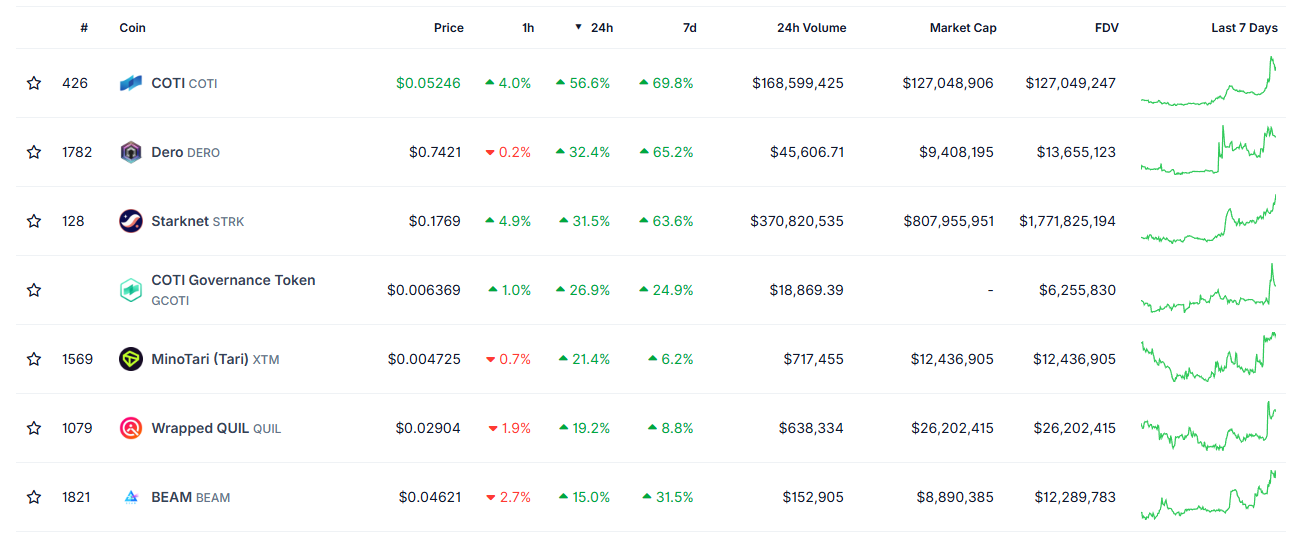

At the time of writing, COTI has surged over 54% in the past 24 hours, making it the best-performing altcoin in CoinGecko’s Privacy Blockchain Coin category.

Privacy blockchain coin. Source: CoinGecko

COTI’s market capitalization increased from $65 million to $127 million in November. Despite this growth, it still lags far behind multi-billion dollar players like DASH and ZEC.

In bullish market environments, rising low-cap altcoins often foster optimism. According to historical data, COTI once reached a market capitalization of $1.6 billion in 2017. November’s rally has reignited investors’ hopes for a return to previous highs.

Daily active addresses reach 6-month high

On-chain data supports this optimism. According to Cotiscan, the number of daily active addresses on the COTI network has reached its highest level in six months, indicating that real-world usage is increasing.

Daily active addresses on the COTI network. Source: Kotiskan

In April, the network had about 100 active addresses per day. That number now exceeds 650 and continues to accelerate into October.

While this growth indicates increased user interest, it remains modest compared to COTI’s long-term potential.

Increase in account number and trading volume

Kotiska’s data also shows a steady increase in the total number of accounts, now over 17,000, showing consistent growth over the past six months.

Number of Coti accounts. Source: Kotiskan

COTI currently processes more than 22,000 transactions each day, with nearly 59 million total transactions completed on the network.

Opportunities and risks for COTI investors

Analysts believe the rise in COTI may not be over yet. Technically, the chart shows a bullish descending wedge pattern. After a short-term correction, the price may continue to rise towards $0.08.

$Coti #Coti successfully retests critical zone, expects move towards 0.044$ area, downtrend line) If Tl clears, could give move towards 0.09$ pic.twitter.com/e0dKhkPQIc

— World of Charts (@WorldOfCharts1) November 9, 2025

However, funds migrating to lower-priced privacy coins could also act as a warning signal. This suggests that investors may see good value in large- and mid-cap privacy coins and turn to small-cap stocks as a last chance.

This behavior often reflects a classic stage in the crypto capital rotation cycle, where attention shifts from large-cap leaders to small-cap speculative assets before broader market consolidation.

This post, “Low Cap Privacy Strategy: Why capital is rotating from ZEC and DASH to COTI” was first published on BeInCrypto.